One of the biggest stories to emerge has been the decline in Emerging Market Currencies. The IMF noted this in their latest World Economic Outlook, which stated:

Growth in emerging market and developing economies is projected to slow from 4.6 percent in 2014 to 4.2 percent in 2015, broadly as expected. The slowdown reflects the dampening impact of lower commodity prices and tighter external financial conditions—particularly in Latin America and oil exporters, the rebalancing in China, and structural bottlenecks, as well as economic distress related to geopolitical factors—particularly in the Commonwealth of Independent States and some countries in the Middle East and North Africa.

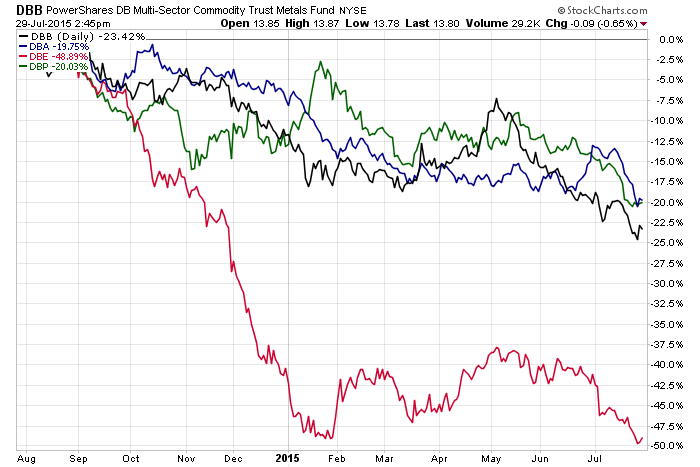

The overall drop in commodity prices is pronounced. As this graph of the four major commodity ETFs (PowerShares DB Agriculture (ARCA:DBA), PowerShares DB Base Metals (NYSE:DBB), PowerShares DB Energy (NYSE:DBE) and PowerShares DB Precious Metals (NYSE:DBP)) shows, all are lower over the last year; with energy’s drop-off being particularly pronounced:

These decreases are especially harmful to developing countries, which depend on raw material exports for growth. Last week, the Financial Times reported emerging market currencies were down 15%. Brazil is a microcosm of the issues involved. The real has lost half its value relative to the dollar over the last five years, which is leading to rising inflationary pressure. Compounding the problem is negative annual GDP growth for the last 6 months. Caught in a stagflation environment, the central bank has opted to fight inflation, lifting rates from 11% in September of last year to their current level of 14.25%. This past week alone they raised rates an additional 50 basis points.

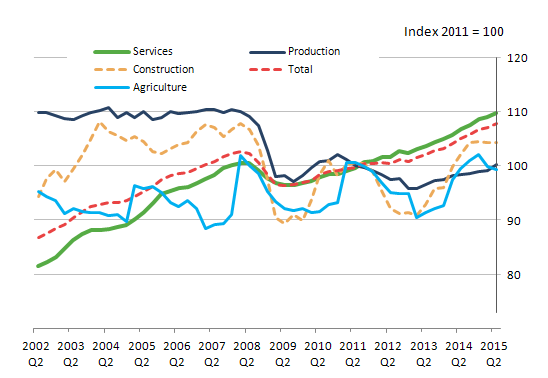

The UK continues to have one of the strongest economies in the developed world. 2Q GQP grew at an annualized 2.6% pace. Services were up .7% while production increased 1%. Construction was flat.

