The growth of ETFs has expanded the investment opportunities available to retail investors. They offer cost-efficiency¹, liquidity, an array of exposures, and an easier means to access the investment world.

These funds have also played a role in an apparent behavioural shift among investors. That is, investors don’t keep assets for as long as they used to². In part this is due to the rise of trading platforms and the ease with which ETFs can be traded, resulting in the shift from the long-term ownership of an asset to what could be termed as a “trading mentality” in which buying and selling happens more quickly.

To highlight this changing behavior, data shows that the average holding period for stocks has declined from about seven years to just 10 months over the last few decades³.

This change has important implications for investors. Focusing primarily on short-term fluctuations rather than long-term compounding⁴ and fundamental value could undermine the very benefits that equity ETFs offer. Here's why ETF investors might consider a long-term mindset.

Eye on the horizon

The shortening of time horizons, particularly in the realm of stock investments, could work against an investor’s financial interests.

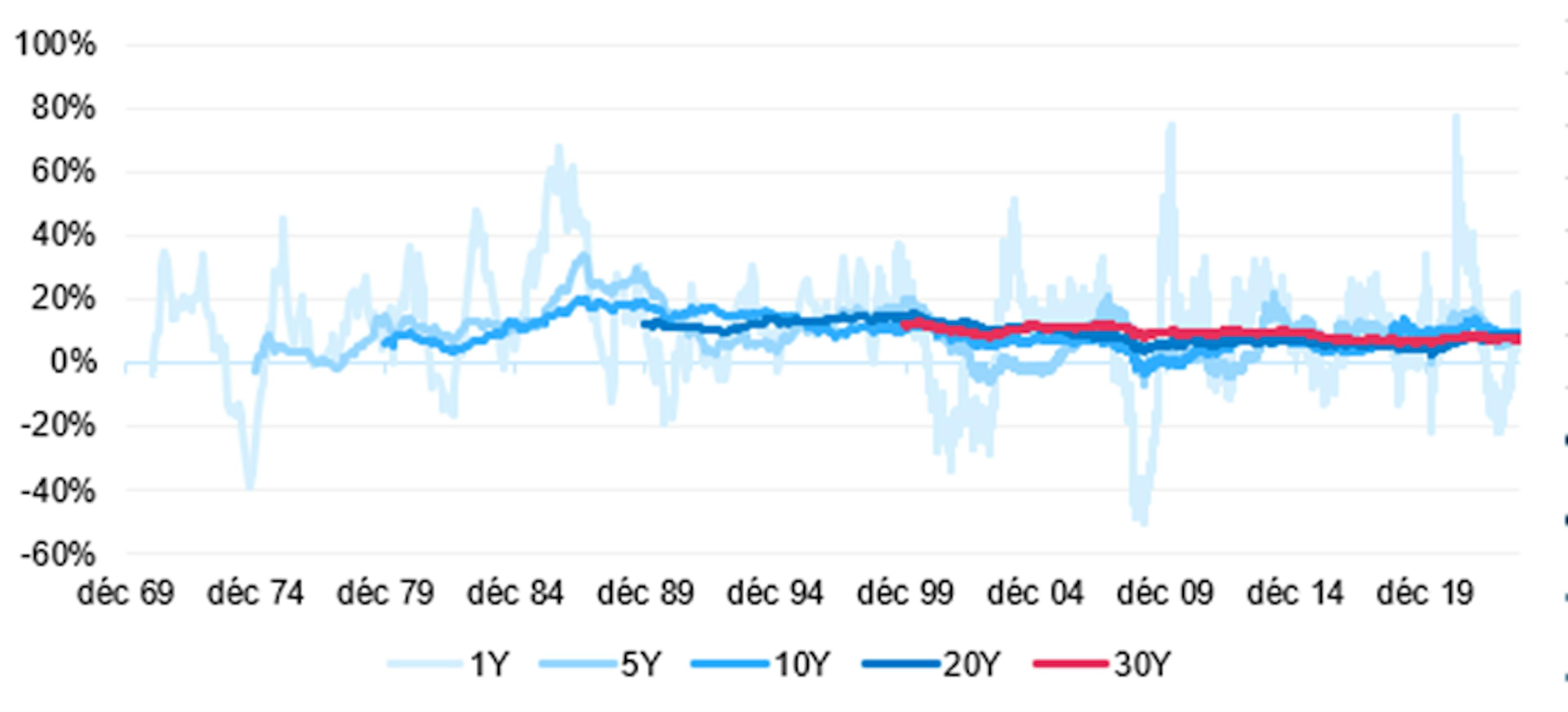

As evidenced by historical data, investments in the MSCI World Index show a marked decline in the variability of returns as the holding period increases⁵.

Essentially, historical data shows that time could act as a buffer, smoothing out the inevitable ups and downs of the market.

MSCI World - long term performance (in %, annualised)

Performance NTR in USD. Source: Bloomberg, Amundi. Data as at 20/02/2024. Past performance is not a reliable indicator of future performance

The equity risk premium needs time to work

Moreover, adopting a long-term horizon is not just about managing risk—it's crucial for capitalising on the power of compounding, which is earning returns on your original investment and getting returns on your returns⁶.

