by Clement Thibault

Since the 2008 financial crisis, of the 'big four' US banks—JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC)—two, JPMorgan and Wells Fargo, have consistently led the pack, both in successfully navigating the financial crisis and maintaining ongoing profitability.

The net income of each of these banks, while lower during the last economic downturn, never crossed into negative territory, a result of their conservative approach to business, stable management. No surprise then that when investors consider buying into the financial sector JPM and WFC, because of their proven profitability, are top of the list.

As each bank gets set to report Q2 '17 earnings, both on Friday July 14, before markets open, we're wondering which might be the better investment right now.

Wells Fargo: Still King of US Banking?

For years, Wells Fargo was the US banking king. The financial institution showed exemplary growth and management capabilities. Warren Buffett (NYSE:BRKa) has been heavily invested in the bank for years; he currently owns $26.7 billion in WFC stock, putting his ownership stake at just under 10%.

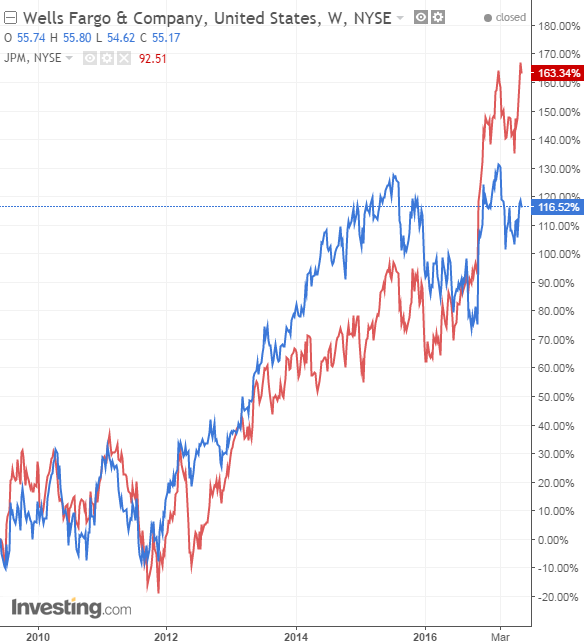

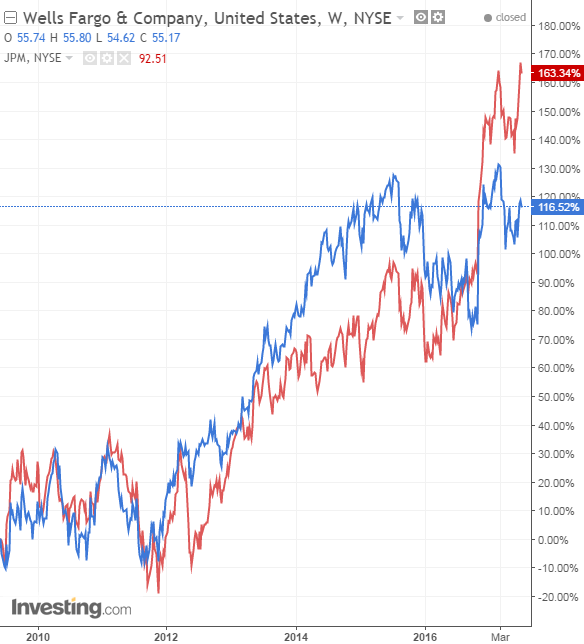

Historically, Wells Fargo shares reflected the company's positive traits, and the bank returned 320% to shareholders from February 2009 to August 2016. In comparison, for the same period, JP Morgan returned 195%.

Wells Fargo now trades for about $55 a share, while JPMorgan trades close to $93. From a market cap perspective, JPMorgan has the larger valuation, $331 billion compared to Wells Fargo's $277 billion market cap.

However, on September 8, 2016, Wells Fargo suffered a bruising hit to its brand and reputation, when news broke that steady-as-you-go Wells Fargo had become embroiled in a years long fraud scandal involving the creation of millions of fake savings and checking accounts by bank employees, using unsuspecting real customer information, at management's urging. Since then, Wells Fargo stock has gone up just 12%, compared to JPM's 40%. It's been almost a year since the news broke, but Wells Fargo hasn't fared well.

When the aftermath of the scandal become public, then CEO John Stumpf resigned, creating a management crisis for the bank that's still being resolved. Wells Fargo continues to make organizational changes to its community bank segment, in order to "restore customer trust." That's clearly a direct admission that managerial focus alongside internal cultural changes are necessary in order to rebuild the bank's standing in the eyes of consumers and the financial arena.

In addition, the bank continues to be liable for fines and suits stemming from the scandal. Earlier this week, Wells Fargo received preliminary approval for its proposed $142-million class-action settlement to compensate customers who had unauthorized accounts opened in their name.

