When are Central Banks (and traders for that matter) going to learn that central bank intervention is a waste of time? The free market always wins. Not sometimes wins, ALWAYS WINS.

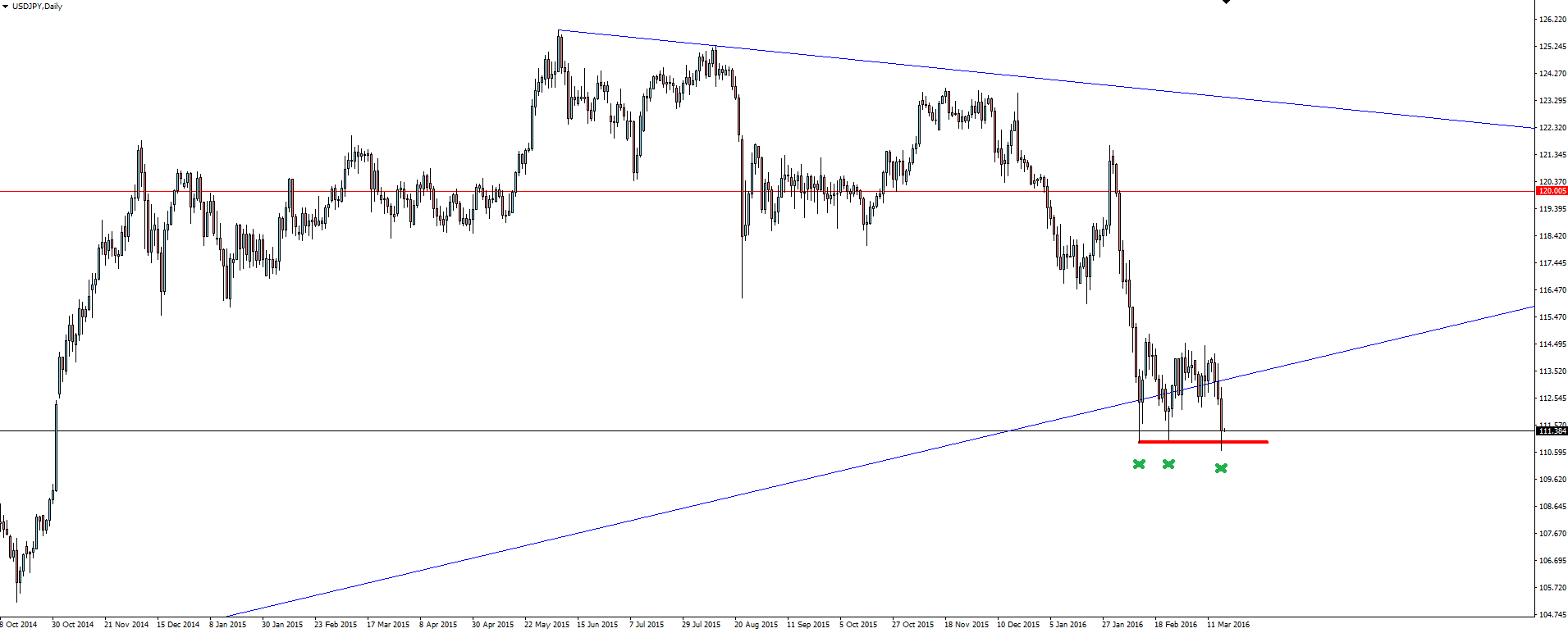

USD/JPY Daily:

