Visa Inc. (NYSE:V) is a household name, and for good reason. That little blue-and-gold card has become a global symbol of convenience, tucked away in wallets around the world, supported by strong financials, a dominant market position and strategic investments in emerging technologies like blockchain and digital wallets. However, with its stock trading at a premium price-earnings ratio above 30 and facing rising competition from fintech disruptors like Block (NYSE:SQ) and PayPal (NASDAQ:PYPL), the stock seems to be fairly valued and is a hold for me at current levels.

While the company's strong financials and market position make it an attractive long-term investment, in the short term, the premium valuation limits upside potential.

Overview of recent performanceThe stock has been quite stable in recent months, consistently closing around $276.37. Up around 13.31% year to date, this is a fairly good performance, especially after adjusting for the economic headwinds consumers have had to endure. Although existing problems such as inflationary pressures and high interest rates continued to affect consumers' demand, transaction volumes as well as revenues have remained constant and even improved for Visa. This goes a long way in explaining its capacity to deliver above-average results.

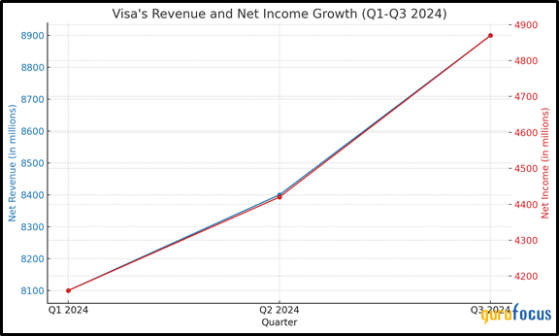

For the third quarter of 2024, Visa disclosed a net revenue of $8.90 billion, up 9.60% from the same period last year, while its net income rose by 17.20% to $4.87 billion. These robust numbers indicated the company is able to achieve steady growth no matter how hard the going gets; the result of its market leadership coupled with operational excellence. That being said, the economic environment remains rather volatile.

Revenue and net income growthThe following chart shows a steady rise in Visa's revenue and net income over the first three quarters of 2024. Revenue increased from $8.10 billion in the first quarter to $8.90 billion by the third quarter. Net income also followed an upward path, growing from $4.16 billion to $4.87 billion over the same period. Although this growth is not explosive, it highlights Visa's ability to maintain solid, reliable performance even in a challenging economic environment.

So why the wobble? Let's look a little closer.

What's moving the needle? A look behind the numbersVisa's premium valuation is well justified by its exceptional growth potential, market leadership and consistent financial performance. Trading at a price-earnings ratio of 30.20above the broader market averagethe stock commands a higher valuation, but for good reason. Its ability to steadily increase both revenue and profits, despite global economic challenges, is a testament to its resilience. This premium reflects investors' confidence in Visa's future dominance in the payments space, as the company continues to innovate and expand internationally.

To illustrate how Visa's valuation stands compared to the market, consider the following chart comparing its price-earnings ratio against the market average.

Visa's elevated earnings multiple suggests investors are willing to pay a premium for its potential growth, but it also highlights the vulnerability to market corrections if the company doesn't meet its growth expectations. Now, let's dig deeper.

There is also its PEG ratio of 2.10. Some may consider this metric, which takes earnings growth into consideration, to be higher than desirable, but it is more a product of the marketplace's belief in Visa's capacity to maintain rapid growth. This is why investors are willing to pay a premium to enjoy the future expansion of Visa's digital payments, and its international market expansion. This PEG ratio indicates that this company's performance is not only rock-steady but contains a growth component as well.

Further, Visa has an enterprise value/Ebitda ratio of 22 that is higher than that of its industry peers, which are estimated to be between 15 and 18 times, indicating the efficiency of its operations and its capacity to produce solid cash flows. The company has maintained high operating margins and its current standing at 66.70% with almost $13 billion in cash allows it to participate in strategic acquisitions and investments. This goes some way toward explaining its higher EV/Ebitda ratio because Visa has remained a brilliant allocator of capital.

The price-sales ratio of 18.40 is also a testament to the market's appreciation of the fact Visa has been translating its robust sales figures to even better profits. Nonetheless, this rate is way above the sector average.

Lastly, Visa's free cash flow yield of 3.50%, while slightly below the industry average, underscores its consistent ability to generate substantial cash flows. With $14.42 billion in free cash flow over the past nine months, the comany is well-positioned to continue reinvesting in future growth and rewarding shareholders through dividends and share buybacks. The cash flow, combined with a low payout ratio of 21.90%, suggests there's ample room for dividend growth, which makes it an attractive choice for long-term investors seeking both capital appreciation and income.

Where does Visa go from here?So where does Visa go from here? Despite the challenges, the company isn't just sitting back. It is pushing hard into digital payments and expanding in international markets, where there's still plenty of room for growth. For example, its international transaction revenue for the nine months ended June 30 hit $15.40 billion, up from $13.50 billion the previous year. That's a solid 14.10% increase, showing it is successfully leveraging its global network.

However, Visa's focus is not limited to analogue transactions, though that is where it started from. It is embracing new trends in payments solutions such as decentralized wallets and blockchain to be on track with the ever-evolving market. For example, Visa Direct has become a real-time payment mechanism with a rather large presence. The company has further ventured into peer-to-peer transactions through integration with other digital wallet providers such as PayPal and Venmo. These affiliations help it address the issue of capturing the market of young people of the technological era, where cashless transactions are gradually dominating.

Blockchain technology is also on the radar at Visa, especially when it comes to international remittances. Earlier this year, it moved to stablecoin settlements using USDC on the Ethereum network in partnership with Circle. This is a rather progressive approach that effectively places Visa at the heart of decentralized finance. One of the biggest benefits of using blockchain is time and cost savings in international payments, which can be a powerful tool to increase revenue in international markets.

ChallengesBut before you start thinking Visa is invincible, let's talk about a few of the challenges it is facing.

First, the company is tangled up in a few legal battles over interchange fees and other practices, which could cost it bigboth in terms of dollars and reputation. As of June 30, it has set aside $1.69 billion for litigation. That's not pocket change, even for Visa.

Then there's competition. The payments space is crowded, and it's getting more crowded every day with fintech startups and other established players like Block and PayPal gaining market share, while tech giants like Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL) are pushing hard with Apple Pay and Google Pay, respectively. These companies are offering innovative, often cheaper, payment solutions that could potentially erode Visa's market dominance

And finally, there's the whole priced for perfection thing. With a price-earnings ratio north of 30, investors are expecting Visa to keep hitting it out of the park. Any slip-upwhether it's a missed earnings target or a macroeconomic shockcould send the stock tumbling.

The bottom lineVisa is still a powerhouse with a lot going for itstrong financials, a dominant market position and operating in a high barrier of entry market with a track record of smart investments in digital wallets and blockchain. However, its premium valuation means investors are paying for high growth expectations. For those reasons, I am a hold on the stock currently.

This content was originally published on Gurufocus.com