U.S. energy prices are on the rise. Reduced capital spending across natural gas and coal markets have finally given producers in each sector a boon this winter for pricing in both commodities. Coal prices are up 22% since last November while winter Henry Hub forwards is trading between $5.00 and $6.00/MMBtu, which would be the strongest monthly average since January 2010. A tight natural gas market has contributed to strong natural gas prices increasing the competitiveness of coal in the U.S. generation stack. Here we explore how coal generation and coal production is responding to higher natural gas prices.

Coal Generation Moving Higher

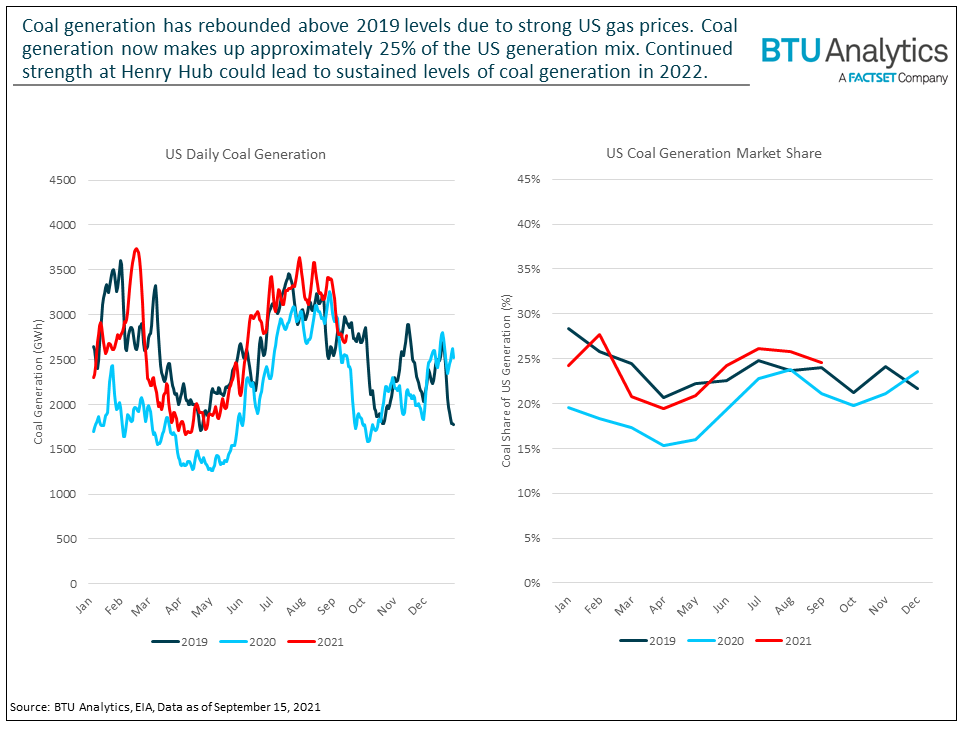

U.S. coal generation has returned to and even exceeded 2019 levels driven by strong natural gas pricing and increased demand for electricity in the U.S. Coal generation year-to-date (YTD) is 28% higher than at the same point in 2020. Compared to 2019, coal generation is just 0.6% lower YTD, but 3% higher than 2019 since the beginning of the summer. Total U.S. generation has also rebounded in 2020 and is up 5% YTD compared to 2019, but only 0.2% over the summer. Thus, coal generation has increased its share of U.S. electric generation. Coal generation averaged 23% of total U.S. generation in the summer of 2021, up from 20% in 2020 and 22% in 2019. However, this increase is not entirely at the expense of natural gas as record low hydro generation in the West has helped keep overall natural gas generation higher.

Can Coal Producers Keep Up?