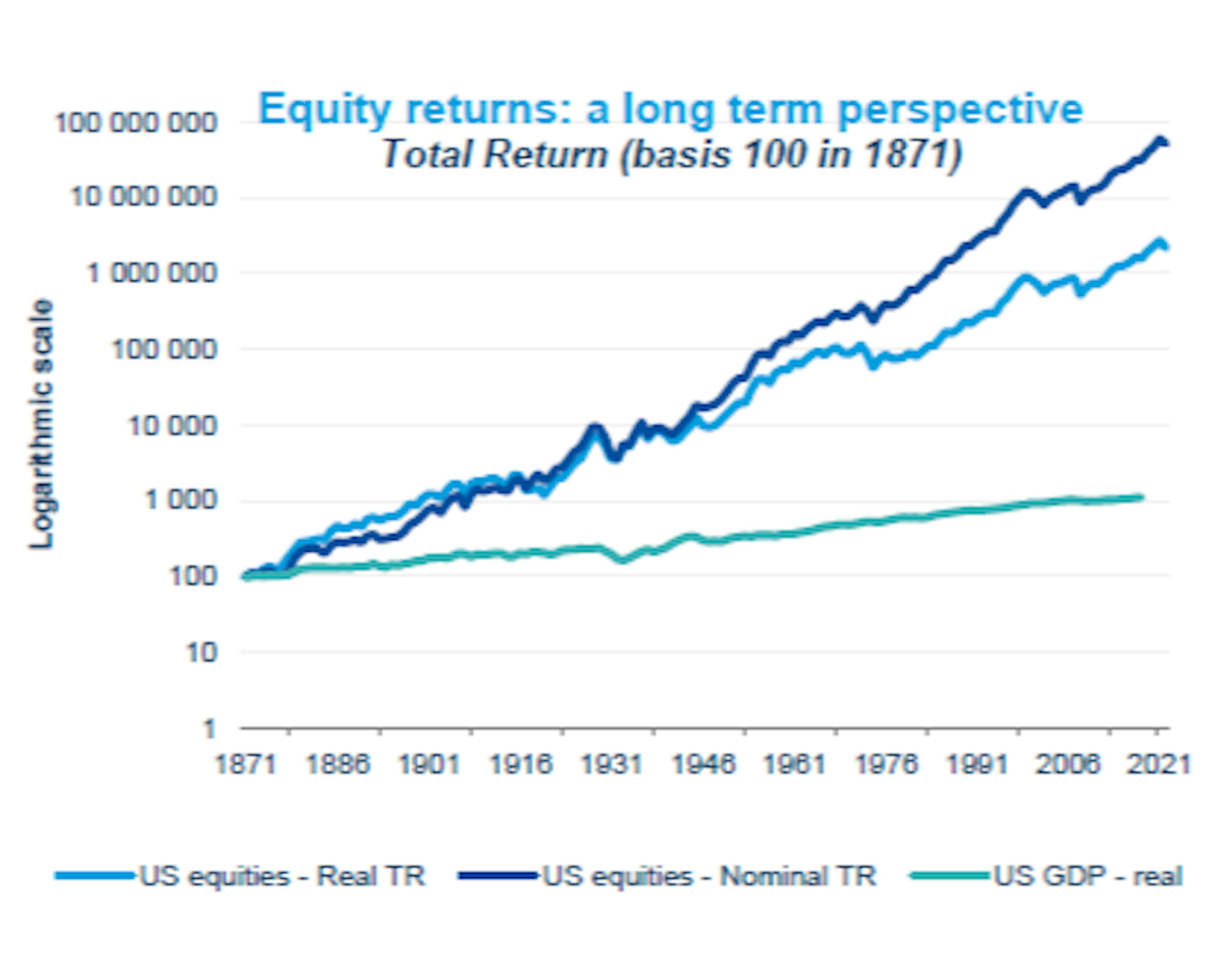

The historical performance of US equities has shown a compound annual growth rate of 9% since 1871 in nominal terms, and 6.9% in real terms, adjusted for inflation⁷. In contrast, the real returns on government bonds hover around 2.5%⁸.

Source: Amundi, Shiller, Maddison Project. Data as at 22/02/2024. Past performance is not a reliable indicator of future performance.

This difference underscores the equity risk premium that equities could offer over relatively safer investments like bonds, but only when sufficient time is factored into the equation.

It's important to view short-term volatility not merely as a barrier to quick profits but as the "price of admission" to achieve returns that outstrip those available from bonds.

Rather than trying to time the market for short-term gains, understanding and embracing this volatility could lead to more substantial long-term rewards.

How to invest globally

Finally, it's important to recognize that the equity risk premium isn't confined to any single geographic location; it can be found in markets around the world.

While investing domestically could reduce currency risk, limiting your investments to your home country could result in being underdiversified⁹.

The global market offers a "free lunch" of sorts, as you could spread risk and potentially capture growth from a variety of economic environments.

For those looking to invest globally, there are several options that could be worth considering. A notable one is the Amundi MSCI World UCITS ETF (EPA:CW8U). This ETF features an accumulating structure, meaning it reinvests the dividends it receives, and charges a management fee* of 0.12%.

It replicates the performance of the MSCI World Index, which includes a market-cap weighted portfolio of developed market countries and boasts $3.3 billion USD in assets under management¹⁰.

For investors with environmental, social, and governance (ESG) preferences, the Amundi MSCI World ESG Climate Net Zero Ambition CTB UCITS ETF (ETR:CLWD) might offer a viable alternative.

This distributing ETF has a management fee* of 0.2% and tracks the MSCI World ESG Broad CTB Select Index. It specifically underweights many controversial companies in the energy and materials sectors, aligning with the European Union’s ethical and sustainability criteria.

Additionally, the Amundi Prime All Country World UCITS ETF (ETR:WEBN) could present an even broader option. With a mere 0.07% management fee*, this distributing ETF tracks the Solactive GBS Global Markets Large & Mid Cap Index.

Unlike the MSCI World Index, it includes exposure to emerging markets such as China and India, providing what could be considered a truly global investment opportunity.

* Management fees refer to the management fees and other administrative or operating costs of the fund. For more information about all the costs of investing in the fund, please refer to its Key Information Document (KID). Transaction cost and commissions may occur when trading ETF.