American Tower Corp. (NYSE:AMT) is known as a good stock for long-term holding. Legendary value investor Chuck Akre (Trades, Portfolio)'s firm has owned this stock for more than 15 years in his fund portfolio. Currently, Akre Capital Management holds nearly 6.20 million shares of the company, representing nearly 8.60% of its equity portfolio.

But the stock has done badly in the last three years, down 30.40%, making shareholders disappointed. Let's take a closer look to determine whether American Tower is a good pick for investors at the current price.

Business overviewAmerican Tower is a leader in owning, operating and developing multitenant communications real estate. Its primary revenue stream is the leasing of space on communication sites to wireless service providers, radio and TV broadcasters, wireless data providers, government agencies and various other tenants. This leasing business, inclusive of its data center operations, accounted for 99% of total revenue in 2023. It also provides tower-related services in the U.S., including site application, zoning and permitting, structural analyses and construction management, in support of its site leasing operations.

The company's portfolio includes over 224,502 communication sites worldwide, comprising towers it owns, operates through long-term leases and distributed antenna system networks. It has grown this portfolio through acquisitions, long-term lease arrangements and site development. American Tower's assets are spread across the U.S., Canada, Asia-Pacific, Africa, Europe and Latin America, with 28 data center facilities across 10 U.S. markets. These centers house networking, storage and communications technology infrastructure, adding another revenue stream from enterprises, network operators and cloud providers.

Strategic advantage of scarcity in its business modelThe business model of American Tower is based on the limited availability of its communication sites - essential for all telecom operators, but difficult to replicate for several reasons.

First, it's tough to get permits for new tower construction owing to strict zoning restrictions. Local governments usually have strict rules regarding how and where towers may be constructed and how many are permissible. Further obstacles arise from communities 'aesthetic and environmental concerns, as residents often oppose the construction of new towers in their neighborhoods. This opposition can result in long approval processes and high costs for new developments.

That is why existing communication sites owned by American Tower have established infrastructure and connectivity, making them highly valuable to telecom operators. These sites already have the necessary equipment and network integrations, reducing the need for additional investments and facilitating faster deployment of telecom services. As a result, telecom operators prefer leasing space on existing towers rather than navigating the complex and costly process of building new ones.

This scarcity and high demand for established sites enhances the value of American Tower's portfolio, allowing it to maintain strong pricing power and stable revenue streams. The difficulty of replicating these communication sites keeps the company a vital component of the telecommunications infrastructure sector, providing services to meet the growing demand for data and connectivity.

Moreover, the company benefits from organic growth driven by increasing global internet traffic. According to ITU data, worldwide global internet traffic has experienced a 22% compounded annual growth rate, from more than 2,400 exabytes in 2019 to 5,291 exabytes in 2022. By 2030, the global internet traffic is expected to continue to grow 20% to 25% or more. This trend is even more pronounced in many of the company's international markets, where growth rates are expected to be higher.

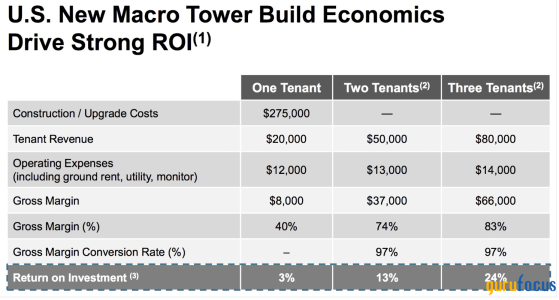

Attractive unit economicsFinancial performance is bolstered by American Tower's attractive unit economics. The tower model generates high returns on investment, especially with multiple tenants on a single tower. For instance, a typical tower costing around $275,000 to build can yield a 13% ROI with two tenants and 24% ROI with three tenants. The variable costs associated with adding tenants are minimal, with gross margin conversion rates reaching 97%. Moreover, the company's capital requirements for maintaining existing towers are low, ranging from $1,200 to $1,700 per year per tower in the U.S.

Source: AMT presentation

Decent first-quarter growth and expected deleveragingIn the first quarter, American Tower reported a solid performance, exceeding initial expectations across key metrics. Consolidated property revenue grew by 3.30%, or over 4.50% when excluding non-cash straight-line revenue, despite facing approximately 100 basis points of foreign exchange headwinds. U.S. and Canada property revenue growth was around 1.80%, or over 4% excluding straight-line impacts, including over a 1% impact from Sprint churn. The international segment saw a revenue increase of approximately 3.70%, or roughly 6% excluding currency fluctuations. The data center business also posted 10.60% revenue growth, driven by robust demand for hybrid and multi-cloud IT architectures.

Adjusted Ebitda increased by 5.20%, or nearly 8% when excluding non-cash straight-line impacts, while cash-adjusted Ebitda margins improved by approximately 240 basis points year over year to 64.90%. Additionally, attributable AFFO and attributable AFFO per share grew by 10% and 9.80%, supported by a high conversion of cash-adjusted Ebitda growth to attributable AFFO.

Source: AMT presentation

For 2024, American Tower expects organic tenant billings growth of approximately 4.70% in the U.S., with co-location and amendment growth projected to reach $180 million to $190 million year over year. The company's disciplined capital allocation strategy remains focused on selectively funding high-return projects and debt reduction. That is why the company would maintain a relatively flat annual common dividend of $6.48 per share and spend more money to reduce debt levels to achieve a net leverage target of 5 times by year-end. The sale of ATC India to Brookfield is expected to close in the second half of 2024, with total proceeds potentially reaching $2.50 billion, further strengthening the company's balance sheet.

Thus, the company has kept itself in a quite good shape, with a robust liquidity position, bolstered by strong cash flow generation and a lot of cash on hand. As of March, the company had nearly $2.40 billion in readily available cash and $128 million in restricted cash, with $1.9 billion held by foreign subsidiaries, including $354.10 million in joint ventures. The company adheres to financial covenants that cap total debt-to-adjusted Ebitda at 6 times and senior secured debt-to-adjusted Ebitda at 3 times, ensuring compliance and financial stability.

Source: AMT presentation

Undervalued compared to past historyIn the past 10 years, American Tower's forward AFFO multiple has fluctuated between 15.54 and 32, with the average at 21.79. Looking forward, the company has recently raised its 2024 AFFO outlook to $10.42 per share. At the current trading price of $194 per share, the company is valued at only 18.60 times its AFFO, lower than its average multiple in the past decade. Applying an average multiple of 21.79, American Tower should be worth $227 per share, 17% higher than the current trading price. Moreover, with $6.48 per share in dividends, investors got a decent 3.30% dividend yield at the current price.

Key takeawaysDespite a 30.40% decline in share price over the past three years, American Tower represents a compelling opportunity for investors due to its strong business fundamentals, attractive unit economics and strategic positioning in the high-demand communications infrastructure sector. With a forward AFFO multiple below its historical average and a robust dividend yield, the stock is currently undervalued. We maintain a buy rating with a price target of $227 per share, suggesting 17% upside from its current price.

This content was originally published on Gurufocus.com