- Investment banks annually release S&P 500 forecasts, but history shows they often miss.

- They then persist in forecasting to cover up their errors and appear adaptive to market changes.

- Despite their track record, why do investors continue to believe their forecasts?

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Every year, major investment banks release their highly anticipated annual forecasts for the S&P 500. However, history shows a different story – these predictions often miss the mark by a significant margin, ranging from 10% to 25% over the past three years.

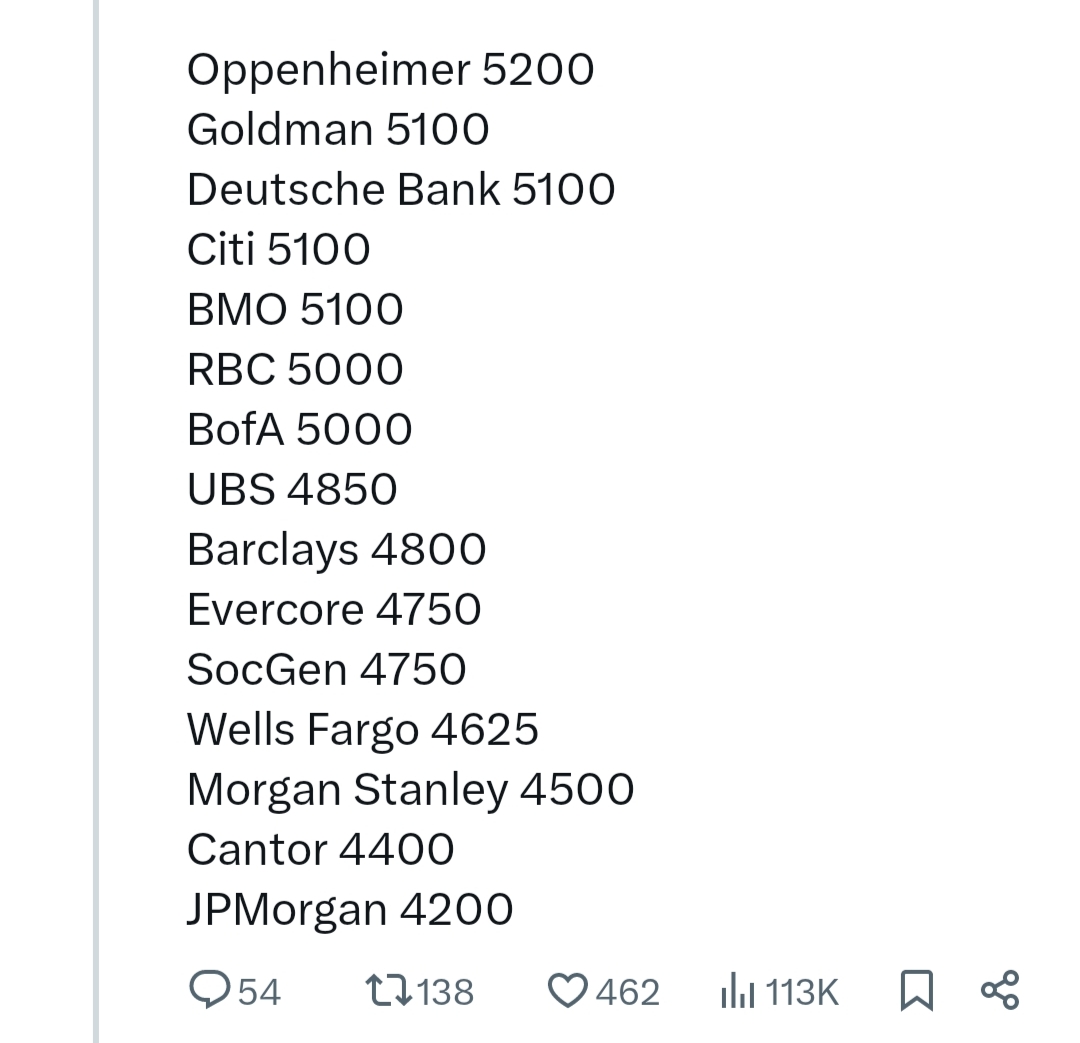

For example, take the forecasts they made at the beginning of 2024:

Like every year, their predictions proved wrong once again. This inconsistency raises a question: why do institutions persist in making these forecasts, knowing their accuracy is questionable?

This boils down to two main reasons:

- Downplaying Errors: Institutions might aim to minimize the impact of earlier inaccuracies by subtly aligning their forecasts with the current market direction.

- Self-Preservation: Alternatively, some may present the revisions as evidence of foresight, cleverly demonstrating their ability to adapt to market changes.

Despite their track record, forecasting is big business. It's like everyone's in a rush to predict the market's next move, especially when the S&P 500 posts a 15%+ mid-year gain.

