- Warren Buffett's Berkshire Hathaway reported better-than-expected earnings over the weekend

- Apple, as expected, was the biggest contributor to the stellar earnings

- Considering the fundamentals and technicals of Berkshire Hathaway stock, is it prudent to hold or buy at current levels?

- Short-term economic and market forecasts are unreliable and hold little value.

- The world is teeming with gamblers, but it's the patient investors who tend to fare the best.

Berkshire Hathaway (NYSE:BRKa) (BRKb) earnings surpassed expectations, raking in a whopping $12 billion in revenue and generating a solid $10 billion in operating profit, which is 6% higher than last year.

The company also experienced robust cash flow growth and saw a significant increase in the value of its stock portfolio, largely driven by the soaring Apple (NASDAQ:AAPL) stock, contributing approximately $33 billion in earnings.

With assets crossing the impressive $1 trillion mark, Berkshire Hathaway stands as a financial giant. However, anyone eyeing its Class A shares would have to dig deep into their pockets and shell out over $500,000 per share.

So, let's dive into the remarkable performance of this financial powerhouse and see what sets it apart from the rest.

Fundamental View

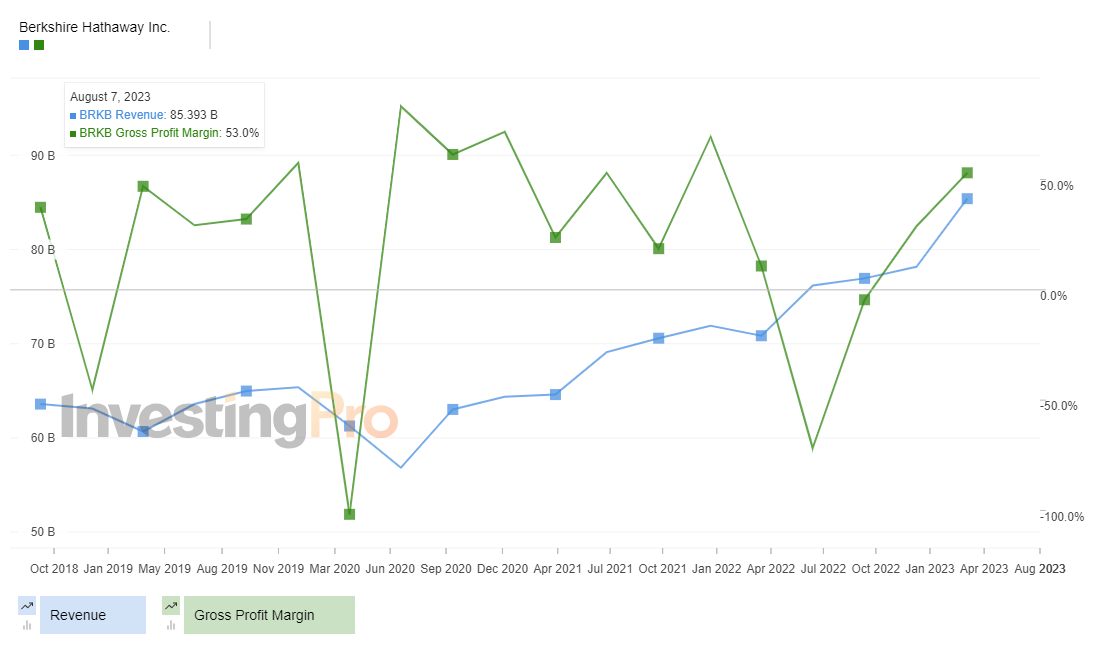

InvestingPro data shows a promising trend for Berkshire Hathaway. After hitting lows in 2020, the earnings have seen a sharp upward trajectory, surpassing the $70 billion mark in 2022 and recently crossing the $80 billion mark. On average, earnings hovered around $265.3 billion from December 2018 to 2022.