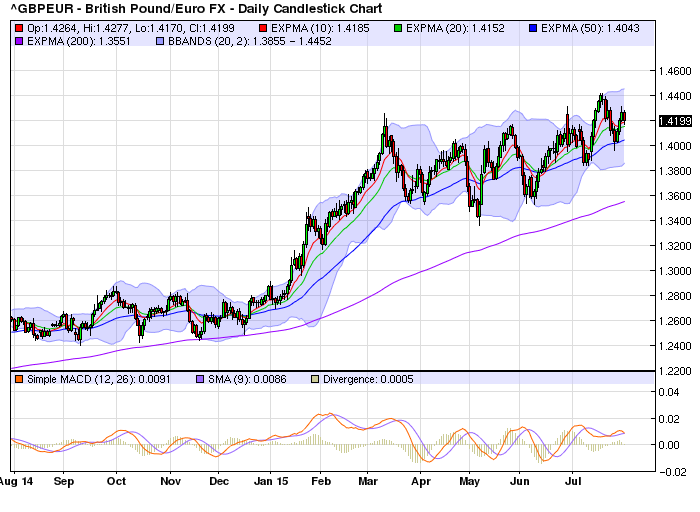

However, Services are the primary driver of the current expansion, with construction providing ancillary stimulus. Production is still below pre-recession levels. The strength of the UK economy combined with the belief the BOE is close to raising rates has placed a strong bid under the sterling, whose strength is beginning to hamper exports. This is especially apparent in the pound/euro chart, which is trading near one-year highs:

As always, US news will receive an in-depth treatment in our US Equity and Economic Review. Consumer confidence decreased nearly 10 points, falling from 100-90.9. The Conference Board noted a slight decline in short-term expectations. Durable goods increased 3.4%; the number was still up .8% without transport orders. And thanks to a rebound in consumer spending, 2QGDP was up 2.3% from the previous quarter.

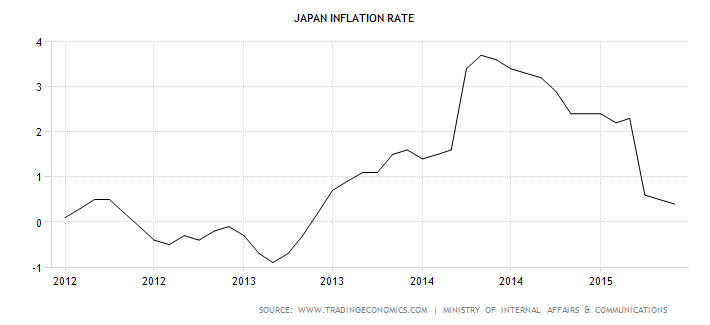

Japan’s news was mixed. After rising over 3% in early 2014, inflation has moved lower, and is now approaching the 0% rate. Thanks to oil’s price decline, inflation is decreasing, which this chart shows clearly:

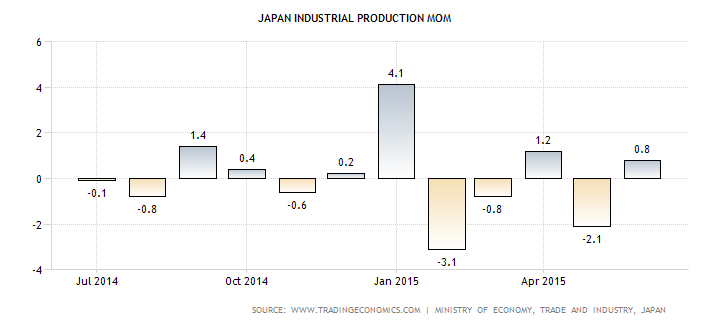

In the most recent minutes, the BOJ stated they believed price expectations were rising and businesses were now trying to pass on cost increases from the depreciating yen. They also believed that inflation expectations were increasing. Unfortunately, those beliefs are anecdotal. Industrial production was up 2% Y/Y with a 1.5% increase in shipments. This coincident indicator has been weak thanks to an overall decline in Asian economic activity. In the last 12 months, the M/M increase has been positive only 6 times.

Retail sales were up .9%. The best number, however, was the 16.3% increase in housing starts. This is the best release in over 2 years, and may indicate the Japanese construction industry has emerged from a two-year hiatus.

