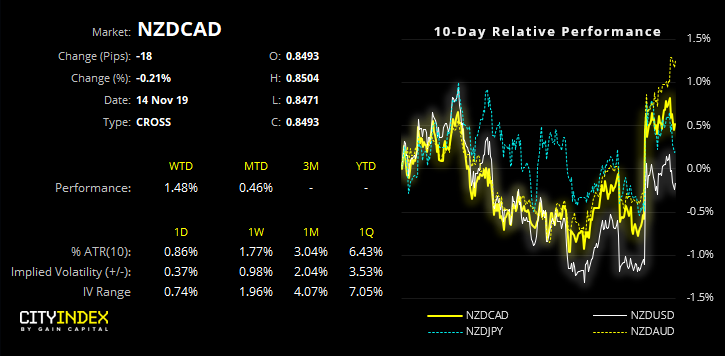

Just as NZD/CAD tests a key level of resistance, it’s worth considering its potential for a change of trend. Personally, I think the bearish trend on NZD/CAD has been one of the better ones for FX traders this year. Since failing to break a key resistance level in March, the commodity FX cross tumbled over 11% (or over 1,000 pips) within a relatively clean downtrend.

Yet having tested the upper bounds of it bearish channel on the daily chart, NZD/CAD has approached an inflection point and there are compelling arguments for both bulls and bears to consider.

Bearish swing traders could take comfort in the following:

- While prices have recovered nearly 3% from this year’s low, the overlapping nature if price swings suggest the rebound is corrective, so poised to turn lower once more.

- Bank of Canada has rates at a ‘whopping’ 1.75% compared with RBNZ’s 1.0%, which provides Canada a positive yield differential with New Zealand.

Contrarians (bulls in this instance) could take note of the following:

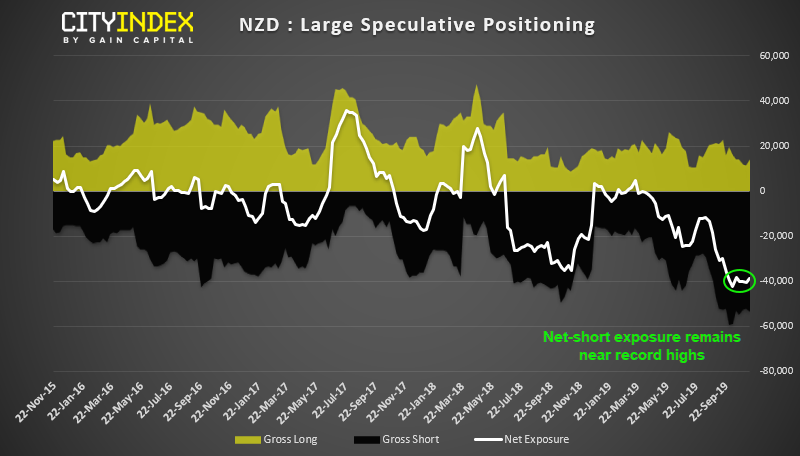

- Net-short exposure on NZD futures remains near a historical extreme. The 3-year Z-score is around -3.5 standard deviations and the 1-year was recently below -2 SD level which have been associated with a short squeeze historically. Ultimately, NZD could be vulnerable to short covering (as seen yesterday) if data improves and / or RBNZ are less dovish.

- While differentials currently favour CAD, markets will respond if they suspect this differential will narrow, which would be positive for NZD/CAD. And as it’s possible RBNZ will hold at 1% so, if CAD data weakens, then it could well send NZD/CAD higher.

- Yes, prices have stalled near a cluster of resistance. Yet, if these levels are to be broken, it could trigger stops and exacerbate a bullish follow through.

Given the importance of 0.8500 resistance, NZD/CAD could well turn lower over the near-term. Yet, due to the strength of momentum leading into resistance, an eventual upside break is the bias whilst prices hold above the 0.8347/63 lows. Also take note of the rounding bottom forming which, if successful, projects an approximate target around 0.8770.

- Bears could look to fade into moves below the trendline and/or 0.8500 resistance