Wells Fargo (NYSE:WFC) & Company is an American multinational financial services company with over 8000 branches. It is the 4th largest bank in the US by total assets and is one of the largest banks as ranked by bank deposits and market capitalization. After many years lagging the S&P 500, Wells Fargo has surged in performance over the past year on the back of good results and upheaval in the banking industry. All financial companies did well this year as investors look to branch away from big-tech stocks, and longtime shareholders in Wells Fargo were rewarded for their commitment as the bank increased their quarterly dividend for Q3 while instituting massive buyback programs in Q1 and Q2, that contributed to the rapid rise in the price of the bank's stock. The collapse of regional banks meant that more customers looked to bigger institutions like Wells Fargo for their banking needs especially after receiving signals that the US government would intervene as required to protect such large banks from insolvency during a crisis period. As the Fed gradually roles out interest rate cuts, Wells Fargo's top-line revenue is expected to increase as more customers will be able to avail loans at lower interest rates. The rise in price presents an ideal selling opportunity to pocket gains in an industry which rarely sees multi-fold growth within a single year.

Financials and Operations AnalysisFrom a pure numbers angle, Wells Fargo has performed averagely as compared to its competitors. Total (EPA:TTEF) Revenue stayed almost the same for Q3-2024 as compared to Q3-2023 decreasing by 0.02% and by 0.003% for the nine-month period Y/Y. Net Income decreased by 11% for the quarter and by 7.2% for the nine- month period Y/Y. This is considerably worse than those of Wells Fargo's competitors of the same size, like Morgan Stanley (NYSE:MS) that was able to increase Revenues and Net Income for both the quarter as well as 2024 as a whole compared to 2023 by over 10% (for Revenues) and 25% (for Net Income) respectively. JP Morgan Chase (NYSE:JPM), despite being much larger was still able to increase both Revenues and Net Income. Wells Fargo faired much better against competitors like Bank of America (NYSE:BAC) (BofA) and Citi Group that saw stagnant revenues and a large decrease in Net Income for the period (>13% for BofA and >10% for Citi Group). In that sense, the boom in Wells Fargo's stock can be justified as the bank has done much better than consensus expectations, as analysts had predicted a poorer Q3 than what was realized.

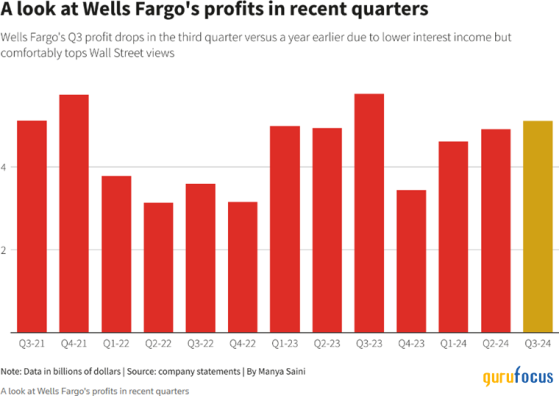

Despite a poorer Q3 2024 as compared to Q3 2023, Wells Fargo has still improved its performance while looking at the last 4 quarters starting from Q4 2023. In fact, while looking at the bank's overall performance over the last 3 years, Q3 2024 has been one of the best quarters for the bank in terms of profit.

Capital and Liquidity are two metrics that are of prime importance for a banking company like Wells Fargo as stronger ratios imply that the bank has a higher capacity to withstand unforeseen economic events or a run-up on the banks cash reserves from disgruntled depositors. Wells Fargo's Common Equity Tier 1 (CET1) ratio represents the core measure of a bank's financial strength from a regulatory perspective and is the bank's common stock + retained earnings divided by the bank's total risk weighted assets. Wells Fargo's CET1 ratio of 11.34% was higher than the Basel III minimum of 8.9%, which is a positive sign. The Liquidity Coverage Ratio (LCR) describes how much high-quality liquid assets the bank possesses in relations to its net cash outflow and is a key measure to assess solvency. Wells Fargo's LCR stood at 127% for Q3, above the 100% as required by the Basel III accords.

Share Price and Industry PerformanceWells Fargo has risen dramatically over the last few days, owing to the aftermath of Donald Trump's victory in the US election spurred on by hopes that a Trump presidency would result in softer regulations for the banking sector.

After lagging the S&P 500 Index for multiple years, Wells Fargo has had its best year, returning over double of what the Index has generated and has outperformed the index on both a price and total return basis for the last 1 year (graph below).

The massive outperformance though is not specific to Wells Fargo. Most of the bank's competitors have all performed well against the Index in 2024. All big banking stocks have returned over 60% this year, but only Goldman Sachs (NYSE:GS) has outperformed Wells Fargo so far, returning 81% against Wells Fargo's 75%.

Wells Fargo has instituted prudent financial management while managing its excess cash by increasing its regular dividend payment by 14% for Q3 2024 to $0.4/share. The company also bought back $12.2 billion worth of company shares over the first two quarters of 2024, before announcing it will slow down the pace of buybacks for the rest of the year. These actions were positive signs from management that they are committed to rewarding long-time shareholders. As buybacks imply that there is less stock outstanding in the open market, share price increases. The effects of this program led to a rise in the EPS despite a decline in Net Income for Q2 2024.

