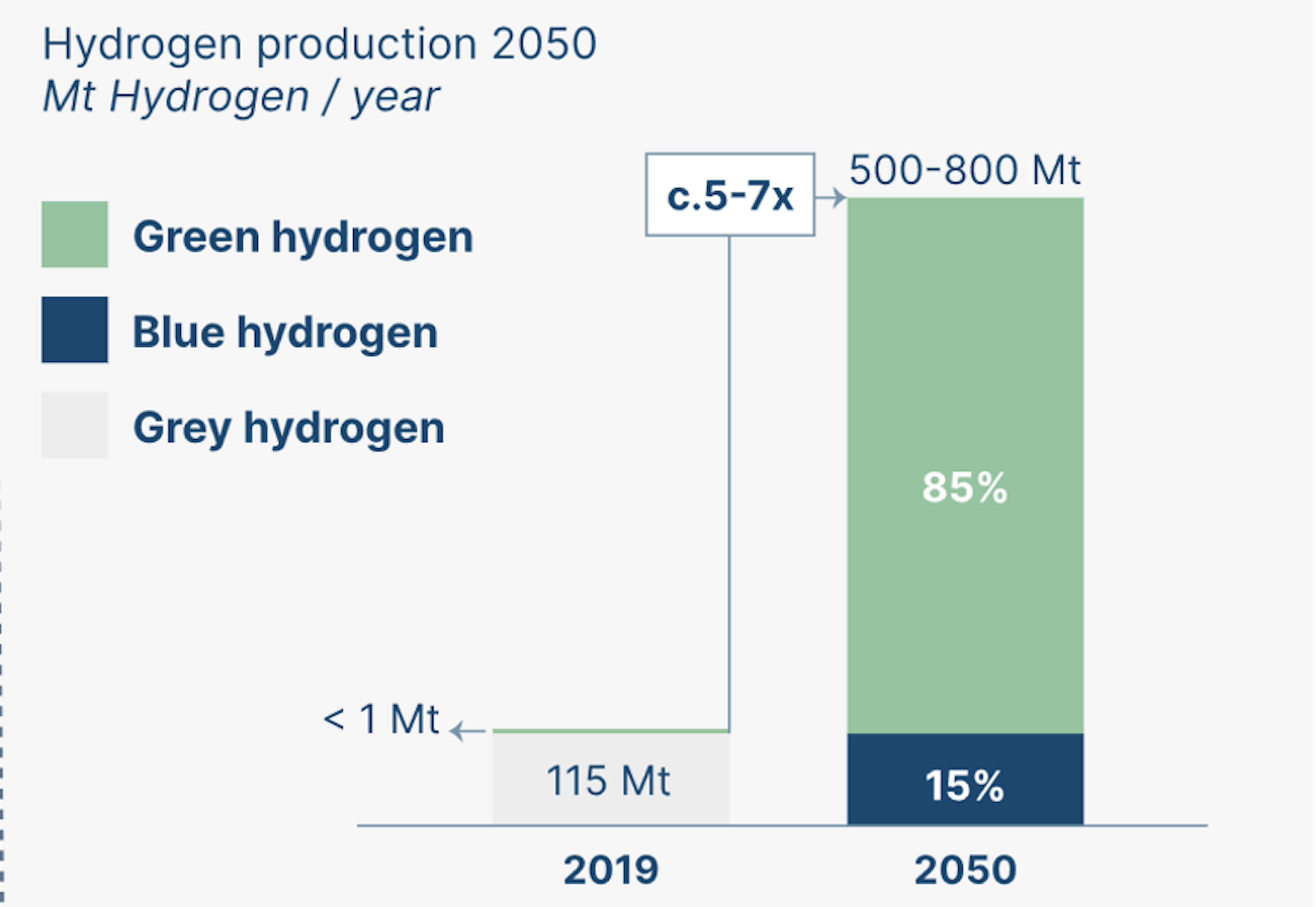

Green hydrogen, which uses renewable electricity to power electrolysis that splits water molecules into hydrogen and oxygen, is becoming a major part of the global clean energy solution. As a result, the demand for this technology is growing and is expected to climb from about 87 million metric tons (MT) in recent years, to as much as 680 MT by 2050.

