This article was written exclusively for Investing.com

Stocks and bonds are diverging, with equities rising and bonds trading sideways. Both asset classes appear to be telling a different story. The rising stock market tells a story of hope, while the bond market seems to be in despair. If the bond market proves to be a better indicator of the economic outlook, then the stock market may be in for a harsh reality.

Since March 23, the US 10-year Treasury rate has been hovering around 60 to 70 basis points and is going nowhere fast. The record-low interest-rates would suggest the economic outlook is not likely to improve for the US anytime soon. Meanwhile, the S&P 500 has risen by roughly 28.5% from the lows, suggesting perhaps the worries of the coronavirus may be behind us.

Low Rates Are A Bad Sign

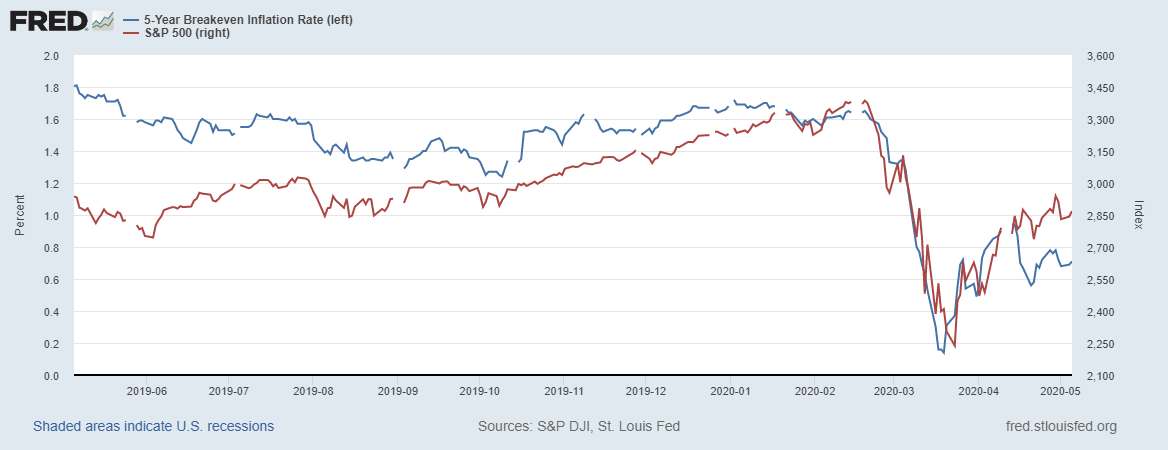

Typically, one would think that low-interest rates would be positive for stocks. But in this case, the low rates suggest the economy is not likely to see a meaningful acceleration any time soon. Even 5-year breakeven inflation rates have tumbled. Which all suggests a sluggish economic recovery, and that is not particularly good for the stock market over the longer-term.

During the steep February and March sell-off, inflation expectations fell along with the S&P 500. However, on April 15, inflation expectations fell sharply, while stocks continued to rise. The change in trend seems to suggest that the economic outlook for both markets took different paths.

Weak Economic Recovery?

With inflation expectations falling, it suggests that economic output is likely to be weak. With weak growth and low inflation, there is no reason for bond yields to rise. If that is the case, then one must wonder what it is the equity market is thinking about at the moment.

If rates did begin to rise, then it would validate the equity markets' sudden surge and indicate an economic recovery is taking shape. While typically rising interest rates can be seen as a negative for stocks, that is not the case at the moment. The Federal Reserve has also made it pretty clear it will not tighten monetary policy anytime in the near future. It means that rising inflation and interest rates will not pose a threat to stocks at this point.

Two Tales?

The divergence between stocks and bonds may be telling a tale of two markets with two very different viewpoints. One that suggests economic growth and inflation are likely to remain subdued for some time to come. If this is the case, then it seems to be only a matter of time before the stock market itself realizes the adverse effects of the economic slowdown, and the recovery is not taking hold as planned.

In either case, there seems to be a clear separation taking place between the markets, and it seems more likely that the bond market is looking for a slow economic resurgence, while stocks are still looking for that elusive "V" shaped recovery.

Whatever shape the recovery ultimately ends up taking will only be known in hindsight. For now, what it really comes down to, is which market you believe more, and which market will ultimately be right. Bonds or stocks?