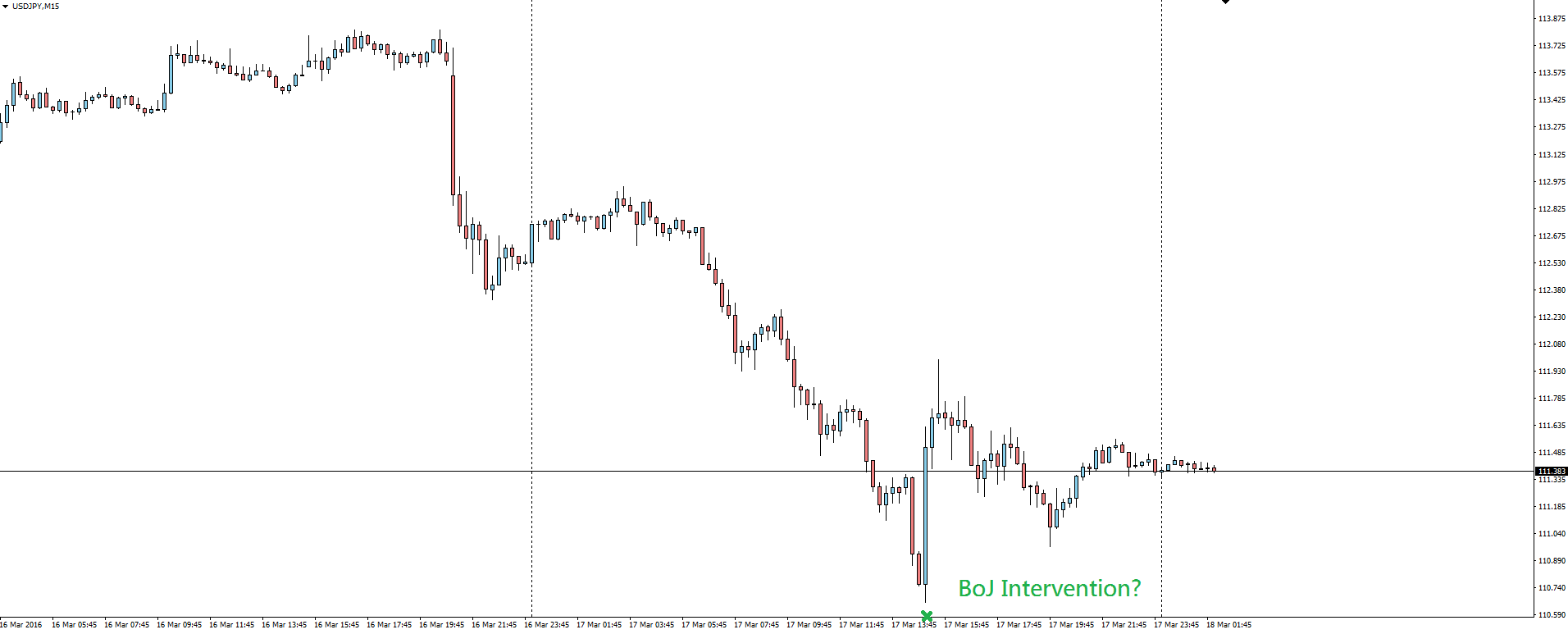

Yesterday as USD/JPY headed down toward the 111.000 level, we again saw a huge upward spike. While nothing official, this has been widely accepted as Japanese central bank intervention.

Looking at price action on the 15 minute chart, the way that price spikes up and then just slowly but steadily makes its way back to ‘market value’ has all the hallmarks of a failed intervention.

Just simply compare the invention move to the previous day’s fall at the left of the chart and come to your own conclusion about intervention vs market driven moves.

The risks in this pair are still skewed to the downside, but the BoJ isn’t going to give up that easily. Yen traders, strap yourselves in because you’re in for a wild ride ahead!

Chart of the Day:

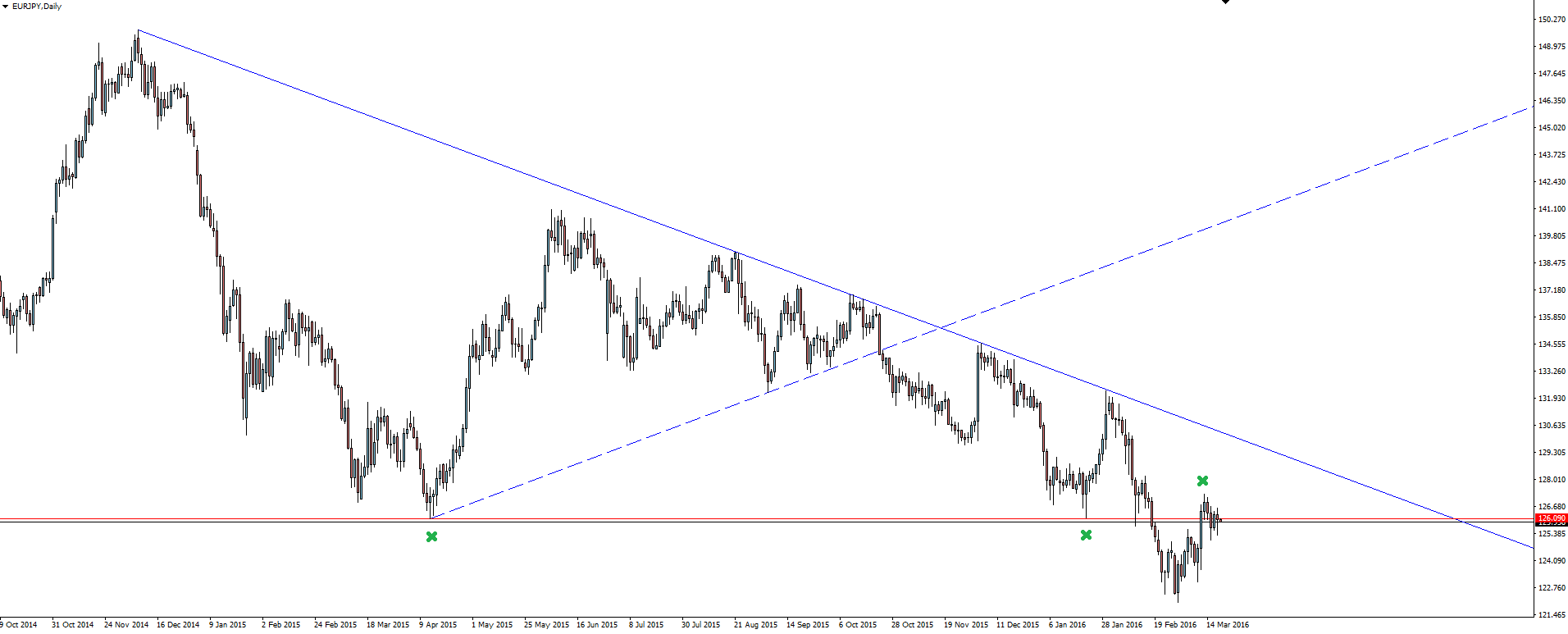

Following up from our early week look at the AUD/JPY chart, today’s yen themed blog moves across to EUR/JPY.

The daily chart shows a clear bearish trend and break of daily support after a strong move down from trend line resistance. With price coming back to res-test the broken level, we’ve gotten a pause but nothing more substantial.

On the Calendar Friday:

JPY Monetary Policy Meeting Minutes

CAD Core CPI m/m

CAD Core Retail Sales m/m

USD Prelim UoM Consumer Sentiment

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our ECN forex trading prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.