In addition to meeting green energy goals, hydrogen addresses specific needs in the heavy industry sector where direct electrification is not cost-effective or even possible in some cases.

Hydrogen also serves as an especially economical and practical way to store energy over the long term which will be important for meeting seasonal needs. Moreover, as renewable energy production costs continue to fall, the economics of green hydrogen will become more favorable.

Here we look at the following:

- Why green hydrogen is expected to grow

- How the hydrogen economy will develop

- How investors can participate in this growth

Why Green Hydrogen is Expected to Grow

Green hydrogen has the potential to “contribute more than 20 percent of annual global emissions reductions,” according to research from McKinsey. This kind of contribution is possible because of hydrogen’s versatility. Green hydrogen can decarbonize fertilizer production, steelmaking, maritime shipping, and even aviation. Realizing this potential, however, will require considerable investment.

Fortunately, that’s already happening.

Today, there are about 680 large-scale hydrogen projects globally representing approximately $240 billion in direct investments. In the coming years many of these projects will move away from gray hydrogen, a process in which hydrogen is produced with fossil fuels. In its place, green hydrogen production will rise along with blue hydrogen production in which fossil fuels are used but in a way that limits emissions.

Consider that the total planned production for green and blue hydrogen through 2030 has already roughly quadrupled since 2020 according to the same body of data from McKinsey.

A Projected 5 to 7 Fold Increase in Hydrogen Production Towards Net Zero

Source: Energy Transitions Commission

Additional reasons why green hydrogen is poised to grow:

- The cost of hydrogen production is expected to fall by about 50% through 2030 with continued decreases at a slower rate through 2050.

- More than 52 steelmaking projects that aim to use green hydrogen have been announced.

- By 2050 green hydrogen could be produced in most regions globally at a price competitive with natural gas.

