We’ve finally made it to the last week of 2020. A coronavirus vaccine is in the process of being rolled out, a Brexit agreement is in place and U.S. President Donald Trump finally signed the stimulus bill into law. With a few days left until the end of the year, there’s a lot to be optimistic about. Stocks extended their gains and currencies should have done the same, but the rally was limited to the euro, Swiss Franc and the Canadian dollar. Other currencies like sterling declined and, while this move may seem counterintuitive after years of waiting for an agreement, investors have Brexit exhaustion.

The euro has been one of the strongest currencies this year and it is still in demand for a number of reasons. The euro stands to benefit just as much as sterling from a Brexit deal because a breakdown in talks would disrupt economic activity for both regions. UK Prime Minister Boris Johnson caved on the fisheries issues, giving EU boats uninterrupted access for the next 5.5 years. Strict lockdown measures in France, Italy, Spain and the Netherlands have also slowed the virus curve. These countries are seeing material curve flattening and, while it’s too early to tell, we may be seeing improvements in Germany as well.

The global economic calendar is very quiet with all markets closed on Friday. The Brexit and U.S. stimulus agreements minimize headline risk this week leaving year-end flows the primary driver of market movements. The S&P CaseShiller House price index is scheduled for release tomorrow followed by pending home sales, Chicago PMI and the trade balance on Wednesday. Jobless claims will be released on Thursday. Low interest rates prevented the housing market from crashing this year and in some suburban areas, we’ve seen significant uptick in prices. Massive pent up demand raises the prospect of a stronger growth in 2020.

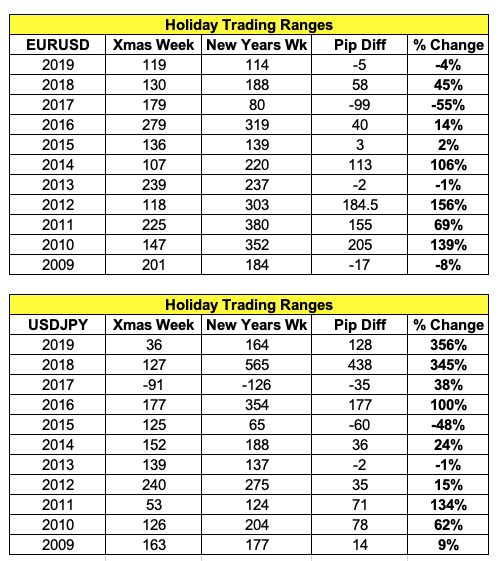

There was a lot of news flow but minimal big moves Christmas week. Looking ahead, New Year's week is typically a more eventful one for currencies. As shown in the table below, in most years, the trading ranges for EUR/USD remains the same, but the trading range for USD/JPY can expand significantly. You may even recall the flash crash on Jan. 3, 2019, that took USD/JPY from 108.90 to 104.80 in a matter of minutes. In late 2019, USD/JPY, which hovered near a 7-month high the day after Christmas, sold off sharply New Year's week. There’s not much on the calendar to trigger a move, but year-end flows in a low liquidity environment means USD/JPY could squeeze higher.