BoC Governor Speaks In Toronto

Bank of Canada governor Stephen Poloz will speak to the Empire Club in Toronto on Thursday.

This will be Poloz first public appearance since announcing last week that after six years in the top spot at the central bank he will not seek another term. His stint as governor of the central bank will end in June 2020.

His appearance also comes days after the bank held the line on interest rates last week, pointing to what it termed resiliency in the economy as the main reason for doing so. But that announcement came two days before Statistics Canada released its monthly Labour Force Report that showed the country had lost more than 71,000 jobs in November. The job losses pushed the unemployment rate to 5.9% and moved the Canadian dollar downward against the U.S. greenback.

Status Of Canadian Household Debt

Statistics Canada will release the national balance sheet for the third quarter on Friday. Included in the information in this data release is a snapshot of Canadian household debt.

The key indicator of debt to income of Canadians is a metric that is closely followed by the Bank of Canada when taking the pulse of the economy.

Housing Starts And New Housing Price Index

Also among the economic data to be released this week is Canadian Housing Starts for November and Building Permits for October. Both will be released on Monday. The national New Housing Price Index for October will be released on Thursday.

Hudson’s Bay, Lululemon Among Key Earning Results

A few key earnings reports will be on the watch list this week. They include Costco (NASDAQ:COST), Hudson’s Bay, Lululemon, Transat and Transcontinental.

Retailer Hudson's Bay Company (TSX:HBC) will release its third-quarter figures before markets open on Monday, followed by a conference call on Tuesday. A group of minority shareholders are battling with shareholders led by the company’s executive chairman Richard Baker over a bid to take the company private.

Last month, Catalyst Capital Group made an offer to buy the retail chain of department stores for $11 a share, outbidding the group represented by Baker. A special committee created by the company’s board of directors is in the process of analyzing the bids. A shareholder vote on the the Baker group’s offer of $10.30 a bid is still scheduled for Dec. 17.

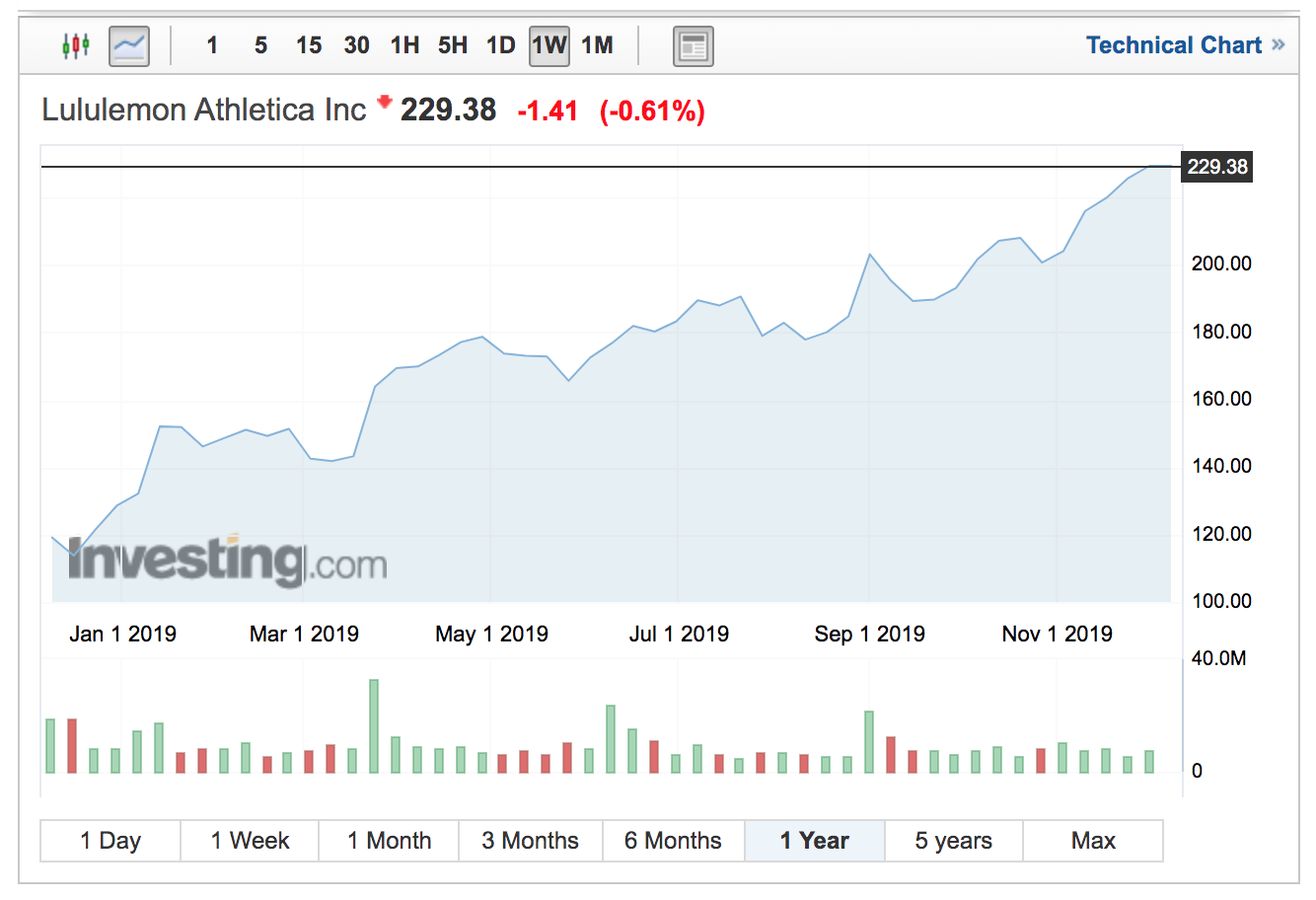

On Wednesday, sports and activewear maker Lululemon Athletica Inc (NASDAQ:LULU) will unveil its third-quarter earnings on Wednesday. Shares of the Vancouver-based company have jumped 101% in the last year as sales have steadily increased, hitting an all-time high of $232 last week. Traded on the U.S.-based Nasdaq, the stock closed Friday at $229.38.