Vertiv Holdings Co. (NYSE:VRT) is riding a powerful wave of demand growth driven by the rapid expansion of data centers and AI applications, as demonstrated by its recent Q3 2024 earnings beat. With robust revenue growth and an upward revision to guidance, Vertiv continues to solidify its market presence, leveraging a diversified portfolio that addresses critical digital infrastructure needs. In this article, I explore Vertiv's business model, competitive advantages, financial performance, and the risks it faces in a rapidly expanding industry.

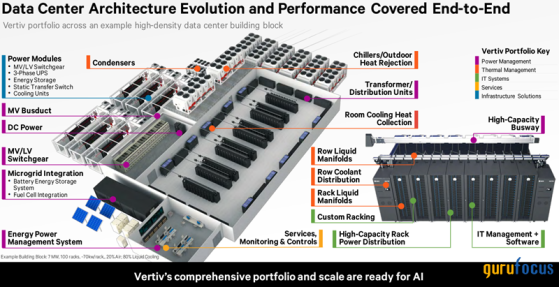

Business Model and Competitive AdvantagesVertiv operates at the forefront of critical infrastructure solutions, providing essential technologies for data centers, communication networks, and various commercial environments. Its product portfolio encompasses AC and DC power management, advanced thermal management solutions, and modular systems, crucial components as data centers expand to accommodate the increasing computational demands of AI and machine learning.

Vertiv's comprehensive infrastructure offerings position it uniquely in the market, catering to the full spectrum of hyperscalers, colocation centers, and industrial applications. As Chairman David Cote stated:

We had the agricultural revolution and industrial revolutions. And now we're only about 20 years into the digital revolution. AI is just the next step in that digital revolution. AI is real. It has just begun. It's got a long way to go. Data centers are fundamental to all that computing. There is no other alternative. Even on the horizon, distributed architecture enhances the need for data centers. Even quantum computing relies on digital based data centers.

Source: Vertiv Investor Presentation

The total addressable market for AI-driven data centers is expanding substantially, creating broader opportunities for Vertiv across its entire product range. Vertiv's scope extends beyond just thermal management. The company offers a full range of thermal chain technologies, from infrastructure outside data center buildings to rack-level solutions. In future data centers, liquid and air cooling will coexist, each playing a role in heat collection. Regardless of the specific cooling mix, heat rejection remains essential, with air cooling and heat rejection projected to comprise 70% of the market and liquid cooling the remaining 30% over the next few years. This translates to expected compound annual growth rates (CAGR) of 10% for air cooling and 30% for liquid cooling, positioning Vertiv well to capture significant market share.

As data centers witness rising power demand, the cost per megawatt is increasing from $2.5 million to $3$3.5 million. This highlights the need for both advanced power and cooling solutions, areas where Vertiv's technologies excel. To support this growth, Vertiv has expanded its production capacity with new facilities in India and South Carolina, not only to meet current demand but also to prepare for future needs as the AI and data center markets continue to evolve.

An example of Vertiv's proactive positioning is its strategic partnership with NVIDIA (NASDAQ:NVDA). This collaboration focuses on developing advanced power and cooling solutions to serve the infrastructure needs of AI-driven data centers, underscoring Vertiv's leadership in this high-growth market. As NVIDIA CEO Jensen Huang stated:

With Vertiv's world-class cooling and power technologies, NVIDIA can realize our vision to reinvent computing and build a new industry of AI factories that produce digital intelligence for every company and industry.Moreover, major industry players like Taiwan Semiconductor (NYSE:TSM) have signalled strong demand for AI-driven infrastructure. In its FQ4'24, TSM highlighted strong AI-related demand, with profit margins and anticipated FY2025 capital expenditures (CapEx) rising in response to structural AI trends.

The outlook for data center demand outlook continues to strengthen, as seen with companies like Microsoft (NASDAQ:MSFT) (NASDAQ:MSFT) and Facebook (NASDAQ:META) (NASDAQ:META) significantly raising their CapEx guidance in response to the growing need for cloud and AI infrastructure.

