Investment ThesisOverall profitability was impacted in the fourth quarter of fiscal 2025 by Walmart (NYSE:WMT)'s SG&A spending deleveraging by 46 basis points (bps). Tech investments, greater variable compensation, and higher marketing and utility expenditures across Walmart U.S. were the main causes of the cost increase. The pressure was further increased by transaction-related costs associated with the VIZIO purchase. The time adjustment of Flipkart's Big Billion Days (BBD) event presented cost issues for international operations, and Sam's Club U.S. had to absorb greater labor investments, which are anticipated to have an adverse effect on profitability in the upcoming quarters.

Investment UpsidesInherent Strength Drives Growth: Walmart's shares have rallied 57.4% in the past year compared with the industry's growth of 55.6%. The company's performance reflects the strength of its highly diversified business, with contributions spanning various segments, markets, channels and formats. It has been benefiting from an increase in both in-store and digital channel traffic, reflecting its adept navigation of the evolving retail landscape. Walmart continued to showcase a robust performance in the fourth quarter of fiscal 2025. The company experienced growth across all business segments, expanding e-commerce, increasing pickup options and accelerating delivery services. Newer ventures like the marketplace, advertising and membership have contributed to diversified profits, reinforcing the resilience of Walmart's business model. It also hiked its annual dividend rate. The company witnessed a 16% increase in global membership income in the quarter. WMT's global advertising business advanced 29%. Together, these upsides reinforce the company's position as a retail powerhouse with a keen eye on sustained success and customer engagement.

Road Ahead Looks Bright: For the first quarter of fiscal 2026, Walmart expects consolidated net sales growth of 3-4% (at constant currency or cc). The adjusted operating income is expected to increase 0.5-2% at cc in the quarter. Walmart expects quarterly adjusted EPS to be in the 57-58 cents range. The company recorded an adjusted EPS of 60 cents in the first quarter of fiscal 2025.

For fiscal 2026, WMT expects consolidated net sales growth of 3-4% (at cc). The adjusted operating income is expected to increase 3.5-5.5% at cc for the year. Net interest expenses are likely to escalate to $100-$200 million. Walmart expects adjusted earnings per share (EPS) for fiscal 2026 to be in the $2.50-$2.60 range. The company recorded an adjusted EPS of $2.51 in fiscal 2025.

Impressive Comp (WA:CMP) Sales: Walmart has been gaining from its sturdy comp sales, which in turn is driven by its constant expansion efforts and splendid e-commerce performance. The company has been strengthening its physical fleet, which plays a dual role by catering to customers directly and also fulfilling a considerable chunk of the company's e-commerce sales. Walmart has been focused on store remodeling in an attempt to upgrade them with advanced in-store and digital innovations. Additionally, the company has been undertaking several efforts to enhance merchandise assortments. Walmart remodeled 100 U.S. stores in fiscal fourth quarter. The company is also gaining from its compelling pricing strategy, which helps it draw customers. Walmart US reported a 4.6% increase in comparable sales during the quarter, driven by a 20% growth in e-commerce sales and ongoing market share gains across various categories. This growth was primarily fueled by higher customer transactions both in-store and online. The grocery category continues to perform strongly, with mid-single-digit growth, while the health and wellness sector saw impressive mid-teens growth. A significant contributor to this growth was the sales of GLP-1 products, which added approximately one percentage point to the segment's comparable sales, maintaining the trend from previous quarters.

Robust E-Commerce Initiatives: Walmart continues to be driven by its strong omnichannel business. From investing in pioneering data analytics to expanding its digital presence and optimizing in-store operations, Walmart leaves no stone unturned. Impressive store proximity to customers has allowed Walmart to use its stores to fulfill e-commerce orders. The company has undertaken several initiatives to enhance e-commerce operations, including buyouts, alliances, and improved delivery and payment systems. In the fourth quarter of fiscal 2025, Walmart's Global e-commerce sales surged 16% as penetration increased across all segments. The upside can be attributed to store-fulfilled pickup and delivery services, along with growth in the U.S. marketplace. Walmart U.S.' e-commerce sales rose 20%, driven by store-fulfilled pickup & delivery and growth in the marketplace as well as its Connect advertising. In Walmart International unit, e-commerce sales went up 4%. E-commerce net sales jumped 24% at Sam's Club U.S., backed by momentum in delivery from the club, with digital penetration at an all-time high.

Walmart has been innovating in the supply chain and adding capacity as well as building businesses such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+ and Walmart Fulfillment Services. Other notable strides in the e-commerce realm include the buyout of a major stake in Flipkart, which has been bolstering its International segment. Walmart's majority stake in India's digital transaction platform, PhonePe, is also worth mentioning. Additionally, the company has made aggressive efforts to expand in the booming online grocery space, which has long been a major contributor to e-commerce sales.