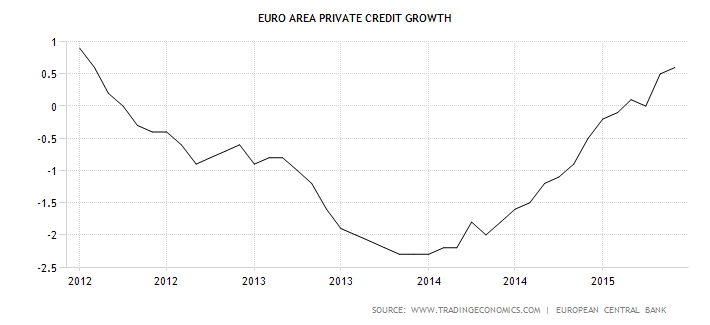

EU loan growth continues to impress; the latest figure was up .6%. As this graph shows, loan growth has made an impressive rebound:

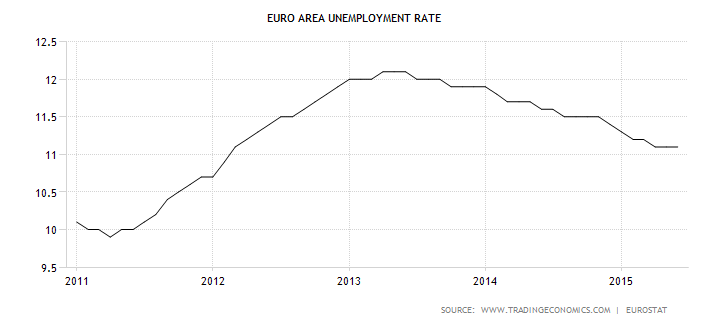

Spanish and Irish GDP increased 3.1% and 6.1% Y/Y, respectively. These figures are especially impressive as both countries contributed to the EU slowdown. Inflation, however, remains low, with the latest .2% Y/Y figure indicating deflation may still be a possibility. And unemployment remains stubbornly high at 11.1%, printing yet another month over 11%:

Part of the problem is the statistical composition, as it represents 28 countries, with 21 below the 11.1% average. However, only five countries have rates below 6%, indicating the 11.1% figure has some statistical weight.

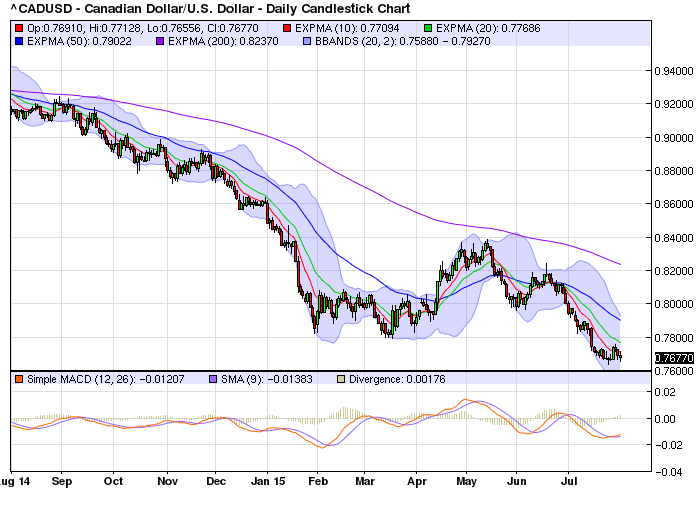

And finally, Canadian GDP was down again:

Real gross domestic product fell 0.2% in May, the fifth consecutive monthly decrease. The decline in May was mostly a result of contractions in manufacturing, mining, quarrying, and oil and gas extraction as well as wholesale trade.

The output of goods-producing industries fell 0.6% in May, down for a fifth consecutive month, primarily as a result of declines in manufacturing and mining, quarrying, and oil and gas extraction. Utilities were also down. In contrast, construction and, to a lesser extent, the agriculture and forestry sector were up.

The drop in oil prices was the primary driver of this decrease. One more month and Canada will be in a technical recession, increasing pressure on the Bank of Canada to again cut rates. Last week, the loonie found support at the .78 level versus the dollar:

But with the Fed expected to raise rates and the recent bearish news from Canada, expect this pair to move lower.

So, where are we as we go into the new week? The biggest story is the emerging market exodus, exacerbated by the anticipation of the Fed's move and weakness in the Chinese stock market.

This could quickly become a major problem as developing countries see their currency values decrease, increasing imported inflation and thereby pressuring central banks to raise rates. And the five months of Canadian weakness are starting to raise concerns as well.

Unlike most developed countries, Canada is still natural resource dependent, which means it reacts more like a developing country from an international standpoint. The rest of the world saw little meaningful economic change last week.