Facebook (NASDAQ:FB) stock has recently seen negative headlines, especially following the global outage that affected its apps as well as the testimony by the whistleblower who brought attention to the social media giant’s priorities that put "growth over safety.” As a result, in the past month, FB shares are down about 14%. By comparison, the NASDAQ 100 index lost about 4.5%.

In early September, Facebook stock hit an all-time high of $384.33. The 52-week range for the shares has been $244.61 - $384.33. Yet, despite the recent decline, FB stock is still up close to 19% in 2021. With a market capitalization of $920.2 billion, it is one of the most important tech names on Wall Street.

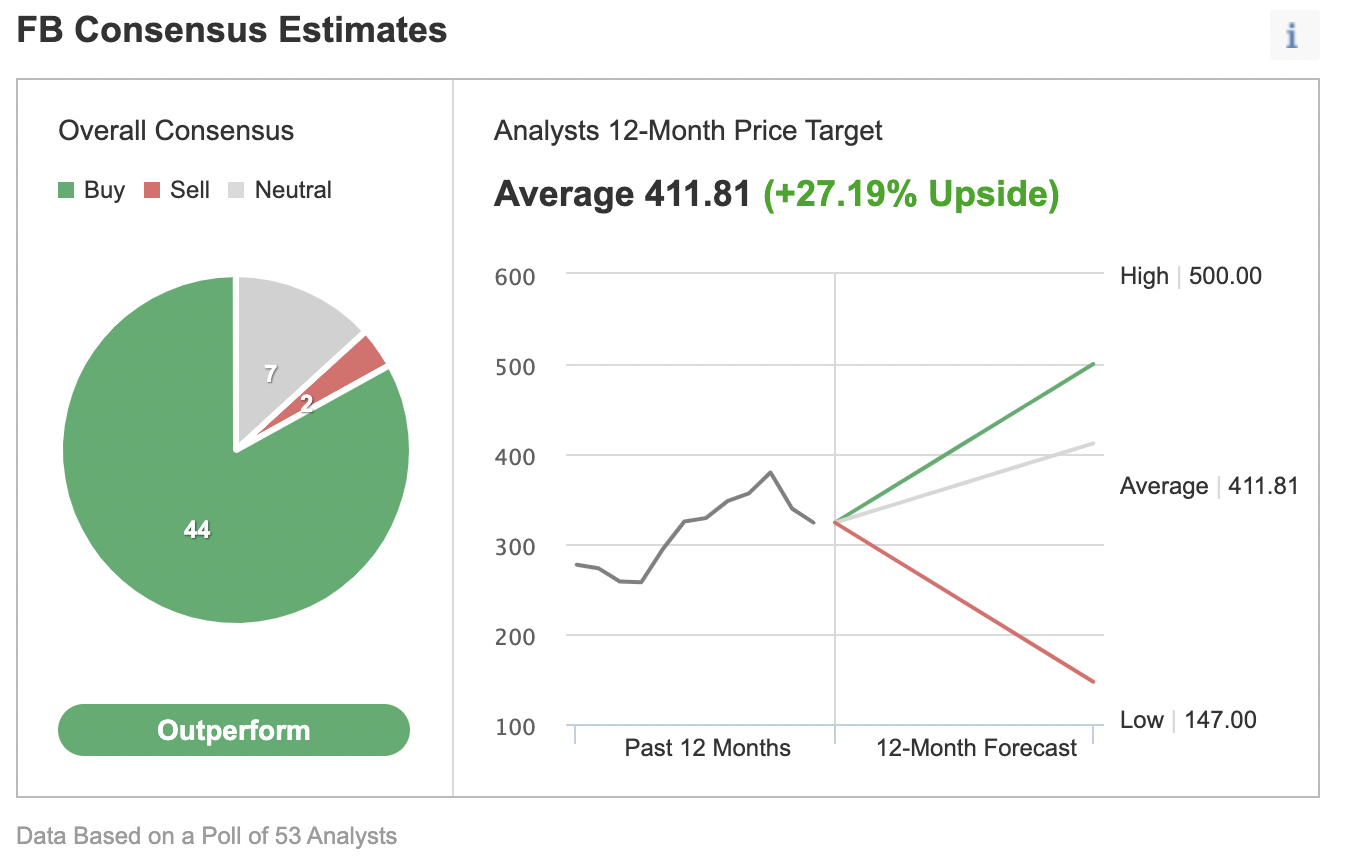

Many investors now wonder whether it's all gloom and doom for the company. Or, is Facebook still a solid buy? Among 53 analysts polled via Investing.com, the stock has an ‘outperform' rating.

