Gold and gold stocks have stabilized after forming a short-term low and even held up well while the US Dollar Index pushed to an 8-month high. Conventional wisdom would tell us with the USD Index nearing a major breakout, Gold and gold stocks would be vulnerable to further losses. However, many astute analysts and traders believe that Gold and the USD Index can rise together and we note that the trend in the USD Index while important, is not the primary driver of Gold. Ultimately, as long as Gold’s fundamental driver—declining or negative real rates—remains in place, then the fledgling bull market will remain on track.

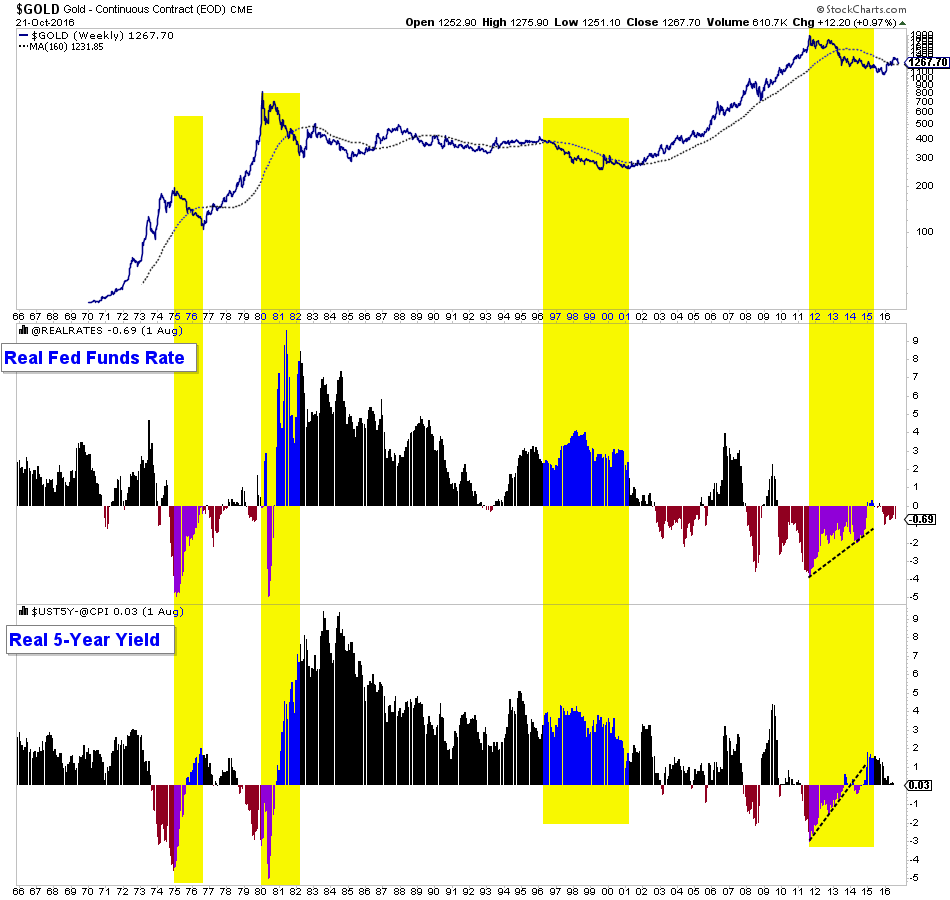

First, take a look at what I like to call my master chart for Gold’s fundamentals. We plot Gold, the real Fed funds rate and the real 5-year yield. We highlight the major bear markets in Gold which occurred when real rates were rising or were strongly positive. Since the middle of 2015, real rates have declined and that explains the sustained recovery in Gold this year.

Although the Federal Reserve could raise rates, inflation is ticking higher and recent market action argues that inflation and inflation expectations will rise into 2017. Inflation metrics such as the sticky CPI and core CPI are showing inflation well above 2% without higher energy prices, which could be on the way in the months ahead. Oil closed the week at a 15-month high and in recent weeks surged above important moving averages such as the 200 and 400-day.

In other words, the potential coming rise in inflation figures could dwarf a measly quarter point rate hike. Recall the mid 2000s and the 1970s. Inflation rose faster than interest rates and so Gold performed well. The Fed raises rates when inflation rises, but the Fed is almost certain to remain behind the curve and let inflation run. That is bullish for Gold in USD terms, even if the USD Index is performing well.

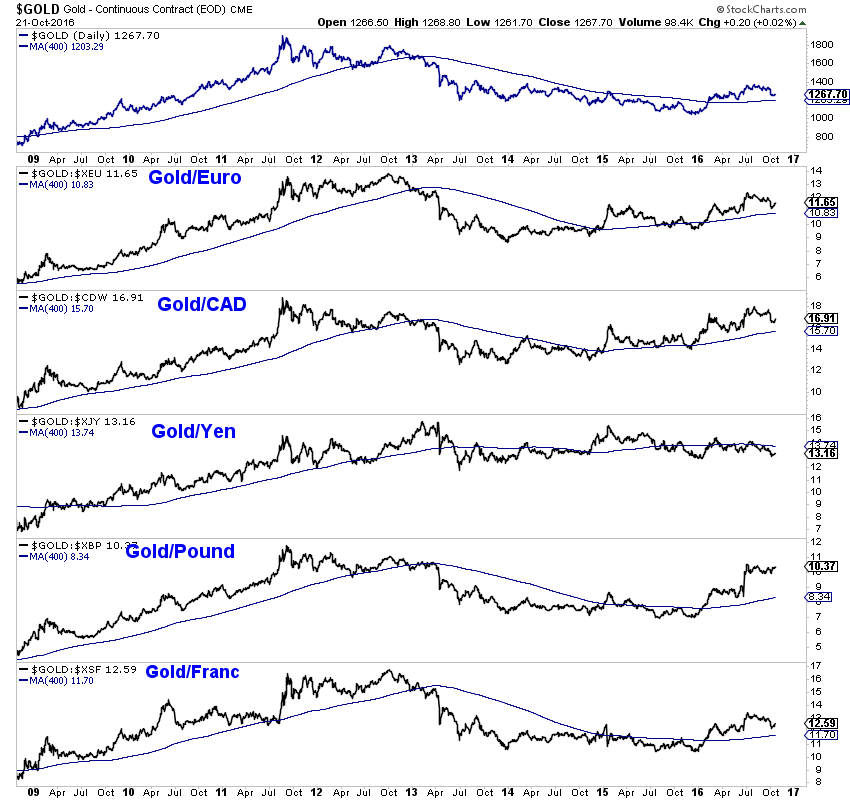

Another thing to keep an eye on is Gold’s performance against foreign currencies. Below we plot Gold priced in a number of different currencies and the corresponding 400-day moving average. Other than in yen terms, Gold is in an uptrend against every major currency and remains above rising 400-day moving averages. Below, euro, Canadian dollar, yen, pound sterling and Swiss franc.

Ultimately, the single most important driver of Gold is negative or declining real interest rates and with inflation poised to rise, real rates are likely to decline further in 2017. If the USD Index is rising, then that certainly puts some cap on Gold’s performance in USD terms.

However, the presence of negative real rates combined with continued out-performance in foreign currency terms would sustain the bull market. Moreover, precious metals already experienced a vicious multi-year bear market. You don’t get that kind of buying opportunity twice, but the recent correction in the sector has created a lower risk buying opportunity.