Trading gold need not be as onerous or capital intensive as it once was, as many of the MT4 brokers now offer the precious metal on their platforms, along with other metals and markets.

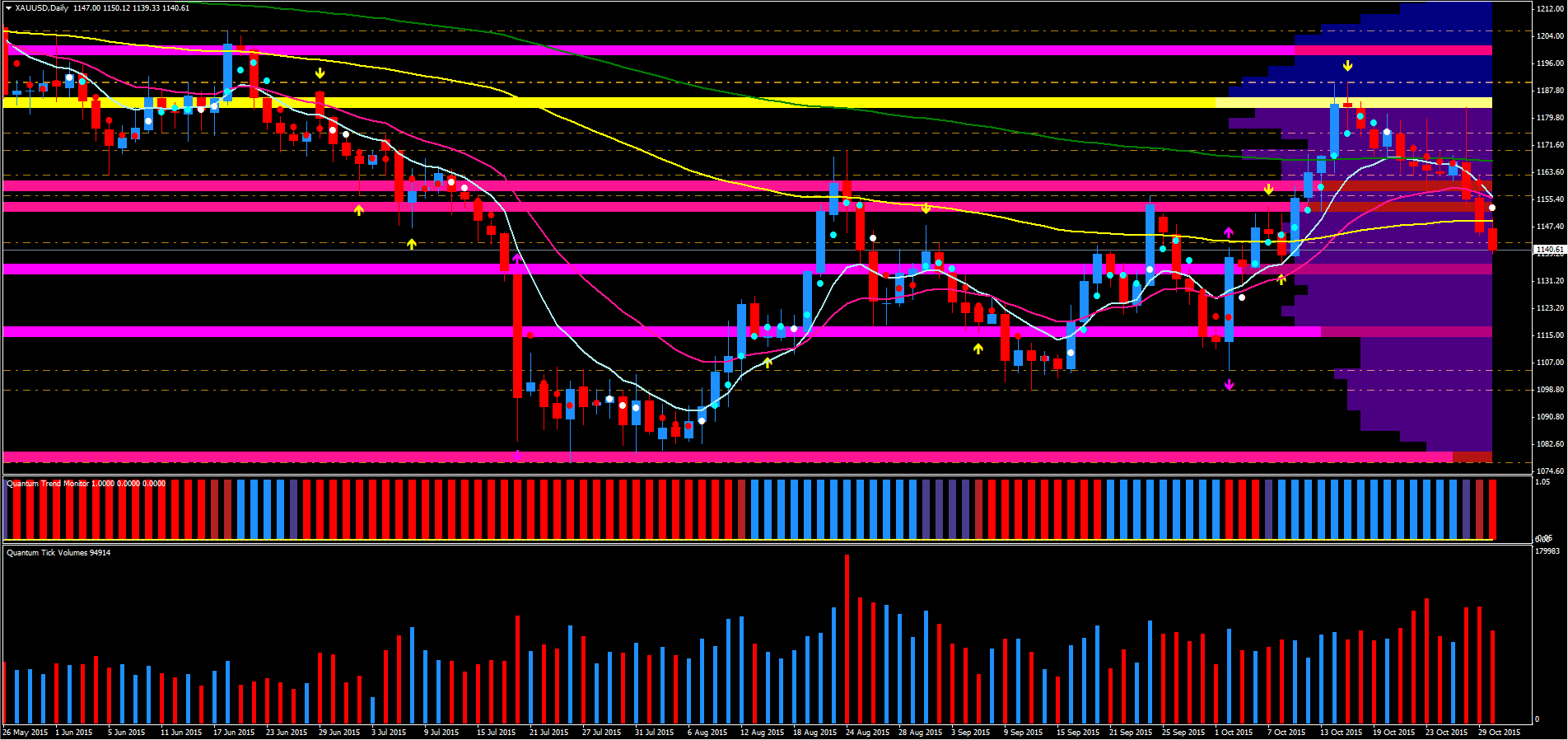

And indeed the daily chart for gold on MT4 is as bleak for gold bugs as it is in the traditional futures market. The bearish momentum that I highlighted earlier this past week has taken hold once again, driving the price of gold lower, down towards the $1140 per ounce region, and in addition taking the metal below the 100 day MA on the daily chart.

What is perhaps most interesting at present is that this is against the context of US dollar weakness where we would expect to see gold rise as a consequence.

Key levels for the precious metal include $1132 and any move through here will then open the way for a deeper move to test further support in the $1108 region. Overhead we now have deep and sustained resistance from $1180 up to $1225 per ounce. For any recovery to take place we will need to see a buying climax and consequent move higher along with sustained and rising volumes.