Precious metals rally: UBS warns of profit-taking risk into holidays

Upstart (NASDAQ:UPST) Holdings' stock has enjoyed a scintillating run in its past six months, surging by approximately 260%. However, despite its astounding form, the sustainability of Upstart's latest surge can be contested by talks of re-inflation, a potential shift in credit risk, and Upstart's ongoing profitability concerns.

Aside from the above-mentioned, JP Morgan (NYSE:JPM) recently downgraded Upstart to 'underweight' on the basis of an unjustified valuation. According to JP Morgan, Upstart's "shares seem to be priced to perfection," adding substance to a revision of the stock's prospects.

The headwinds mentioned within the introduction provide a summary; let's traverse into a more comprehensive discussion of Upstart's emerging headwinds.

An Overview Of Upstart

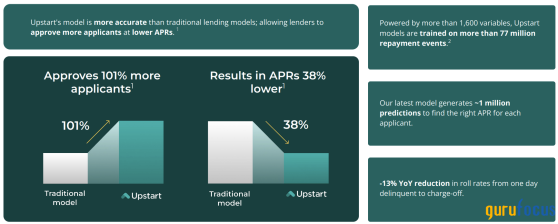

Critiquing Upstart requires an understanding of its business model. For those unaware, Upstart is a lending marketplace that leverages artificial intelligence to curate comprehensive borrower credit scores. The company passes its data analytics to banks, who ultimately write consumer loans.Source: Upstart

Upstart's business model has delivered tangible success as the company's loan approval rate outpaces that of traditional banks while also reducing the borrower's repayment rate. Moreover, Upstart has successfully implemented a complex model, where it bases its scenario analysis on over 1,600 variables and 77 million repayment events, illustrating the company's successful use of big data analytics to curate justified credit scores.

Another compelling feature of Upstart is its 'skin in the game,' whereby the company holds its very own loan portfolio, showing its commitment to its methodology. As illustrated in the following diagram, Upstart recorded approximately $334 million in co-investments during its latest quarter, a substantial increase from $66 million a year prior.

Source: Upstart

Key Drivers

Upstart's identifiable key drivers are both internal and external.Firstly, as previously mentioned, the company utilizes a comprehensive screening methodology whereby it leverages artificial intelligence to optimize large data sets. Moreover, its machine learning techniques incorporate non-linear relationships, allowing Upstart to generate a wider breadth of scenarios than traditional economic models otherwise would.

Upstart's digitalization has evidently resulted in a cutting-edge marketplace. However, the company's internal drivers are influenced by external factors such as interest rates, inflation, credit risk, and related variables. Therefore, a secondary driver for Upstart is the overall health of the lending environment.

Cumulatively, Upstart's key drivers have contributed to its cyclical performance, displayed by the fact that the stock remains nearly $300 below the heights it achieved in 2021 when it reached the $380 handle.

Bearish Case

The Refinancing Play Seems OverdoneAn observation of Upstart's stock price shows its correlation to interest rates. For example, the stock regressed since 2022's rate hike cycle started, yet recovered when certainty of an interest rate pivot occurred earlier this year.Source: Yahoo Finance

The main reason for Upstart's sensitivity to interest rates derives from its dependency on loan volumes. The company's marketplace platform relies on fee-based earning and, therefore, acts counter-cyclically to interest rate levels.

Lower interest rates visibly spiked Upstart's stock price since mid-year. However, disinflation has slowed, reducing the capacity for interest rate cuts. In fact, factors such as President Trump's proposed tariffs, China's stimulus, enhanced consumer sentiment, Middle Eastern tensions' influence on oil prices, and enhanced industrial production might contribute to an argument for a 2025 re-inflation scenario.

Source: Trading Economics

Whether effective rates decline in the coming quarters remains to be seen. Nonetheless, key variables suggest that investors might've overestimated the velocity of future disinflation, which, in turn, caused Upstart's stock to surge beyond its fair value.

Machine Learning Doesn't Dictate Credit RiskThis sub-section's title refers to the fact that Upstart's advanced data analysis likely won't defend against severe macroeconomic headwinds. The company's methodology might produce relative value. However, a rapid rise in credit risk will ultimately reduce lenders' willingness to write high-risk loans.

Credit spreads remain tight, suggesting the U.S. credit market is healthy. However, spreads are cyclical and mean-reverting; therefore, widening will likely occur at some stage. Upstart's marketplace and loan book has flourished in 2024's low-spread environment. Nevertheless, as mentioned, widening may disrupt its flow.

Source: St. Louis Federal Reserve

The question now becomes, what may cause spreads to widen again? A key driving factor could be consumer loan delinquencies. Delinquencies remain elevated, and lower U.S. interest rates haven't decreased delinquencies by a material level. Thus, an argument exists that the real economy's credit risk might be underpriced by spreads, causing investors to ramp up Upstart's stock in recent months.

Source: St. Louis Federal Reserve

As with interest rates, 2025's credit risk outlook is up for discussion. However, a decaying credit environment would likely dent Upstart's loan origination volumes through lower conviction from banks and other lenders. Moreover, a secondary impact can occur as the company has consumer debt on its own balance sheet, with auto loans spanning most of Upstart's loan book.

Source: Upstart

The Business Is Expensive To ScaleUpstart's business has scaled since its inception yet struggled to achieve profitability. Although running at a loss is normal for growth-stage firms, the nature of Upstart's expenses conveys how expensive it is to expand its business model.

The following figure shows Upstart's comprehensive income statement; a discussion follows.

Source: Upstart

A telling feature of the company's income statement is its engineering and product development line item, which spans approximately 32% of the company's operating costs. While innovation is key, engineering costs can be persistent as top talent usually costs a premium. Upstart's competitive advantage is product-driven; therefore, retaining top-tier engineering capabilities will be vital in the years ahead.

Furthermore, Upstart's sales and marketing expenses comprise about 20% of the company's expense base, while general and administrative expenses span roughly 29%. These costs are more straightforward to dilute than engineering expenses, especially if broad-based inflation stabilizes; however, a competitive environment poses challenges, likely forcing Upstart to inflate its marketing budget.

In effect, Upstart has a scalable business model. However, the competitive environment and Upstart's product-centric approach mean Upstart's top-line success is expensive to ascertain.

Valuation and Technical Indicators Point SouthAs pointed out earlier, JP Morgan is concerned about Upstart's valuation outlook. Key metrics agree with the investment bank's consensus. For example, Upstart's price-to-sales ratio has nearly doubled since last year. Moreover, the company's price-to-book ratio has surged to 11.78x from roughly 5.55x a year ago, while its price-to-free cash flow ratio is arguably outlying at 86.87x.

Source: Macro (BCBA:BMAm) Trends

An isolated view of the Upstart's price multiples accompanies the thesis' fundamental argument. It is unlikely that Upstart's fundamental growth will sustain its current multiples, especially if investors decide to 'take profit.'

Lastly, Upstart had a 14-day relative strength index of 66 at the time of writing the article. For those unaware, an RSI of 70 and above suggests a stock is technically overbought. Therefore, Upstart's RSI will likely cause concern in light of its elevated fundamental price multiples.

Final Word

Upstart Holdings is a growing company with a highly compelling business model emphasizing a product-driven approach. However, history has proven that Upstart's stock is cyclical, and key identifiers suggest that Upstart stock's latest form might come to a halt in 2025.While some might disagree with the fundamental argument, Upstart's valuation multiples and technical features are hard to pass, even in a bull market.

Upstart's stock seems overcooked for the time being.

This content was originally published on Gurufocus.com