These trends signal a strong outlook for Vertiv, with the increasing demand for data center infrastructure aligning well with the company's strategic positioning. Vertiv's broad array of solutions, including power management, storage, thermal management with both chilled-water and liquid cooling technologies, integrated server rack systems, and modular operations, establishes a solid foundation in the expanding digital infrastructure sector.

FinancialsVertiv delivered a strong Q3 2024, with revenues of $2.07 billion, exceeding expectations with 19% organic net sales growth year-over-year (YoY) alongside a 41% increase in adjusted operating profit, which reached $417 million. The company achieved a 20.1% adjusted operating margin, a 310 bps point improvement, while adjusted EPS of $0.76 a 46% YoY increase. Moreover, Vertiv's backlog rose by 47% to $7.4 billion, reflecting continued robust demand across data infrastructure.

While Vertiv's balance sheet is upside down, carrying $2.9 billion in debt compared to $909 million in cash, its free cash flow (FCF) increased by 53% YoY to $339 million, providing ample support for ongoing investments and financial resilience. The number of shares outstanding also decreased by 1% YoY, signaling management's focus on shareholder value.

The company's full-year guidance was raised to $7.8 billion in revenue, expecting organic growth of 14% and an adjusted operating profit of $1.485 billion. Adjusted EPS guidance increased to $2.68, up from prior estimates, while adjusted margins are expected to reach 19%. Strong margins, a growing order book, and strategic positioning in the AI and cloud computing sectors indicate that growth in 2025 will accelerate relative to 2024. However, management cautioned that current order growth will continue to grow at 60% unlikely, indicating potential moderation in order growth.

RisksAlthough Vertiv has managed inflation and supply chain challenges effectively, fluctuations in material costs or availability could impact profitability. While Vertiv's significant backlog points to solid demand, supply chain disruptions could delay order fulfillment and escalate costs, potentially pressuring margins.

The digital infrastructure sector is seeing a surge in competition as AI and cloud computing drive demand. Vertiv's comprehensive portfolio gives it an edge over niche players like Delta Electronics, Johnson Controls (NYSE:JCI), and Soco Holdings. However, global giants such as Schneider Electric (EPA:SCHN), Siemens (ETR:SIEGn), and Huawei add considerable pressure, while Eaton Corporation (NYSE:ETN) remains a U.S.-based competitor. CEO David Cote emphasized that competition in this sector isn't new, but the heightened focus on AI-driven infrastructure has brought increased visibility and competitiveness.

ValuationVertiv's valuation metrics are elevated relative to historical levels. The stock currently trades at a price to earnings ratio of 72x and a forward P/E ratio of 34x, with a price to sales (P/S) ratio of 6x. While these metrics place Vertiv near the higher end of its historical trading range, they may be justified by its solid performance and growth potential. Investors are essentially buying a better and more mature company now at the heart of a critical technological wave, as digital infrastructure is indispensable for supporting AI and cloud ecosystems.

Additionally, the price to FCF ratio at 37x, though high, aligns with Vertiv's growth trajectory and historical valuations, particularly considering recent free cash flow expansion.

Lastly, using a discounted cash flow analysis, which combines multiple-based approaches and a perpetuity growth model, I estimate Vertiv's intrinsic value at $135 per share. This represents an approximate 25% upside from current levels. However, given the high investor interest in AI, the stock could experience volatility, which may affect performance in the short term.

Source: Author

ConclusionThe digital infrastructure market is experiencing rapid growth, with AI-related tailwinds that are likely to strengthen in the coming years. Vertiv has positioned itself as a key player in this emerging era, and if, like me, you believe this growth phase is just beginning, then Vertiv presents a compelling investment opportunity. While supply chain challenges, heightened competition, and high valuations introduce certain risks, I remain optimistic about Vertiv's long-term potential to generate shareholder value and capture market share as the demand for digital infrastructure escalates.

This content was originally published on Gurufocus.com