Focus on Delivery Services: Walmart has significantly bolstered its delivery capabilities, as exemplified by its Express On-Demand Early Morning Delivery service, Spark Driver platform, partnership with Salesforce, the expansion of the InHome delivery service, investments in DroneUp, the Walmart+ membership program and a pilot with Cruise to test grocery delivery through self-driven all-electric cars. Preceding these endeavors, Walmart introduced Express Delivery in April 2021, and in January 2019, it forged partnerships with Point Pickup, Skipcart, AxleHire and Roadie. Additionally, the acquisition of Parcel in September 2017 was a strategic move to elevate its delivery service. The company's store and curbside pickup options add to customers' convenience. Walmart has expanded its store-fulfilled delivery network, now covering 93% of U.S. households with same-day delivery in the fourth quarter of fiscal 2025. In addition, the company has seen a positive response to its newly launched same-day pharmacy delivery service. As of the fiscal fourth quarter, Walmart U.S. had nearly 4,600 pickup locations and about 4,500 delivery stores.

Shareholder-Friendly Moves: Walmart's healthy cash flows have been allowing it to make shareholder-friendly moves. For fiscal 2025, WMT generated an operating cash flow of $36.4 billion and a free cash flow of $12.7 billion. During fourth-quarter fiscal 2025, Walmart's share repurchases amounted to $1.4 billion, representing 15.9 million shares. The remaining share repurchase authorization stands at $12 billion. The company recently announced a 13% increase in its annual dividend for fiscal 2026, raising it to 94 cents per share.

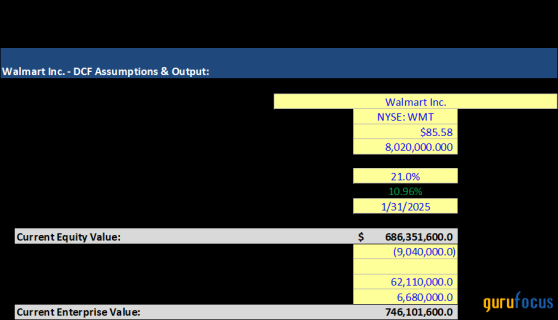

Valuation

Free Cash Flow

DCF

Investment DownsidesStock Appears Overvalued: Considering the price-to-earnings (P/E) ratio, Walmart looks overvalued compared with the industry. The stock has a trailing 12-month P/E ratio of 35.59, which is above the median level of 29.78 scaled in a year. Meanwhile, the trailing 12-month P/E ratio for the industry and the S&P 500 is 32.80 and 21.52, respectively.

Cost Woes to Hurt: Walmart's SG&A expenses deleveraged by 46 basis points (bps) in the fourth quarter of fiscal 2025, impacting overall profitability. The rise in costs was primarily due to tech investments, higher variable pay, and increased spending on marketing and utilities across Walmart U.S. In addition, transaction-related expenses from the VIZIO acquisition added to the pressure. International operations faced cost challenges from the timing shift of Flipkart's Big Billion Days (BBD) event, while Sam's Club U.S. absorbed higher wage investments, which are expected to weigh on profits for the next few quarters.

Volatile Currency Movements: Due to high exposure to international markets, Walmart remains prone to volatile currency movements. In the fourth quarter of fiscal 2025, currency headwinds reduced reported sales by 120 bps. Looking ahead to fiscal 2026, the company expects foreign exchange fluctuations to affect sales growth by 100 bps and operating income by 150 bps, posing a potential challenge to profitability.

Macroeconomic Concerns: The macroeconomic environment poses a significant challenge to Walmart's growth trajectory. Underlying inflation, combined with stagnant wage growth for lower- to middle-income consumers, creates a tough operating landscape. While Walmart has benefited from its value proposition, the broader economic pressures are leading to shifts in consumer behavior. The company noted deflation in general merchandise and consumables categories in the fiscal fourth quarter that constrained revenue growth in historically high-margin segments.

Guru Activity

Gurus, being gurus of the markets, have sniffed the frothy valuations of WMT and hadn't added WMT to their portfolios much in the past three years. The glaring and gigantic green bar essentially reflects how some of the Gurus were pulled o the stocks by the increased dividends in that quarter. And the 1.08% yield on the dividend is actually what keeping Gurus content.

Portfolio ManagementThe target share price for Walmart is $51.68, implying a downside of 40% for investors. Walmart has been able to take actions that are beneficial to its shareholders because of its strong cash flows. WMT produced $36.4 billion in operational cash flow and $12.7 billion in free cash flow for the fiscal year 2025. In the fourth quarter of fiscal 2025, Walmart bought back 15.9 million shares for a total of $1.4 billion. $12 billion is the remaining share buyback authority. The business recently declared that its annual dividend for fiscal 2026 will grow by 13% to 94 cents per share.

This content was originally published on Gurufocus.com