- Wells Fargo shares have enjoyed a powerful uptrend since October 2023.

- Financial models predicted the stock would rise by over 60%.

- So, how can you spot the next financial stocks to post double-digit gains?

- Subscribe to InvestingPro to find out, thanks to a range of super-powerful stock market tools!

Wells Fargo & Company (NYSE:WFC) has been on a tear since October 2023. The stock surged over 58%, from a low of $38.5 to a 2018 high of $62.55 on May 15, 2024.

However, after reaching that peak, it has pulled back slightly, closing at $59.48 on Tuesday. Despite the recent dip, Wells Fargo still holds a solid gain of nearly 20% year-to-date.

This impressive rally comes after a period of extended consolidation that began in June 2022. During that time, many analysts argued that the stock was trading significantly below its true value.

The rise in Wells Fargo shares was predictable

However, analysts weren't the only ones to see an opportunity in Wells Fargo shares at the time, as valuation models also pointed out that the stock appeared undervalued based on the fundamentals.

For instance, InvestingPro Fair Value, which combines multiple financial models to predict target prices, estimated Wells Fargo's fair value at $63.98 on March 19, 2023, when the stock was only $37.76. This represented a potential upside of nearly 70%.

However, the rise in the share price began shortly afterward, continuing up to the 6-year peak mentioned above, before the recent weakness that saw the stock lose the $60 threshold.

In other words, InvestingPro subscribers had been warned of Wells Fargo's bullish potential, not based on a hunch, but based on concrete financial data.

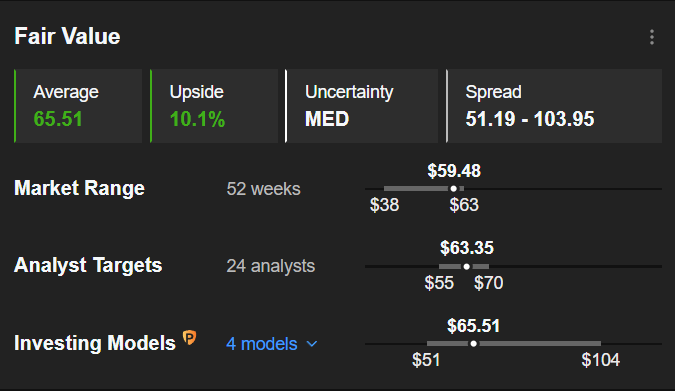

The InvestingPro Fair Value of Wells Fargo shares is now $65.51, corresponding to a modest upside potential of just over 10%, probably not enough to justify a buy.

Source: InvestingPro

Analysts are slightly less optimistic, with an average target of $63.35 translating into a potential upside of +6.5%.

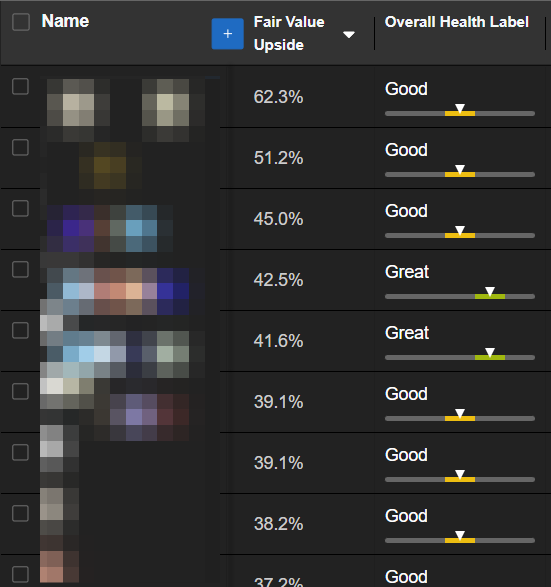

However, there are many other financial stocks currently showing solid upward potential.

What are the best financial stocks to buy according to InvestingPro Fair Value?

More precisely, InvestingPro+'s advanced screener has enabled us to identify 21 stocks that meet the following criteria:

- U.S. listing.

- Fair Value upside potential greater than +30%.

- Financial sector.

- Capitalization over $1 billion.

- Overall financial health rating of "good" or better.

Source: InvestingPro

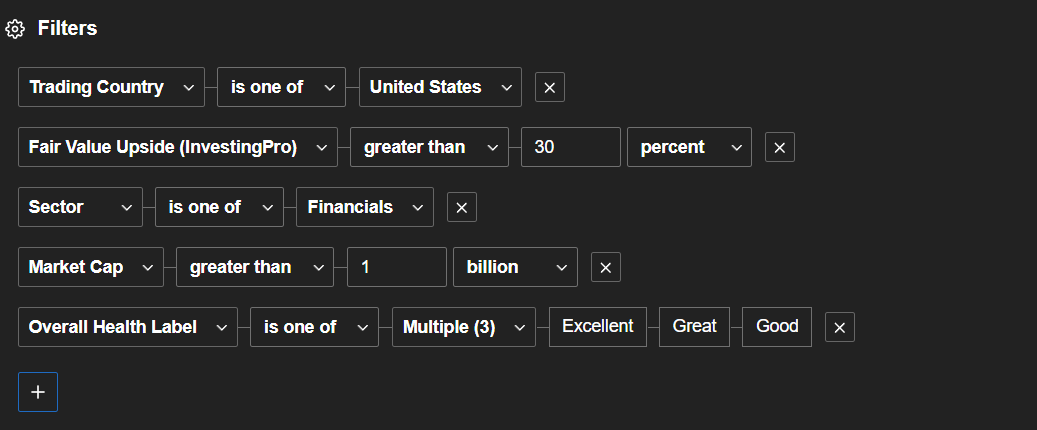

InvestingPro+ subscribers who wish to consult this list can reproduce the following filters on the advanced screener in their member area:

Source: InvestingPro

If you haven't already subscribed to InvestingPro, now is the perfect time to do so: for a limited time, we're offering our readers a -10% discount!

- Click here to take advantage of the special Pro+ rate for a one-year subscription

- Click here to take advantage of the special Pro+ rate for a two-year subscription

We're also offering a 10% discount on 1 and 2-year Pro subscriptions, but please note that some of the features mentioned in this article, such as the stock search by country in the advanced screener, are reserved for Pro+ subscribers.

With a Pro subscription, however, you'll be able to consult the Fair Value, Health Score, and ProTips of all stocks, use the basic screener functions, access the outperforming ProPicks strategies managed by IA, and much more!

- Click here to take advantage of the special Pro rate for a one-year subscription

- Click here to take advantage of the special Pro rate for a two-year subscription

You can also click here to learn more about InvestingPro and compare the Pro and Pro+ subscriptions in more detail. You'll also be able to take advantage of a -10% discount, but you'll need to manually enter the promo code "ACTUPRO" in the dedicated area at the last stage before payment.

Disclaimer:This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.