McDonald's Corp. (NYSE:MCD) presented disappointing second-quarter earnings on July 29. The quarter's indicators show how challenging the company's situation is, with negative same-store sales, flat revenue and an earnings miss.

Despite this, shares have advanced slightly, the justification for which can be attributed to strategies to return value to the consumer like cheaper meal initiatives.

Combining the bad situation with some trends in the fast-food chain's market, I believe a very cautious stance should be adopted since the bad times could last and make the value generated for shareholders over the next few years unattractive in relation to the stock price.

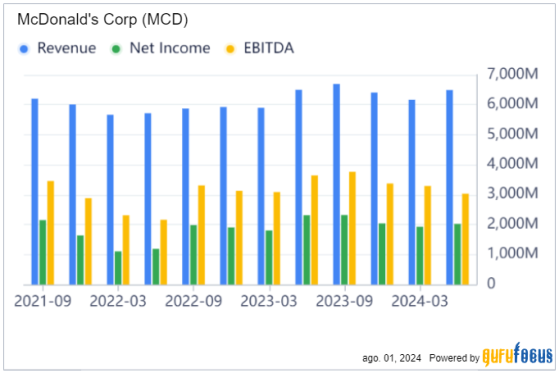

Earnings overview and challengesLooking at the main highlights of McDonald's second-quarter earnings, it is possible to get a sense of the current disastrous period. Global sales decreased by 1%, with declines in both the U.S. and international markets, which generated stable revenue ( up 1% in constant currencies) of $6.49 billion against market estimates of $6.62 billion. With earnings of $2.80 per share reported (down 11%), we have a double miss as consensus estimates were $3.07. This has continued to affect value creation in recent quarters, so it is clear the fast-food giant has been struggling for some time to grow revenue and profitability.

Right at the start of the earnings call, CEO Chris Zempczinski explained that the environment remains pressured, especially among lower-income households, as well as mentioning that "those pressures have deepened and broadened." This is evidenced by the fact that around 60% of Americans are consuming less fast food because of the prices as well as complaints on social media that McDonald's has become too pricey. In addition, this has been intensified by the conflict in the Middle East, which continues to negatively affect the company's dynamics

To try to get around this trend, management adopted some strategies and began a comprehensive rethink of pricing, such as $5 meal deals, which exceeded sales expectations. In addition to extending this program, the company continues to run offers on the mobile app, such as Free Fries Fridays, in an attempt to win back the public, increase awareness, improve brand perception around value and affordability and continue to generate value for customers. During the call, it was mentioned that there is still an opportunity to strengthen the holistic value proposition.

Even though earnings were not positive, McDonald's is still a good company. It has high brand recognition, high penetration in several countries and a verticalized business model with very well-standardized processes that allow the profitability indicators to still be very good, especially the high free cash flow margin of 28% and the high return on invested capital of 19.40%. With these and other indicators, McDonald's guarantees a profitability rank of 9 out of 10. On the negative side, its financial strength is 4 out of 10 since it still has a debt-to-Ebitda ratio of 3.80, which means net interest income takes a chunk (around $1.20 billion per year) out of net income.

Headwinds in the fast-food landscapeThe real problem for shareholders and the McDonald's thesis will be if these unfavorable trends continue over the long run.

For the next few years, the market expects inflation to fall to more normalized levels, and this is supported by weaker indicators around the world. Federal Reserve Chair Jerome Powell also mentioned that as inflation cools, a cut in the federal funds rate could be on the table. Despite staying warm, the American macroeconomic scenario remains very dynamic and not very predictable, with some economists still considering a recession. If this worst-case scenario were to materialize (with lower economic activity and lower disposable income for citizens), McDonald's would certainly continue to be impacted.

The competitive environment is also very latent in this sector. Between the fourth quarter of 2023 and the first quarter of 2024, McDonald's dropped from 25.45% market share to 24.47%, while companies like Chipotle Mexican Grill Inc. (NYSE:NYSE:CMG) gained share. This movement is justified by a number of factors, including lower disposable income and consumers finding McDonald's snacks expensive, but it is also driven by other trends such as the preference for fresher and healthier meals. This is mentioned as one of the risks to the growth of the fast-food market in a Zion Market Research study, while other trends such as a busy lifestyle can boost this type of consumption. They estimate a compound annual growth rate of 4.6% for this market from 2022 to 2028.

Valuation: Fair, but not compellingIt is quite intuitive to think that if the company's real growth is closer to 0% every quarter, the stock should not be trading at 20 times earnings, but at a significant discount. Of course, we will adopt more reasonable assumptions, which recognize the challenging scenario, but also consider that the company still has its moats and has room to resume its operations when the pressures pass.

In a discounted cash flow model, assuming 5% revenue growth over the next five years and net income going to 34% at the terminal stage (the top end of the 33% net income margin has recently been reached, but there is still room for margin capture in a normalized environment), results in a fair price of $254.73 when discounting at a rate of 9% and considering terminal growth of 4%.

Source: Alpha Spread

This fair price indicates the stock is overvalued by 7%. If we reduce the discount rate to 8%, we have an undervaluation of 15%. As the current scenario is one of greater uncertainty and turbulence, it makes sense to want a higher discount rate because of this risk.

Looking at other indicators such as the price-earnings ratio and free cash flow yield, McDonald's shares are not so attractive either. The forward price-earnings ratio is 22.30, slightly below the 10-year average of 23.40 and slightly above the market average. The free cash flow yield stands at 3.90%, while the S&P 500 delivers something close to 3.30%. Both indicators would be sufficient if the company were in a normalized state with stable prospects, but that is not the case.

In short, although the stocks are not expensively valued and do not have rich multiples, they are far from a bargain considering the context of pressure on earnings and some uncertainties about the company's continued growth. Again, McDonald's is by no means a bad company as its moats still prevail and should guarantee good profitability as the macroeconomic scenario normalizes and the initiatives to solve its problems come to fruition, but the premium to pay to see when this will happen still seems expensive.

The bottom lineIn view of the information above, McDonald's is going through a troubled period and needs to reinvent itself to resume growth and win back its customer base. At first glance, the stock looks attractive as it trades at very reasonable multiples and even offers a dividend yield of 2.40%.

Despite this, as the current context is different from the last 10 years, it seems reasonable to want a greater discount for exposure to McDonald's stock.

This content was originally published on Gurufocus.com