- Multiple factors indicate a new Bitcoin bull market may be brewing

- Direct Bitcoin investment complexity, safety concerns drive interest in proxy stocks

- Let's take a deep dive into the three top stocks in the industry with InvestingPro to assess which is the better buy now

Since testing a crucial support level at $25,000 on September 11, Bitcoin has been on a clear upward trajectory. The cryptocurrency recently reached a peak of over $28,500 on Monday and has maintained a positive direction into this Thursday morning, with a minor correction bringing it back to $27,600 at the time of writing.

In the eyes of many experts, this is just the beginning of a potential new bull market that could propel BTC to unprecedented all-time highs.

The Stars Begin to Align for a New Bitcoin Bull

Indeed, some of the factors that exerted significant downward pressure on cryptocurrencies in 2022 and have continued to pose challenges this year appear to be undergoing a reversal.

Rising central bank interest rates were a primary negative factor for Bitcoin and other cryptocurrencies in the previous year. However, the rate hike cycle of the Federal Reserve and other major central banks is nearing its end, potentially signaling the commencement of a countdown toward lower rates -- although the Fed's higher-for-longer narrative appears to keep markets in check for a while longer. Still, the fundamentally positive outlook extends to cryptocurrencies and speculative assets in general.

Moreover, regulatory hostility, particularly from the U.S. Securities and Exchange Commission (SEC), has hindered the crypto industry's development in recent months. However, American courts have ruled in favor of Ripple, which faced SEC allegations of marketing an unregistered security through XRP distribution. The courts have also criticized the SEC's arguments in rejecting the transformation of Grayscale's GBTC fund into a Bitcoin cash ETF.

In essence, the SEC's stringent stance on cryptocurrencies is becoming less tenable, fostering hopes of more favorable regulations conducive to the growth of digital assets.

This development also raises the likelihood of the SEC being compelled to approve Bitcoin cash ETFs, a move that experts believe could significantly impact BTC prices. Such approval would ease institutional and retail investment in the cryptocurrency.

Another crucial factor, the upcoming halving scheduled for April 2024, could potentially boost Bitcoin's price in the medium term. This technical event, programmed into Bitcoin's source code approximately every four years, involves halving rewards for Bitcoin miners.

Consequently, it reduces the rate of supply growth, which, coupled with consistent demand, should exert a bullish influence on BTC prices. This phenomenon has been observed multiple times throughout Bitcoin's relatively short history.

Lastly, concerns regarding bank stability and the prospect of "de-dollarization" in international exchanges underscore Bitcoin's potential as an alternative financial system and a potential global reserve currency. This potential was evident in the cryptocurrency's surge when several regional U.S. banks experienced failures earlier this year.

In summary, the pieces appear to be falling into place for a sustainable bull market for Bitcoin. Nevertheless, as Bitcoin ETFs remain a distant prospect and direct cryptocurrency ownership remains challenging for newcomers, many investors are exploring stocks that stand to benefit from a significant Bitcoin rally.

Which Stocks Are Most Correlated With the Price of Bitcoin?

Several types of companies are directly exposed to changes in the Bitcoin price, including crypto exchange platforms, Bitcoin mining companies, or those investing heavily in cryptocurrencies.

However, as Binance pointed out when relaying a study published at the end of August, 3 stocks in particular stand out for their strong correlation with the price of bitcoin in recent months.

These are:

- Coinbase Global Inc (NASDAQ:COIN), the largest crypto platform in the USA,

- Riot Platforms (NASDAQ:RIOT), a leader in crypto mining,

- and MicroStrategy Incorporated (NASDAQ:MSTR), a software company that has made bitcoin buy-and-hold its core business.

Below, we'll take a look at these stocks individually to determine which represent the best investment opportunity relative to current prices.