The PEG ratio, i.e., the P/E-to-Earnings Growth ratio for Wells Fargo is 1.63. This implies that the P/E ratio for Wells Fargo is 1.63x its projected earnings growth. Although the ideal level for the PEG ratio is below 1 indicating that a stock maybe undervalued, the slightly higher PEG ratio is reflective off the surge in stock price seen for financial sector companies this year. As loan demand catches up due to interest rate cuts, earnings growth is likely to increase, and this would bring the PEG ratio down. From a competitive standpoint, Wells Fargo has a median PEG ratio, much better off than JP Morgan Chase and Bank of America that have PEG ratios >3, but slightly higher than those of Morgan Stanley and Goldman Sachs. The >1 value for the PEG ratio may be a signal to some long-term shareholders to take part of their profit and look for a better entry point when the stock is available at a discount.

From a price ratio point of view, Wells Fargo is well placed. Despite reaching its all-time high this past week, on the back of the historic US election, Wells Fargo's P/E of 13.77 is comparable with most of its main competitors JP Morgan (14.12), Goldman Sachs (17.42), Morgan Stanley (19.57) and Bank of America (14.75). This reasonable level of P/E suggests that Wells Fargo's price has not reached absurd levels that would make an investment in the company seem foolish. This is still lower than the S&P 500 Index, which is valued at a P/E of 27.87, despite the poorer performance of the index as compared with Wells Fargo, providing further proof that the company's stock price has still not reached a level that would be considered overpriced.

Banking Sector and Industry ForecastMoney has flowed into the banking sector as investors are looking to branch away from the Magnificent Seven tech stocks as many bank stocks pay good dividends. The 2023 banking crisis led to the collapse of regional powerhouses like the Silicon Valley Bank and the First Republic Bank (OTC:FRCB) but it had the opposite effect on bigger banks like Wells Fargo that have much larger balance sheets and were better able to absorb the shock of rising interest rates and decreased demand for commercial real estate loans.

The collapse of smaller banks led to depositors putting more of their money into the bigger banks like Wells Fargo. Aggressive actions from financial regulators sent a signal to investors that the US government will be quick to intervene in times of trouble leading to investors being more confident in this sector, which in turn led to large banks like Wells Fargo capturing more of the regional banks customer base.

Elevated interest rate levels from 2022 onwards led to lower loan growth and pressured Wells Fargo from the liabilities side as the bank had to pay higher rates on their deposits. Loans to borrowers in Q3 2024 fell to $910.3 billion vs $943.2 billion from a year earlier. For the last year, loan demand has been subdued as higher interest rates have deterred retailers and commercial enterprises from borrowing. As interest rates have started to fall since the Fed has started its rate cuts program, we can expect higher demand from consumers for lower interest rate loans. Although lower interest rates affect a bank's profitability, Wells Fargo's interest income can actually benefit from lower rates as the bank will have to pay out less to consumers to hang on to deposits.

Future OutlookThe bank has had a reasonable quarter, with its best performance in 2024 so far, but at the same time lagging behind Q3 2023 from a profit standpoint. The slash in interest rates should be a driver of demand for the banks going forward as more retail participants would be allowed to avail loans at a lower rate, which is beneficial for Wells Fargo in an environment where they have been struggling to generate organic demand.

From an investor standpoint, for a long-term investor in Wells Fargo, it seems like a good time to sell a good portion of their current shares to pocket the gains from an impressive year in stock performance. Going forward, although business performance is expected to catch up and justify the rise in price, the market will eventually price in any current growth factors at which point the stock price would fall. Thus, for an investor who has a position in Wells Fargo for over a year, now would be a good time to cash those gains and make a decent profit. At the same time, the long-term investor can continue to hold their position in the bank to profit from ever-increasing dividends at the same time keeping an eye out for any future increases in the stock price considering the bank's reasonable price ratios (P/E and PEG). If the investor does decide to liquidate their position, it would be wise to track the bank's performance in the near-future to understand whether any potential future buying opportunities will arise.

For a short-term investor, the aftermath of the US election has sent markets into a frenzy allowing for many investors with a short-term perspective to profit off the current volatile macroeconomic environment. In that vein, it may be good to sell shares in Wells Fargo to profit off the current outperformance that the stock has achieved in the market over the last year. At the same time, volatile market conditions present elevated levels of prices that are touched because of irrational decisions from market participants. For an investor with a short-term focus, and who tracks the various spikes and dips in the prices of equities, Wells Fargo at presents a good scenario whereby an investor can profit from the spike in the market spurred on by the election results, while at the same time having strong fundamentals that can support a stock in the coming months. A short-term investor can thus exit his position today and then enter back into Wells Fargo when the current market volatility has subsided and the price is more reflective of the bank's intrinsic value.

This content was originally published on Gurufocus.com