The utilities sector is the worst performer within the S&P 500 index so far this year (down 11.82%). ETFs tracking utilities stocks have markedly underperformed the broader market, with a negative year-to-date (YTD) return of 9.25%, despite the S&P 500 benchmark index being up 17.61%. A distant second in this rather gloomy contest is the consumer staples sector with a less severe YTD decline of 2.76%.

These relatively disappointing performance numbers are largely attributable to rising interest rates. The modus operandi for many investors holding utilities stocks principally revolves around receiving dividends. However, as risk-free rates ascend, these stocks invariably become less alluring.

Bloomberg's estimate puts the one-year dividend yield for utilities stocks at around 2.6%, which is significantly outpaced by the current one-year treasury rate standing robustly at 5.39%. Such figures point unequivocally towards a more attractive risk-free investment environment.

In addition to the adverse effects of rising interest rates, another factor contributing to the declining performance of ETFs tracking the utilities sector is the negative impact of global warming on underlying stocks. As an illustration, the recent wildfires in Maui, which are believed to be caused by equipment owned by Hawaiian Electric amid extremely dry vegetation and strong winds, led to a significant drop in the company's stock price, down 62.44% year-to-date.

This incident is reminiscent of a similar event in 2019 when Pacific Gas and Electric (PG&E), another utility company, faced wildfires caused by outdated equipment. PG&E eventually filed for bankruptcy due to the financial repercussions of the fires. These instances highlight the vulnerability of utility stocks to the effects of climate change.

The Utilities Select Sector SPDR Fund (XLU) and the Vanguard Utilities ETF (VPU) have been particularly hit by this paradigm shift and challenging market conditions. Both ETFs have experienced declines of 9.79% and 10.06% respectively since the beginning of the year.

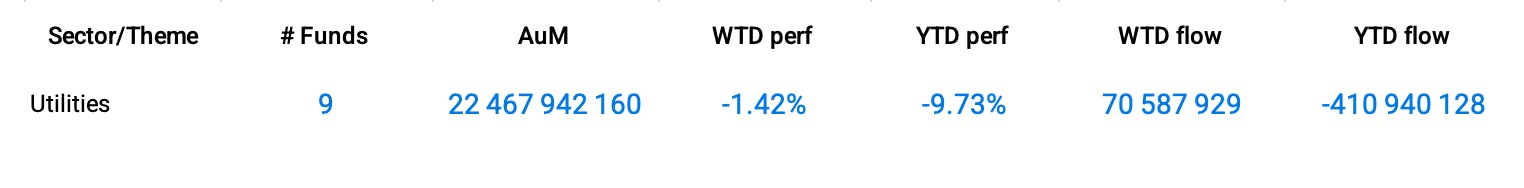

Group Data: Utilities

Funds Specific Data

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI