Recent developments suggest a resurgence in value investing, making it more important than ever to understand the fundamentals behind value strategies. While many ETFs may purport to deliver value exposure, the actual execution can differ wildly.

When selecting a value-focused ETF, it is essential to look beyond the name and ensure the correct approach is taken to screen for undervalued stocks. Instead of smart-beta or index approaches, investors can opt to put their money in actively managed ETFs. Here's why.

Why value now

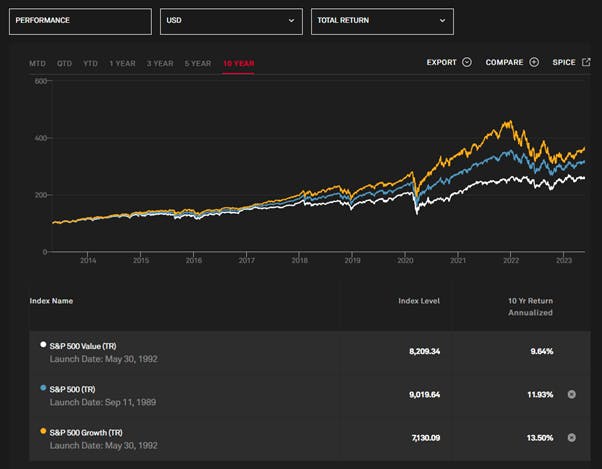

The cyclicality of growth and value serves as a reminder that the market's winners are constantly rotating. When the value factor underperforms, it indicates that growth is on the rise. Consider the last decade, where growth strongly outperformed value. However, this doesn't mean that value strategies will become permanently ineffective.

Source: S&P Dow Jones Indices

As growth stocks continue to surge, now may be the ideal time for investors to reassess their allocations and consider the potential benefits of value investing. By choosing an active value strategy, investors can leverage the unique insights and expertise of a fund's management team to uncover compelling opportunities in the market's undervalued segments.

What's so special about value?

Value investing has long been a cornerstone of successful investment strategies, with historical backtests showing a strong performance of value stocks compared to growth factors over many market cycles.

By focusing on undervalued stocks, value investors seek to capitalize on market inefficiencies and the potential for long-term appreciation. There is a large universe in which value stocks can exist, but specifically, large-cap U.S. value stocks have become particularly attractive in recent years.

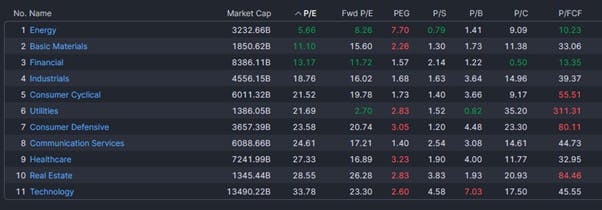

The intense focus on U.S. growth stocks has left the value space under-explored, creating opportunities in sectors such as financials, materials, and energy, while sectors like communication and technologies have seen their valuations balloon amid an era of lax monetary policy. This presents opportunities for the enterprising value investor.

Source: Finviz

As a result, investors can potentially find significant value in these underrepresented areas, if they know how to look. This is where an ETF can offer significant efficiencies and cost savings versus the analyzing individual securities, but only if investors make the right selection. Instead of buying an ETF, consider "buying the ETF team".

What's so special about JAVA

Despite the textbook definition of value, ETFs designed to deliver value can vary widely in their methodologies and consequent effectiveness at capturing the value risk premia.

Different screeners and indexes can lead to disparate outcomes, emphasizing the importance of understanding the specific approach taken by each fund. Factor regression backtests of various value ETFs reveal a wide range of loadings, illustrating the variation that investors can experience when selecting a value fund.

The JPMorgan (NYSE:JPM) U.S. Active Value ETF (JAVA) sets itself apart through its actively managed, fundamental approach to identifying undervalued U.S. large-cap stocks in each sector.

By rigorously analyzing each company's financial health and future prospects from the bottom-up, JAVA is better positioned to uncover true value opportunities, drawing on a combined 119 years of experience from its portfolio management team.

Unlike smart beta ETFs that target value stocks via an elaborate set of screeners, JAVA is unconstrained, free to leverage the expertise and knowledge of its management team. Whereas smart-beta value ETFs must screen stocks based on often rearwards looking criteria, JAVA can instead use a forward-thinking approach to securities analysis and selection.

While index value ETFs may boast low costs and portfolio turnover, they suffer from a common problem – a lack of downside protection. Because securities selection and management in these indices is bound by strict rules, they cannot adapt as effectively to prevailing or shifting market conditions.

In contrast, actively managed ETFs like JAVA can pivot their holdings as the team deems fit. JAVA is able to buy and sell holdings due to changes in fundamentals, valuations, or if there is another stock that presents a better opportunity. In doing so, the ETF is not constrained by an index, and is free to manage risk and return in a more flexible manner.

The final word on active value

The resurgence of value investing offers an opportune moment for investors to revaluate their investment strategies and consider the potential advantages of actively managed value ETFs like JAVA. This ETF presents a compelling choice for those seeking to harness the power of value investing in today's dynamic market environment.

By understanding the fundamentals behind value investing and the importance of a sound screening approach, investors can capitalize on the current market cycle and position themselves for long-term success, while avoiding the shortfalls and constraints of smart-beta and index value ETFs.

At the end of the day, the premise of value investing is simple: to purchase securities for under their intrinsic value and sell them once the market re-prices them accordingly. While indexes and screeners can help implement this, the role of traditional securities analysis by seasoned professionals remains valuable.

ETFs like JAVA offer this service in an attractively priced, tax-efficient, and transparent package. By employing a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary securities analysis, JAVA could deliver exposure to value in ways index and smart-beta ETFs cannot.

This content was originally published by our partners at ETF Central.