In terms of margins, the data indicates a bullish trend, with a notable increase of 53% over the past 12 months since the lows observed in July 2022. Source: InvestingPro

Source: InvestingPro

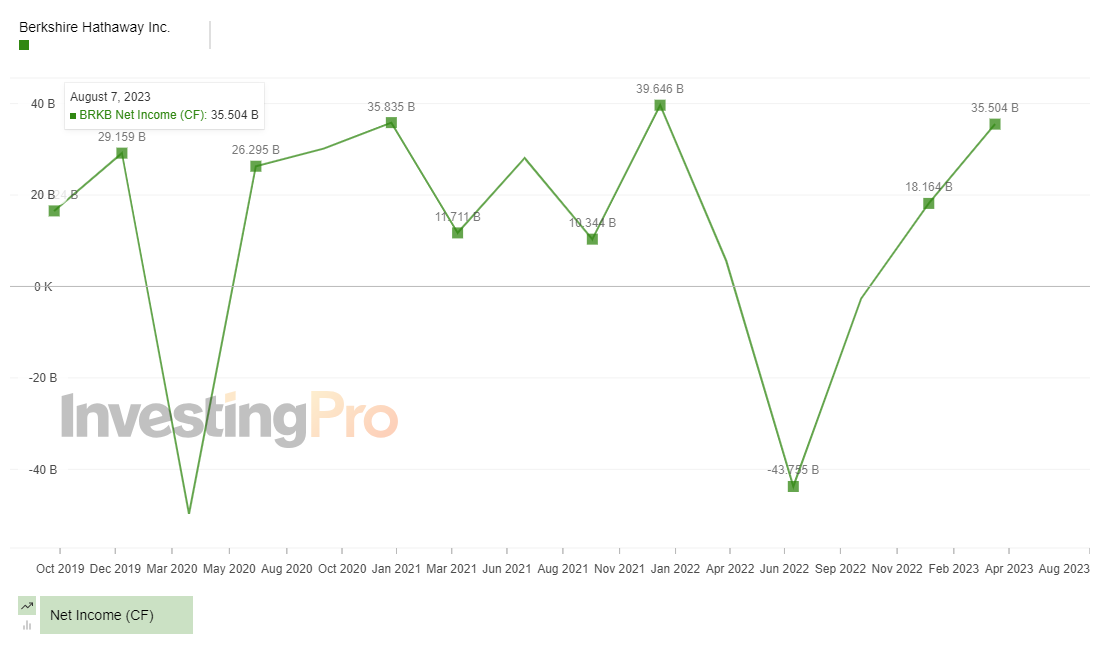

Regarding net income, after reaching a peak of $39.6 billion in December 2021 and hitting lows in June 2022, the last 12 months have seen a net income of $35.5 billion. This puts it in close proximity to the average of $39.6 billion observed between December 2018 and 2022.

Source: InvestingPro

Source: InvestingPro

In terms of diluted earnings per share growth rate for the last quarter, it has surged by more than 500%. Currently, earnings per share (EPS) showed a significant improvement, reflecting a 24.8% increase compared to the average of the past 12 months.

Analysts are also optimistic, forecasting an increase in EPS expectations for the next quarter of +5.6%, with projections rising from $5,256 to $5,553 per share year over year.

Source: InvestingPro

Source: InvestingPro

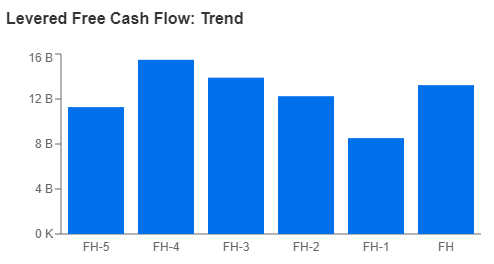

The Price/Cash Flow ratio has been on the rise since the below-average results until June 2022. Over the past six months, the company recorded operating cash flows of $21.7 billion, with 2.174 billion shares outstanding, resulting in $9.98 in operating cash flow per Class B share.