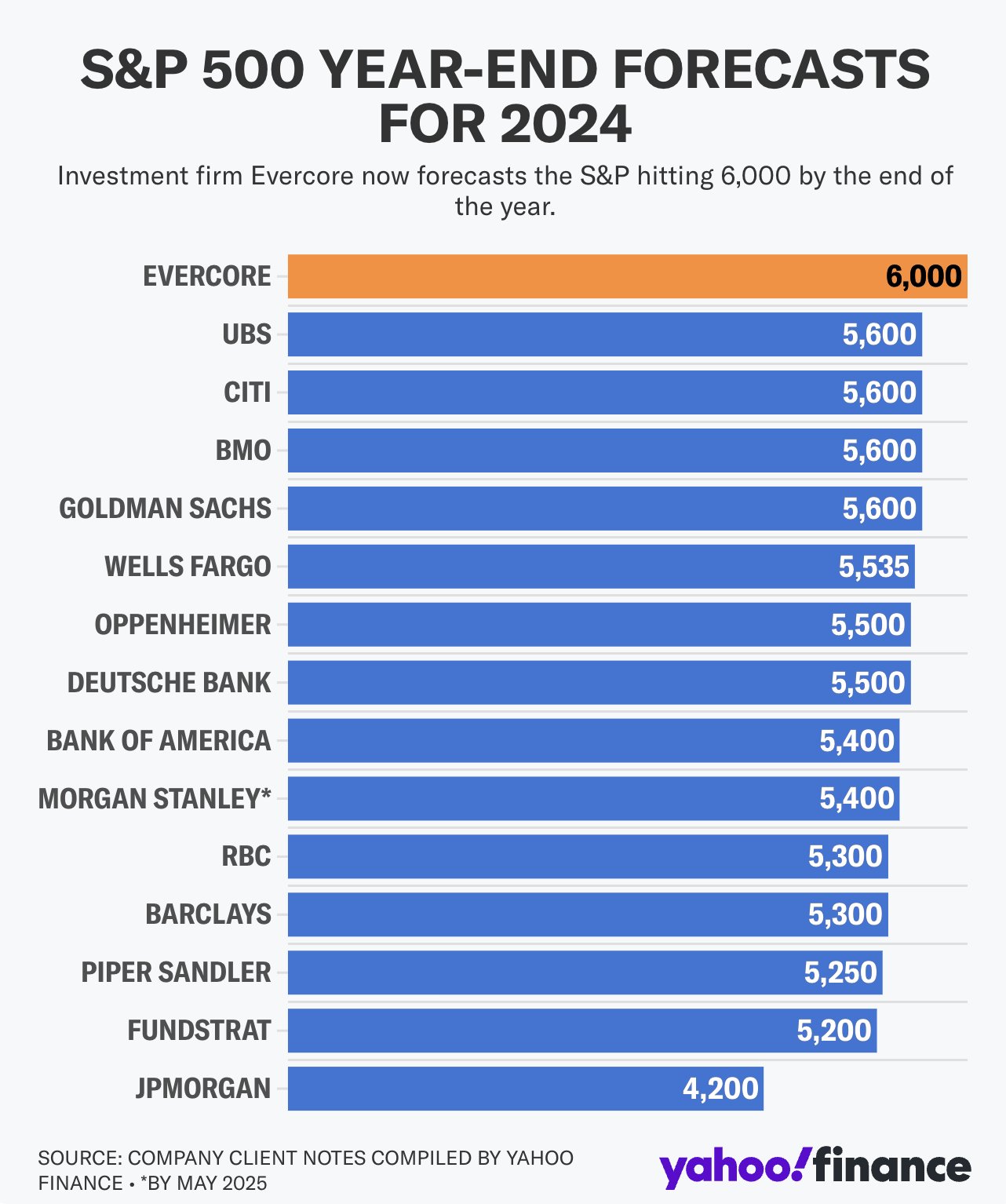

Suddenly, mid-year updates come out, and surprise, surprise—they're all revised upward to match the market's climb.

Indeed, here are the new estimates for 2024, updated after the S&P 500 has already climbed 15%+.

Why Do Investors Continue to Believe These Forecasts?

So, why do we keep falling for this? Why do people keep betting their savings on these predictions when they're proven wrong time and time again?

Well, it boils down to some pretty basic human tendencies. Laziness plays a part—we'd rather listen to someone else than do the legwork ourselves.

And then there's the illusion of expertise. You throw a few terms around at a family dinner, maybe name-drop Nvidia because it's hot that week, and suddenly you're the investing guru of the family.

But here's the thing: real investing is supposed to be boring and long-term. It's about setting up a solid plan, like parking your money in an S&P 500 index fund and forgetting about it for a few decades. Not exactly thrilling, but it's proven to work.

Meanwhile, the market's a swirling mess of inflation scares, interest rate hikes, and geopolitical tensions. Today's stock stars sometimes fade fast, just like the Nifty Fifty did back in the day.

So maybe it's time we embrace being the boring family member who talks about index funds over turkey. Because while others chase quick wins, we're in it for the long haul.

Who knows, in ten or twenty years, we'll still have something solid to discuss at Christmas dinner—while others might be onto the next get-rich-quick scheme.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor. The author owns shares in the company mentioned.