- Q3 earnings season is set to kick off next week

- Estimates have fallen sharply for the third and fourth quarter

- This could give the bulls a better-than-feared outcome

Believe it or not, it is that time again when companies start reporting quarterly results and providing outlooks. Yes, earnings season will kick off on October 14, when the big banks begin to report results. Expectations for this quarter's S&P 500 earnings seem low and continue to fall. This could be setting the market up for a better-than-feared earnings season. However, what drives the market from here will be if fourth quarter expectations have been set low enough to provide a relief rally.

Earnings Estimates Decline

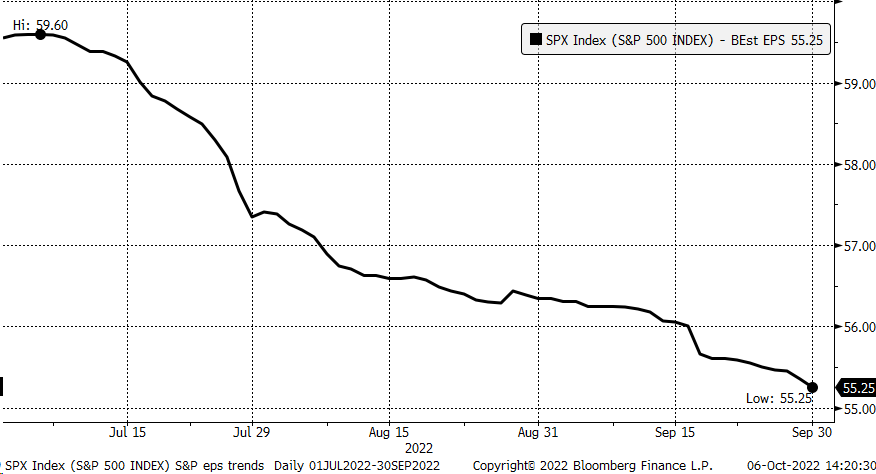

Expectations have fallen, as earnings estimates for the S&P 500 for Q3 have dropped approximately 7%, from around $59.60 per share to roughly $55.25 per share. It probably helps to explain some of the market price weakness witnessed in the third quarter. Fears of Fed monetary policy played a significant role in Q3 stock market declines, but it can't be ignored that earnings likely played a role too.

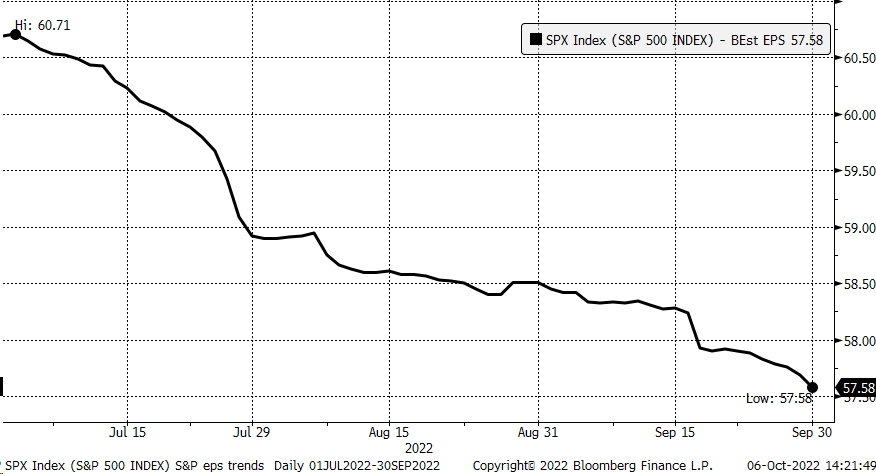

Additionally, earnings estimates for Q4 fell steadily and are now around $57.60, from about $60.70 at the beginning of July. The decline in earnings estimates also suggests that investor expectations have likely fallen, making it easier for companies to provide better results and guidance than feared. Now, it isn't to say that will happen because there is undoubtedly a chance companies report results and outlooks that are worse than expected.

Individual Company Risk

For example, companies that reported at the end of September, like FedEx (NYSE:FDX), Nike (NYSE:NKE), and Micron (NASDAQ:MU), provided disappointing results and guidance, leading to shares plunging. What also sunk these companies were the gloomy outlook they provided.

Micron fared better, given how much the stock had already fallen into results, but expectations had dropped so much that even though the revenue outlook was a big miss; the stock rebounded.

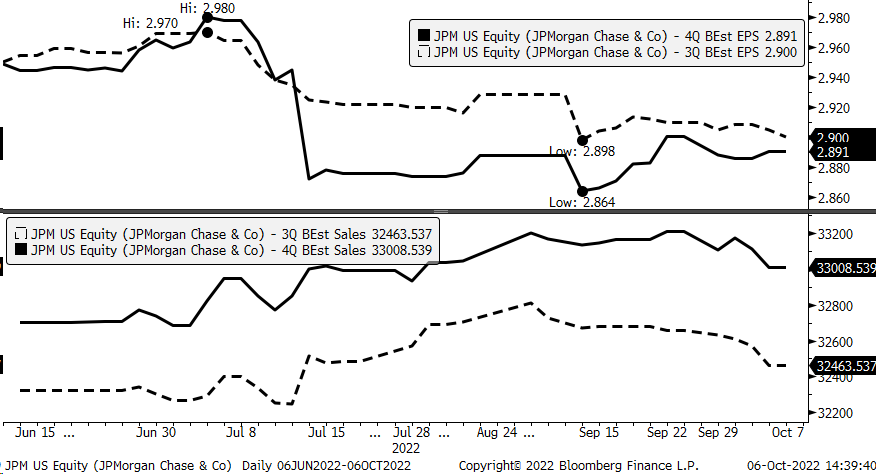

Therein lies the risk. Despite the overall downward trend of index earnings and low overall sentiment, it doesn't mean that individual companies have seen a reset in their expectations. JPMorgan (NYSE:JPM) will report results on October 14 and has not seen its earnings estimates change materially. They came down following Q2 results but have been basically unchanged. Yes, JPMorgan's stock has fallen sharply since August, but it is at the same price today as in July. This could mean investors' expectations haven't been reset lower for this stock and many others like it.

Some stocks will remain at risk of disappointing investors as this third quarter earnings season plays out, but with overall market trends falling, it can also turn out to be a better-than-feared season. If that happens, it could give bulls a reason to try to rally the market, which is not different from what was witnessed in July and August. However, it may not be what companies have to say about Q3 but, more importantly, what they say about Q4, and whether or not fourth quarter expectations have been reset enough.

Disclaimer: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.