- The Japanese yen has kept on strengthening after a possible currency intervention by BoJ.

- Ahead of the Bank of Japan's next meeting at the end of the month, the USD/JPY pair is in a downtrend.

- The pair has already tested the support at 155, and could now break below it soon.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Over the past two weeks, the USD/JPY currency pair has been in a correction phase, likely influenced by potential currency interventions from the Japanese government. Historically, without coordination between the government and the Bank of Japan (BoJ), persistent downward pressure on the yen tends to continue.

All eyes are now on the Bank of Japan (BoJ) meeting on July 31st to see if the bank will adopt a more restrictive monetary policy. On the same day, the Fed is expected to hold rates steady. However, the Fed’s accompanying statement could provide key insights into potential rate cuts by the year’s end.

Is Currency Intervention Affecting the Yen?

Although the Japanese government has not officially confirmed a currency intervention, the recent dynamics of the USD/JPY pair and data from the BoJ suggest that such actions likely occurred. Estimates indicate that approximately 5.64 trillion yen ($35.6 billion) may have been used, pushing the exchange rate to around 156 yen per dollar.

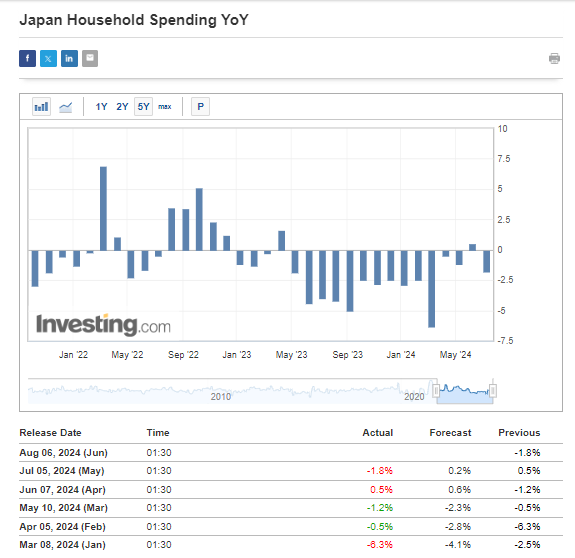

Despite this, the fundamental situation remains unfavorable for the yen, particularly due to the significant interest rate differential between the U.S. and Japan. The BoJ's upcoming meeting could address this gap, but decisive action seems unlikely given the ongoing weakness in consumer spending, which has consistently remained below zero except for one month. Recent data further underscores this negative trend.

In case the Bank of Japan surprises the market hawkishly, we can then expect the yen to continue strengthening.

Meanwhile, the U.S. dollar remains under pressure as markets anticipate a potential policy shift by the Federal Reserve in September. Current expectations suggest a 25 basis point cut is almost certain, with probabilities exceeding 90%.

To sustain this downward pressure on the dollar, however, markets will need more than a single rate cut; they require indications of a full-fledged easing cycle.

Key to this will be a continued decline in inflation, making June's Consumer Price Index (CPI) data crucial. For the easing scenario to gain traction, CPI should show a year-over-year decrease below 3%.

USD/JPY: Downward Trend Likely to Persist

Following a brief rebound at the end of last week, the USD/JPY currency pair is resuming its decline. The prevailing expectation is that the broader uptrend is unwinding, with the immediate focus on the support level around 155 yen per dollar, which has already been tested.

If sellers break through the 155 yen support, the next target is the 152 yen level. This area, where strong demand emerged in early May, may offer additional opportunities to join the downward trend at more favorable prices.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.