JP Morgan: Smooth Sailing Ahead

JPMorgan, on the other hand, has been sailing along smoothly under CEO Jamie Dimon who has been at the bank's helm since 2006. Dimon is widely regarded as one of the most successful bank CEO's today. He's also a major JPM shareholder with approximately 6.75 million shares, for a total value of about $620 million.

Though both operate as banks, their business models aren't exactly the same. Their revenue streams, for example, come from different areas of the banking industry. Wells Fargo is primarily US consumer oriented; 60% of revenues comes from the community banking segment. Just over 40% of JP Morgan's revenue comes from that division.

JP Morgan's advantage comes from its wholesale business, providing services to organizations such as large corporate clients, institutional customers, mid-sized companies, international trade financing and mortgage brokers. This segment is almost equal in size to its consumer banking division. In contrast, Wells Fargo's wholesale banking division is half the size of its consumer segment.

With Wells Fargo still untangling itself from the recent fraudulent events, does it even have a chance of returning to its pre-scandal performance this quarter?

Revenue and Earnings

Wells Fargo's revenue in the past two quarters was $43.6 billion dollars, versus $43.8 billion for the comparable period in 2016, a drop of 0.5%. Its net income slipped from $11 billion to $10.7 billion, a loss of 2.7%.

Business slowed for Wells Fargo and its last earning presentation provided insight as to why. Comparative Q1 '16, total branch interaction was down 4% in Q1 ;17, consumer checking account opens were down 35% and credit card applications were down 42%. Customer loyalty also fell, from 62% to 58%, reflecting the loss of trust in Wells Fargo as an institution.

But it wasn't all bad for WFC; it still showed growth in banking deposits (6.5%), average loans (4%) and Net Interest Income (5%). However, growth wasn't sufficient to make up for the losses created by the scandal.

JP Morgan, on the other hand, just posted its best quarterly revenue number in almost four years. Its revenue over the past two quarters was $48 billion, up 1.9 billion, or 4%, from the $46.1 billion in revenue generated during the same period last year. Its net income for the past two quarters reached $13.1 billion, 20% higher than the $11 billion gained in 2016. In addition, its average deposits rose 11% and average loans are up 5%, outperforming Wells Fargo on two critical metrics of consumer banking.

Profitability

Wells Fargo's revenue and earnings regression may be temporary, but its profitability metrics are worrying. Over the past three years, WFC's return on equity, return on assets, and profit margins have steadily declined. Three years ago, the bank's return on equity was 14.55%—the best in the business—leading JPMorgan by a 3.7% margin. Today, WFC's ROE has declined to 12.46% while JPM's has risen to 11.2%, narrowing WFC's lead to just 1.2%, a third of what it previously had been.

Return on assets looks almost exactly the same. Wells Fargo used to be way ahead, with a 1.47% return on assets compared to JPM's 0.9%. Today though, they're almost even, with 1.15% for WFC to JPM's 1.03%.

The gap in profit margins hasn't just narrowed between the two banks, JPM has pulled ahead of WFC. It's now the major bank with the best profit margins: Wells' margins fell from 27.4% to 22.9% whereas JPMorgan's grew to 26.4% from 24.9% JPMorgan.

Valuation

Right now JPMorgan appears to be the better deal. No surprise since Wells Fargo is still trying to leave the scandal behind whereas JPMorgan shares are at all-time highs. However, we believe that's a deceptive measure.

First, interest rates are rising, and JPMorgan is in an impressive position to take advantage. For each percentage that interest rates increase, JPMorgan is expected to see earnings growth of $2.4 billion, which comes out to about $600 million per hike.

The bank's Price-to-Tangible Book Value is 1.9, admittedly a lot higher than the bank's three year median of 1.46. However, even at 1.9, JPMorgan is still far away from its pre-crisis valuation levels of 2.8 times Tangible Book.

Wells Fargo's Price-to-Tangible Book Value is completely in line with its three year median valuation of 2.1. That's obviously higher than JPMorgan's numbers, despite recent negative trends for WFC. On a Price-to-Earnings Ratio basis, JPMorgan is just barely more expensive, with a ratio of 14.5 to Wells Fargo's 14.

Conclusion

One thing is clear – JPMorgan is currently the leading American bank, having taken the title from Wells Fargo. It is not only the best performing, it's also the financial institution that's shown the most improvement over the past few years. That's a very compelling combination for investors.

But don't count Wells Fargo out. Far from it. It's still maintaining its position as one of the the two leading American banks. However, there are more questions than answers right now about Wells Fargo. It's not clear just how long its revenue and earnings slump will last, nor just how deeply the scandal has affected customer sentiment.

Even more worrying is the multi-year negative trend in profitability. For years, Wells Fargo was known as the most profitable and efficient bank, an institution that smartly allocated resources and got the best returns by a significant margin.

It seems however, that at the moment those days are in the past. To reclaim its former position as best US bank, Wells Fargo will need to reverse current trends by restarting growth and improving on just about all metrics. Until that happens, there's little doubt that JPMorgan is the better bank, and the better investment.