FB shares have a 12-month price target of $411.81, implying an increase of about 30% from current levels. The 12-month price range currently stands between $147 and $500.

In other words, Wall Street regards current negative news as potentially being transitionary. Investors who agree with this view might want to consider buying the dips in FB stock.

However, not everyone might concur. Therefore, for investors who are still concerned about the near-term prospects, we introduce two tech ETFs with little FB exposure. This means that moves in Facebook shares alone are not likely to have a big impact in the price of these funds.

1. Invesco S&P 500 Equal Weight Communication Services ETF

Current Price: $37.93

52-Week Range: $25.50 - $40.00

Dividend Yield: 0.97%

Expense Ratio: 0.40% per year

The Invesco S&P 500 Equal Weight Communication Svc (NYSE:EWCO) invests in stocks in the Global Industry Classification Standard (GICS) communication services sector within the S&P 500 index. Earlier in the year, we discussed the sectors that comprise the GICS (here, here, and here).

In this classification, communication services companies are defined as those “that provide content, such as information, advertising, entertainment, news and social media, delivered on networks, primarily through internet, broadband, cellular, cable and land lines.”

EWCO, which currently has 27 holdings, started trading in July 2018. The leading 10 names make up about 47% of net assets of $42 million. Facebook stock is not one of those top shares as its weighting in the fund stands at 3.92%.

Among the top names are Live Nation Entertainment (NYSE:LYV), which promotes live entertainment events, video game developer Take-Two Interactive Software (NASDAQ:TTWO), streaming pioneer Netflix (NASDAQ:NFLX), advertising and PR agency Omnicom (NYSE:OMC), and telecom group Lumen Technologies (NYSE:LUMN).

The fund returned more than 37% in the past year and 20.5% so far in 2021. Yet, in the past month, EWCO is down 0.5%.

By comparison, the Communication Services Select Sector SPDR® Fund (NYSE:XLC) lost about 5.4% in the past month. Readers might be interested to know that weighting of FB stock in XLC currently stands at 20.90%. In fact, it holds the top spot among the holdings in that fund.

Buy-and-hold investors who are interested in EWCO might see a potential decline toward $36.5-$37 as a better entry point into the ETF.

2. First Trust NASDAQ-100 Equal Weighted Index Fund

Current Price: $110.90

52-Week Range: $83.94 - $117.93

Dividend Yield: 0.24%

Expense Ratio: 0.58% per year

Readers who want to invest in the NASDAQ 100 index through an equal-weighted fund can choose from two ETFs. First Trust NASDAQ-100 Equal Weighted Index Fund (NASDAQ:QQEW) is one of them.

QQEW tracks the returns of the NASDAQ 100 Equal Weighted. The fund started trading in April 2006, and has around $1.31 billion in assets. In terms of the sub-sectoral breakdown, the technology sector makes up the highest portion, with 39.28%, followed by consumer discretionary stocks (23.89%), health care (13.32%), industrials (9.50%) and others.

The top 10 holdings account for 12% of the fund. Put another way, it does not carry the potential risk that comes with top-heaviness. FB stock, whose weighting stands at 0.93%, is not among the leading names.

China-based technology group NetEase (NASDAQ:NTES) and travel services provider Trip.com (NASDAQ:TCOM), Dollar Tree (NASDAQ:DLTR), which operates discount retail stores, human capital management solutions provider Paychex (NASDAQ:PAYX), Marriot International (NASDAQ:MAR), which operates hotel, residential, as well as timeshare properties, are among the top stocks in the roster.

Over the past year, the fund is up about 21.5%. Year-to-date it returned 10.2%. In the past month, it is down 4.5.%. Potential investors could regard a decline toward $105 - $107 as a better entry point.