Furthermore, the stock is currently undervalued by approximately 25.9% compared to its Fair Value, which Investing PRO calculates to be around $671.6K per share based on an average of 13 different models.

Berkshire Hathaway's investment team has consistently contributed to its excellent long-term results, with noteworthy holdings, including $10 billion in short-term U.S. Treasuries.

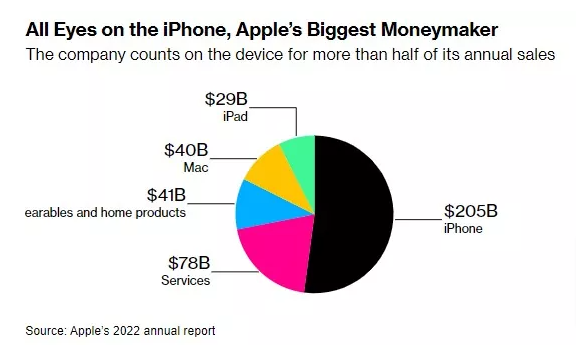

It comes as no surprise that Warren Buffett loves Apple, as the tech giant continues to contribute significantly to Berkshire's earnings.

Apple's market capitalization has skyrocketed, becoming the first company to reach $1 trillion in 2018 and currently exceeding $3 trillion - hovering close to France's GDP, the world's seventh-largest economy.

The company's products and services have revolutionized everyday life, solidifying Apple's position as one of the most influential companies in history.

However, it's worth noting that despite Apple's impressive total revenue of $81.8 billion, it experienced its third consecutive quarter of declining sales, particularly in its iPhones, Macs, and iPads.

The company anticipates a 1.4% revenue decline in the third quarter, which would mark its longest losing streak in two decades. Notwithstanding this decline, diluted earnings per share still rose by 5.5% to $1.26, reflecting the resilience of the company amidst market challenges. One positive highlight from Berkshire Hathaway's earnings report was the impressive performance of its services segment, which proved to be the strongest part of the report.

One positive highlight from Berkshire Hathaway's earnings report was the impressive performance of its services segment, which proved to be the strongest part of the report.

The segment's revenues surged by over 8% to reach a substantial $21 billion, fueled by a remarkable number of more than 1 billion subscriptions.

Overall, Berkshire Hathaway's earnings release delivered positive results, characterized by strong and broad revenue growth along with robust operating profits. Based on these favorable results, I currently see no reason to sell its shares (if you are already holding them).

On the contrary, these impressive figures prompt me to consider the stock for potential long-term returns, prompting me to place it on my watchlist for further evaluation.

Technical View

Taking a technical view, Berkshire Hathaway stock has revisited its previous highs, but on the weekly timeframe, a reversal candle has appeared, further confirmed by the RSI in the overbought zone.

Taking a technical view, Berkshire Hathaway stock has revisited its previous highs, but on the weekly timeframe, a reversal candle has appeared, further confirmed by the RSI in the overbought zone.

This could potentially lead to a price correction below $500,000 after the impressive +33% performance recorded since the bottom in October 2022.

Conclusion

The remarkable data invites us to once again contemplate the legendary Warren Buffett, renowned as the Oracle of Omaha, and his extraordinary achievements. Over the years since 1965, he has delivered an impressive annualized return of 19.8%, far surpassing the S&P 500's 9.9%, solidifying his place as one of the greatest investors in history.

A key aspect of his success lies in his ability to hold onto stocks for the long haul, evident through his ownership of Coca-Cola (NYSE:KO) for 34 years, American Express Company (NYSE:AXP) for 29 years, and Moody's (NYSE:MCO) Corporation for 22 years. This steadfastness in his investment approach sets him apart from those who often hastily sell stocks, chasing quick gains.

Moreover, the valuable insights shared by Buffett and his partner, Charlie Munger, offer crucial lessons for us to heed:

These wise thoughts serve as a reminder of the significance of adopting a long-term perspective when making investment decisions, steering clear of being influenced by fleeting market movements or impulsive speculation.

*** Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.