- Number of initial coin offerings (ICOs) expected to fall in March 2018

- U.S. regulation around ICOs is hazy and a number of projects are under investigation

- ICOs failing because of rampant phishing and online scams

- Added scrutiny, better data could drive the next wave of token offerings

Last week I attended one of the world's largest digital asset events, Token2049 in Hong Kong. Crypto enthusiasts from all over Asia as well as other parts of the world were there to discuss digital assets and blockchain-based tokens and technology. As well, there were a lot of people talking about Initial Coin Offerings (ICOs), the cryptocurrency world's version of equity markets' Initial Public Offering (IPO). To say the number of people talking about launching initial coin offerings was overwhelming is an understatement.

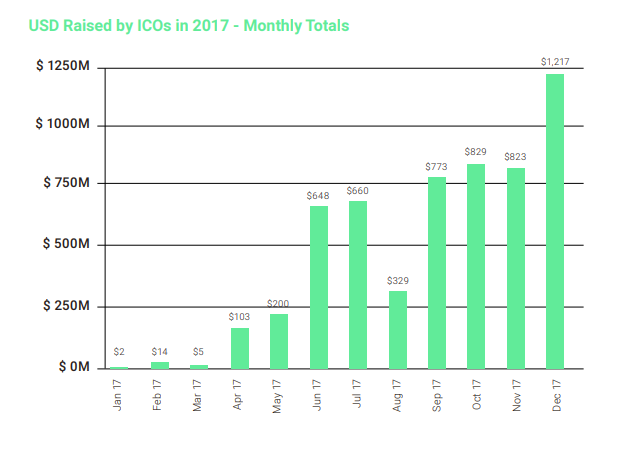

According to a report issued by VC firm FabricVentures and TokenData, based on their metrics, more than $5.6 billion was raised in 2017. "This compares to $1 billion of 'traditional' venture investing in blockchain startups in the same timeframe and a 'mere' $240 million dollars raised by tokens sales in 2016," the report goes on to say.

Source: FabricVentures / TokenData

ICOs have been raising billions of dollars in capital by selling digital assets. But recently these still-unregulated events have become the focus of increased scrutiny. At an MIT-sponsored Bitcoin Expo on Saturday March 17, one of the speakers, Christian Catalini, claimed, “40% to 50% of ICOs are currently underwater – trading at a price lower than the initial offering price.”

As reported by news.Bitcoin.com, although a staggering amount of capital has been flowing into ICOs, statistics for 2018 show that of the 74 offerings completed so far this year, around 76% will end up in the red. Why are so many ICOs trading at a loss, or worse, failing? Some blame the sluggish recent performance of such high profile tokens as Bitcoin and Ethereum.

However, less popular coins, such as EOS, which is up almost 40% over the past seven days, and Cardano, with close to 12% gains over the same period, indicate that there's still upside momentum in the token markets.

U.S. Regulatory Scrutiny

Though the U.S regulatory climate regarding ICOs is still murky, the Securities and Exchange Commission (SEC) currently has dozens of investigations open—and focused on the cryptocurrency space. Reports indicate that as of March 15, the agency has sent subpoenas to 'dozens' of firms it thinks might be breaking securities laws through their involvement in ICOs. Indeed, the reports note that recent SEC probes have resulted in asset freezes that have blocked the completion of some ICOs and forced the suspension of trading for other tokens already on the market.

The Wall Street Journal reported that March’s ICO tally will be the lowest since last August. More than 180 coin offerings are expected to launch in March (data from Token Report). This number will exceed January’s total of 175 but fall below the February figure of 197 offerings. Projects in March are also expected to raise only $795 million, a 45% decline from February’s $1.44 billion.

What's behind the fall-off? Yoav Keren, CEO of New York-based BrandShield, believes that one of the main reasons ICOs are currently struggling is a direct result of the rampant phishing and online scams that have been an increasing factor within the cryptocurrency industry, coupled with the lag of official regulatory policy in this arena.

“Cryptocurrency companies are exposed to numerous threats in all stages of their life cycle: during the ICO process companies that do not protect themselves against phishing are at risk of losing significant funds that are transferred by misled token buyers to phishing websites. During the day-to-day course of business, the holders of their cryptocurrency are at risk of losing their tokens to different scam and phishing activities.

This market is in particular vulnerable to risks, since big money and no governance attracts fraudsters and there is a low emphasis on security. In the end, every fraud incident has a ripple effect on lack of trust in the market."

ICOs Making Data Public and Transparent

Nolan Bauerle, CoinDesk's director of research sees the situation a bit differently. He believes that ICOs offer the opportunity for investors to buy into innovation while helping finance early stage companies.

He concludes that the fact that we can measure their success in funds raised and ROI within such short time frames is both a result of their transparency and proof of innovation. In Bauerle's assessment the fall-off is merely a temporary, statistical glitch. In his view, success and failure rates within the alt-currency arena are, in fact, better than in the non-crypto startup environment.

Bauerle also points out that when venture capitalists (VCs) reigned supreme in early stage finance, the kind of transparency we see with ICOs was unavailable.

“The number of people who could question both the raise [of funds] and the early returns were [limited to] the small group of VCs that were even aware of the opportunities in the first place. It was a small, closed circle of the usual VCs.

Because the numbers are public and transparent in the ICO world, there's plenty of new participants and lots of opportunity for scrutiny. All of that said, the successes and failures of ICOs will break at a rate that is similar to what VCs experience, the main difference being the transparency and ability to publicly measure this in live markets with millions of buyers and sellers.

By way of anecdote, VCs accept that 90% of their portfolio is destined to fail, which is far higher than the 40-50% of ICOs that trade lower than the initial offering.”

The value of the tokens must not be confused with the value of the overall ICO project stresses Moshe Joshua, chief product officer of Blackmoon Crypto. He thinks there is a lack of data from the sell side as well as many crypto investors who are too easily swayed by hype and fear of missing out. This leads to a proliferation of misinformation in place of accurate data and hyper volatility.

“This is a common mistake in most cases.The volatility of the price levels should be associated with the lack of standard protocol when it comes to analyzing investment tactics.

To be more specific—at this moment there is a lack of research from the sell side, meaning that current major crypto exchanges are swarming with inexperienced crypto investors who are too easily influenced into making rash decisions which in fact acts as catalyst to these sudden price movements. So, in conclusion, in most cases the price of tokens (USD equivalent) should not be considered an indicative sign of success or failure a project.”

ICO activity in March may indeed have slowed. However the general consensus seems to be that it's too early to say that ICOs are dead. Rather, the advent of additional regulation, coupled with ongoing, or even greater transparency could fuel the next wave of token offerings.