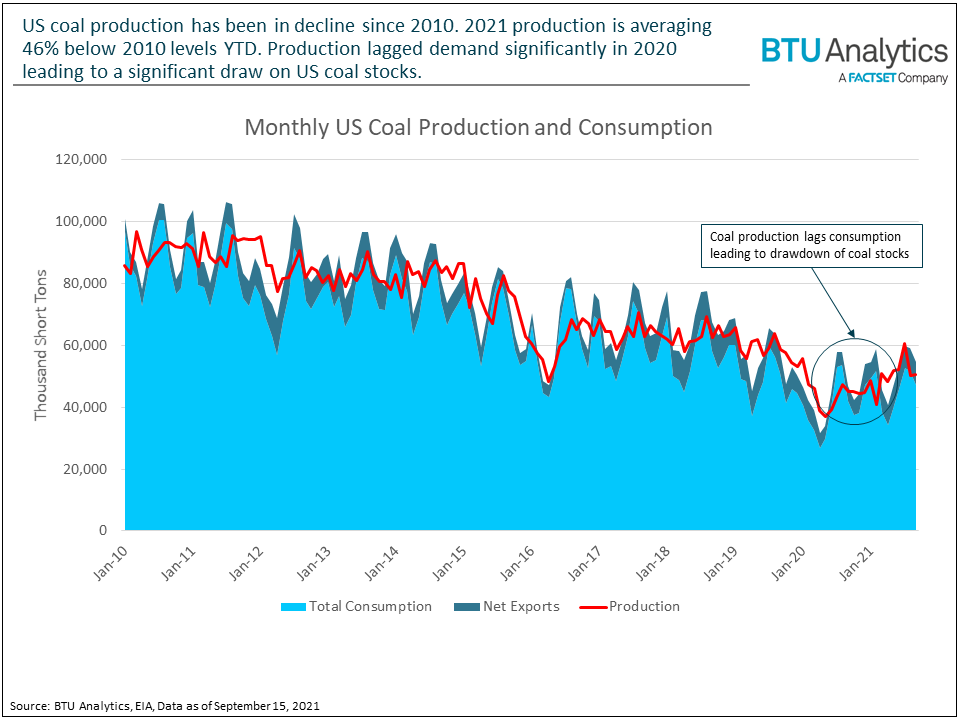

The Henry Hub forward market is currently trading over $4.27 in 2022 indicating that coal generation should continue to be competitive throughout next year. But the rebound in coal generation may come at a time when U.S. coal producers struggle to keep up with rebounding demand for both thermal and metallurgical coal. U.S. coal production has been in decline for over a decade, falling from an average of 90 million short tons per month in 2010 to 49 million short tons per month in 2021. This trend has largely followed the same shape as coal consumption in the electric sector which has declined to an average of 39 million short tons per month compared to an average of 78 million short tons per month over the same period in 2010. Combined with rebounding U.S. exports of coal driven by strong demand in Europe and Asia, demand has exceeded the supply of coal YTD.

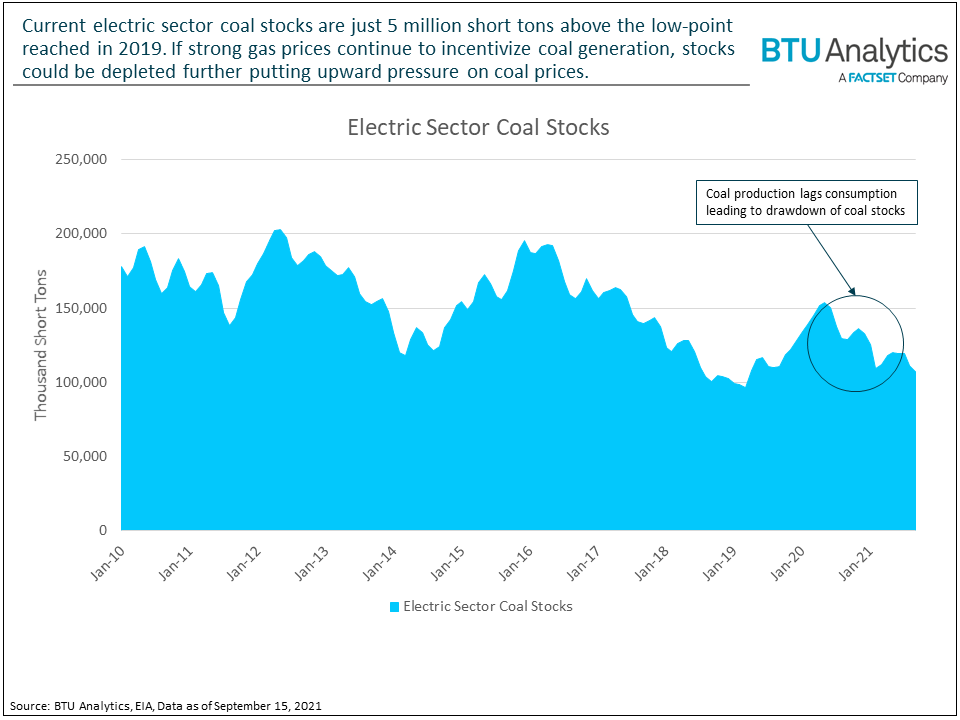

As a result of the rapid rebound in demand for coal and production lagging consumption, coal stocks for the electric power sector currently sit at 120 million short tons, only five million short tons higher than the low point reached in 2019 as shown in the chart below.

Coal consumption and coal production are currently at parity but the ability of U.S. coal production to ramp up significantly may be hampered going forward by many of the same forces curtailing investment in the U.S. oil and gas upstream space. U.S coal producers have faced a decade of bankruptcy and underperforming investments as cheap U.S. coal and U.S. environmental policy have resulted in the closure of hundreds of U.S. coal plants and subsequently, coal producers have shuttered dozens of mines to rebalance the market. Peabody Energy and Arch Resources, two of the largest U.S. coal producers, are focused on using free cash flow to reduce liabilities due to mine reclamation, pension plans, and debt rather than expanding mining operations at a time when the future of U.S. coal seems bleak. Additionally, boosting utilization at existing mines has been hampered by labor shortages as we are seeing in many sectors of the U.S. economy.

European markets are already feeling the strain of a lack of ability to switch from natural gas back to coal with prices skyrocketing to over $20/MMbtu for the winter. Could the U.S. natural gas market be on a similar path this winter if U.S. coal producers fail to keep up with the demand for coal?

BTU Analytics is a FactSet Company. This article was originally published on the BTU Analytics website.

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.