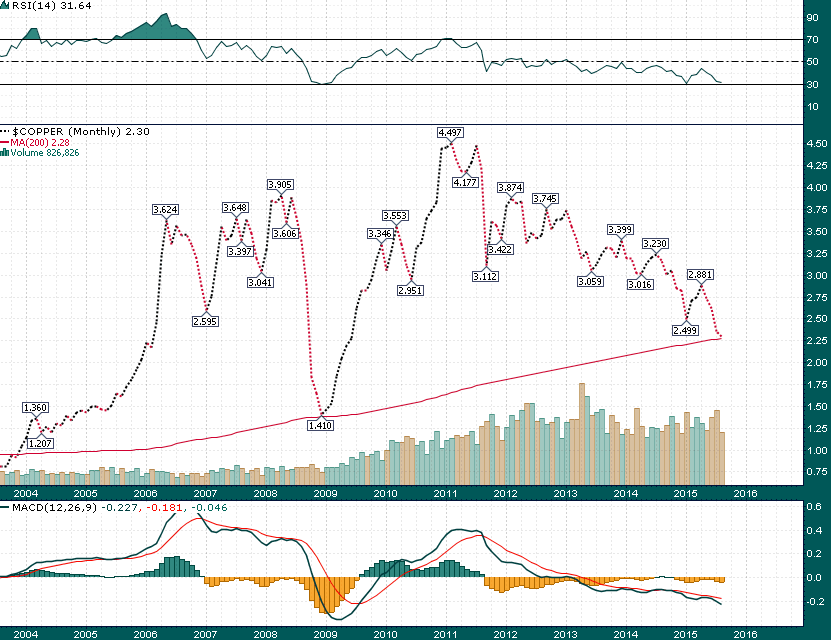

After a promising start to the year, copper has been in a steady downtrend since May and the red metal has just touched the rising 200-month simple moving average for the first time since late-2008:

While it is true that copper prices quickly reversed higher the last time this moving average was tagged, a sample size of 1 doesn’t exactly inspire confidence. Particularly in the face of such a clean, longer-term downtrend.

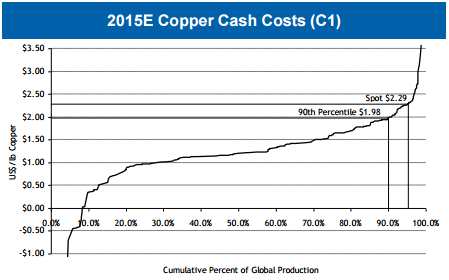

A graphic from RBC Capital helps to illustrate why copper prices may need to fall below $2/pound before the bear cycle low is in:

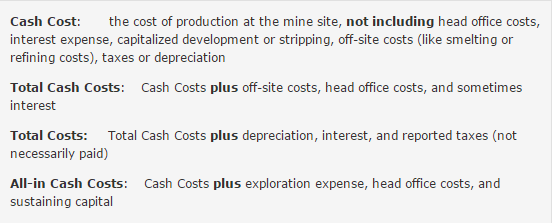

In commodity bear cycles, price often needs to fall below the 90th percentile of cash costs before the supply/demand dynamic is restored sufficiently enough to stop prices from falling further. Given the recent commodity price declines, the subject of cash costs vs. all-in costs of mining has become important. The following graphic courtesy of Brent Cook and Joe Hamilton clearly defines the various mining cost reporting methodologies:

While most copper/gold miners have recently focused on reporting costs exclusively in all-in cost terms, the truth is that mines won’t be shut down and place on care and maintenance until prices fall below cash costs for a sufficient period of time. The vast majority of copper mines are still quite profitable on a cash cost basis and it might take some mine shutdowns to put in a sustainable bottom in copper.

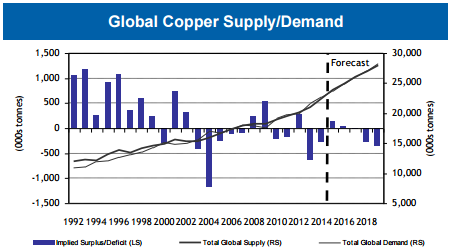

Finally, it is worth noting that while the copper market is currently experiencing a small surplus we are expected to be back at a deficit as early as 2017 – a deficit that could grow larger and last for several years…

Short story: We’re close but not quite there yet in terms of a long-term bottom in copper.