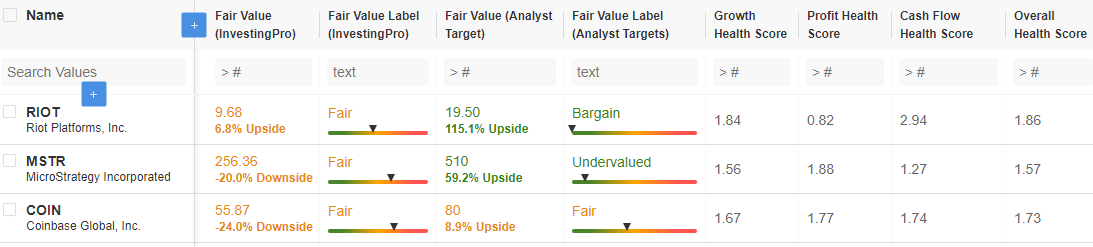

To do this, we've assembled these stocks into an InvestingPro Advanced Watchlist, looking at the potential of these stocks according to analysts and valuation models, as well as each company's financial health score.

Source : InvestingPro

Coinbase, Riot Platforms, and MicroStrategy: Which Is the Better Buy?

The first observation we can make is that Coinbase's share price looks unattractive on the face of it, with a valuation currently deemed "fair" by both analysts and InvestingPro models. In fact, the analysts attribute a bullish potential of 8.9%, while the InvestingPro fair value reflects a downside risk of 24%.

As far as MicroStrategy is concerned, analysts consider the stock to be "undervalued", and assign it a bullish potential of almost 60%. On the other hand, InvestingPro Fair Value warns of a downside risk of 20%.

Riot Platforms, meanwhile, could rise by 6.8% according to InvestingPro models, although the valuation is considered "fair". On the other hand, analysts are highly optimistic, considering the current share price a "bargain", and estimating that it could rise by 115% over a 12-month horizon.

Riot Platforms

As InvestingPro points out:

"Riot Platforms is a bitcoin mining company based in North America. It operates through the Bitcoin Mining, Data Center Hosting, and Engineering segments. The company also provides colocation services for institutional-scale bitcoin mining companies.

In addition, it is dedicated to the design and manufacture of power distribution equipment and custom electrical products; the design, manufacture and installation of power distribution products primarily for large-scale commercial and government customers, as well as a range of markets, including data centers, power generation, utilities, water, industrial and alternative energy."

In other words, not only does Riot Platforms operate in Bitcoin mining, it also makes its equipment available for other activities, a diversification that reduces its risk profile while remaining largely exposed to Bitcoin's rise.

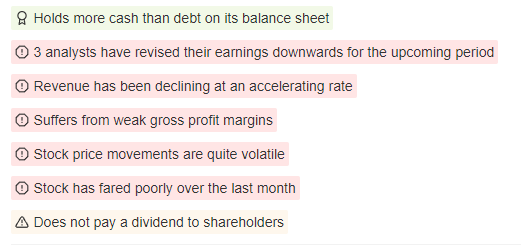

However, that doesn't mean it's a low-risk stock either. Indeed, InvestingPro highlights several weak points, including low gross margins, the stock's volatility, and revenues that have been declining at an accelerating pace.

Source: InvestingPro

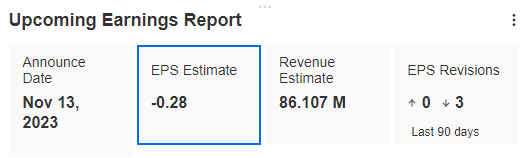

Finally, Riot Platforms' next quarterly results are due on November 13.

Source: InvestingPro

The consensus forecast is for a loss per share of $0.28, versus $0.24 in the previous quarter, on sales of $86.1 million, almost $10 million more than in the previous quarter.

However, given Bitcoin's recent rise, it's not out of the question for these results to be the occasion for a pleasant surprise, particularly with regard to the forecasts that will be shared by the company for the coming quarters.

Conclusion

Buying Riot Platforms shares therefore makes sense for investors wishing to gain exposure to bitcoin, not only because of the high level of correlation between the stock and the cryptocurrency, but also because of its valuation, which currently looks attractive, after a sharp decline since the start of the year.

***

Disclosure: The author holds no positions in any of the securities mentioned in this report.