Stocks finished higher yesterday, no surprise, given that implied volatility levels fell sharply from yesterday’s closing once the CPI report was released. The CPI report itself seemed pretty much as expected, and the inflation trends we have talked about remained unchanged. If there was a slowing in the overall trend, it wasn’t something I could easily find.

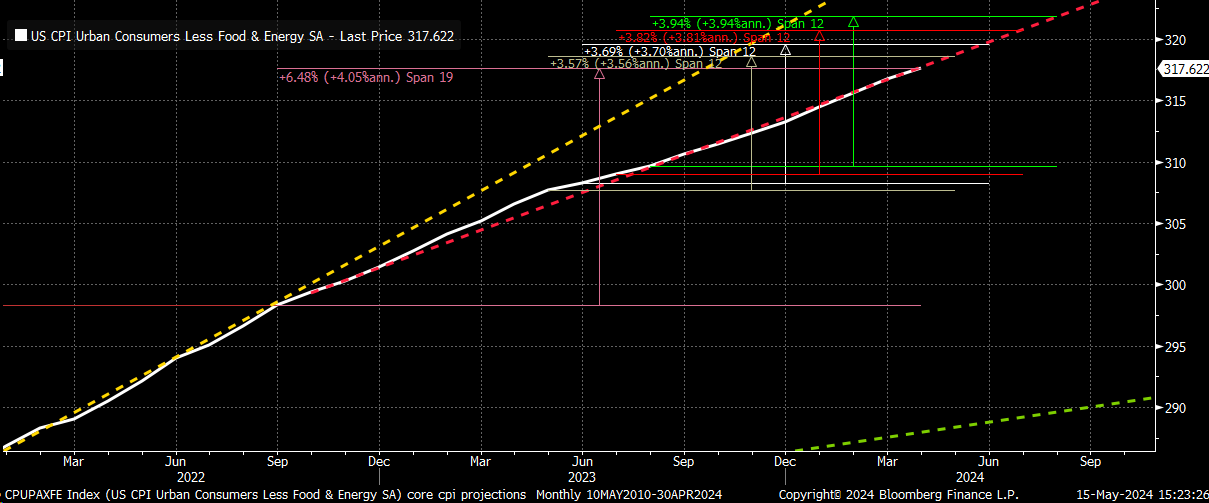

Core CPI has been running at a nice annualized growth rate of 4.0% over the past 19 months, and today’s data did very little to change the trend. If the trend doesn’t change soon, though, the core CPI y/y rate of change will start increasing again in June, and the core could be back to around 4% by August.

I guess the biggest thing going forward for inflation is copper and what is happening there, which has to be up there with one of the craziest moves I have ever seen. If the gains actually hold or take a long time to revert, it will not help bring inflation down at all.

Oil also saw a big intraday reversal due to a bigger-than-expected draw in inventories. This will need to be watched over the coming days.

But the unwinding of the hedging flows dominated the market today as noted by the crush in implied volatility from the VIX1D to the VIX Index, with them all falling. The VIX index’s OPEX comes next Wednesday, which is obviously after this May OPEX on Friday. I’m not all that sure that there is much to be gained from the VIX going lower than 12, though, and I would say, at least based on next week’s OPEX, we could be nearing a floor.

In the meantime, that is it. There may be no write-up tomorrow afternoon. I’m a bit tired from all the excitement.