How the Hydrogen Economy Will Develop

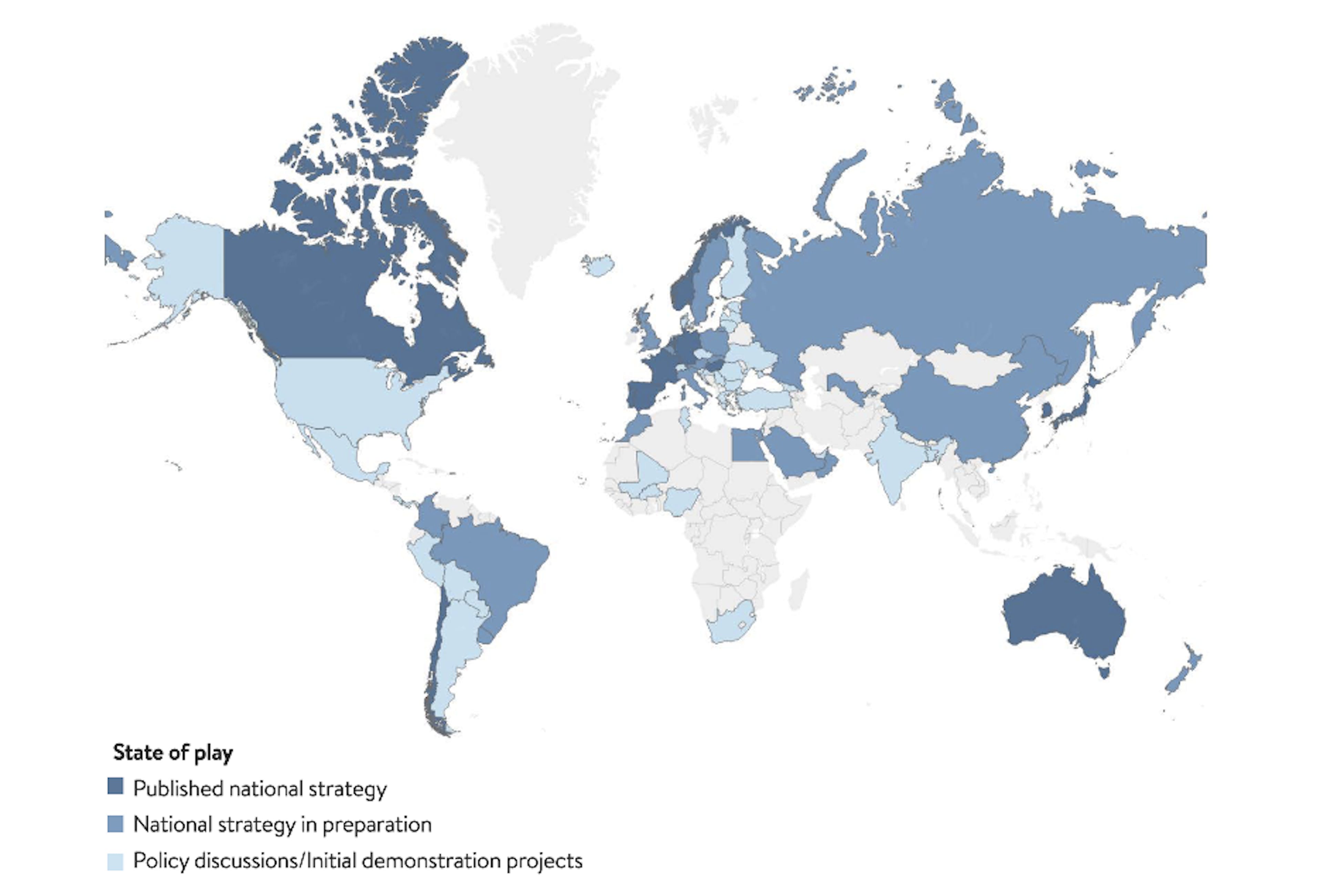

Adoption of hydrogen as an energy strategy is broadening. Today, about 12 countries and the European Union have published their national hydrogen strategies.

This matters because as economically influential countries take meaningful steps towards hydrogen, others follow. As the World Energy Council explains, “Japan’s early commitment catalyzed interest in the Asian-Pacific region, with South Korea and Australia publishing their own strategies shortly afterwards.” Meanwhile, other countries like Australia, Brazil, and China are developing their plans.

These countries are quickly learning that even a low-carbon hydrogen production plan can drive meaningful results. In fact, the Hydrogen Council forecasts that this approach has the potential to be cost-competitive in 22 end applications by 2030. The global commitment to hydrogen is clear from a glance at the money being allocated to projects. For example:

- Japan committed about $1.5 billion to support zero-emission hydrogen production locally and overseas.

- France has plans to invest €7 billion by 2030 focused on industrial decarbonisation and heavy-duty transport.

- Germany’s “package for the future” allocated €7 billion to accelerate the market rollout of hydrogen technologies nationally.

Many of these countries are also developing a range of tools to drive hydrogen adoption. These include tax incentives, accelerating permits, public information campaigns, and resources for businesses to better assess hydrogen as an option for their operations.

Source: World Energy Council

How Investors Can Participate in This Growth

Investors have several options for gaining exposure to this growth market.

L&G Hydrogen Economy UCITS ETF (HTWO)

The bulk of the fund consists of companies in the industrial sector (48.6%) and materials sector (30.9%). The top five holdings of the 27 total in the fund are, Nippon Sanso, FuelCell Energy, Kyocera, Doosan Fuel Cell, and Siemens Energy. The fund is considered dark green with an Article 9 SFDR categorization. Investors gain exposure to global companies that are actively engaged in the use of hydrogen in energy input, production, transport, and storage and as a clean, low-carbon energy resource. The total expense ratio is 0.49%.

Invesco Hydrogen Economy UCITS ETF (HYDE)

The top two sector allocations of the UCITS ETF are industrials (46.37%) and utilities (15.13%). The top five holdings of the 55 total are SMA Solar Technology, Fluence Energy, Neoen, Chung-Hsin Electric and Machinery Manufacturing Corp, and Brookfield Renewable. Like the L&G Hydrogen Economy UCITS ETF, Invesco’s fund also has an Article 9 SFDR categorization. The fund aims to track the net total return performance of the WilderHill Hydrogen Economy Net Return Index, less fees. The expense ratio is 0.60%.

VanEck Hydrogen Economy UCITS ETF (HDRO)

The UCITS ETF has an expense ratio of 0.55% and has 26 holdings the top five of which are, Nel ASA, Air Liquide (EPA:AIRP), Linde, Mitsubishi, and Air Products and Chemicals (NYSE:APD), Inc. The fund invests in securities intended to provide investment returns that closely track the performance of the MVIS Global Hydrogen Economy Index.