On analysis of the movements of the gold futures in different time frames, I find that the current rally could see a halt at this point, despite supportive fundamentals.

Supportive fundaments favor the bulls despite their resistive ignorance to map their presence inside the overbought territory.

Undoubtedly, this rally has pushed the gold prices to hit a new lifetime high, making the situation more problematic for the gold bulls despite favorable geopolitical tension as the budget deficits in major economies like the US, UK, and France look to be quite supportive to keep the bullish momentum intact.

But, merely keeping the eyes shut to ignore the overbought territory could be extremely fatal for the traders as the current situation could take a U-turn at any time.

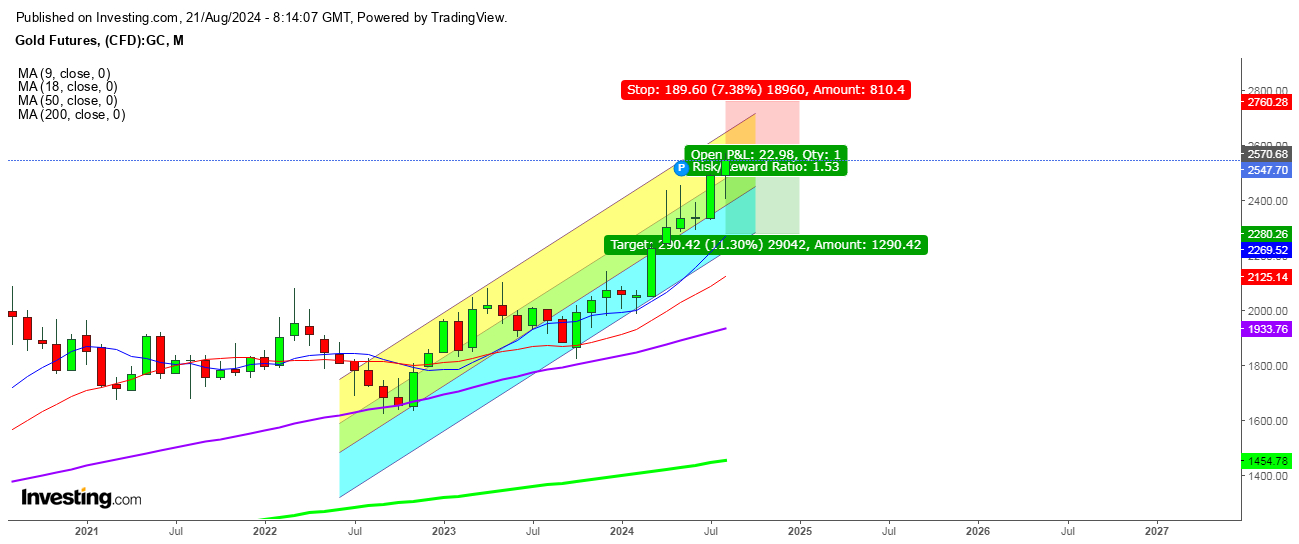

On analysis of the movements of the gold futures in a monthly chart, I find that the gold futures are feeling selling pressure after testing a lifetime high at $2570. Undoubtedly, this has defined the limit inside the overbought territory.

In the weekly chart, gold futures, showing indecisiveness among the traders could tilt the move downward before this weekly closing as the outgoing election cycle is building anxiety among the investors.

In the daily chart, the beginning of the price exhaustion is visible in today’s session. Undoubtedly, a downward move by the gold futures below $2509 will confirm a slide during the rest of the week.

In the hourly chart, gold futures are about to find a breakdown below the significant support at 50 DMA which is currently at $2547.

- English (USA)

- English (UK)

- English (India)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Gold Rally Could Halt at Current Levels

Published 2024-08-21, 04:56 a/m

Why Gold Rally Could Halt at Current Levels

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.