Gold started the new year on an upbeat note, finishing January with a gain of roughly 3% after reaching a 17-month peak on January 25, close to the $1,370 level, as a weaker U.S. dollar boosted its appeal.

However, the yellow metal has since been on the back foot, catching many investors who were expecting prices to continue higher by surprise, testing the $1,400-handle.

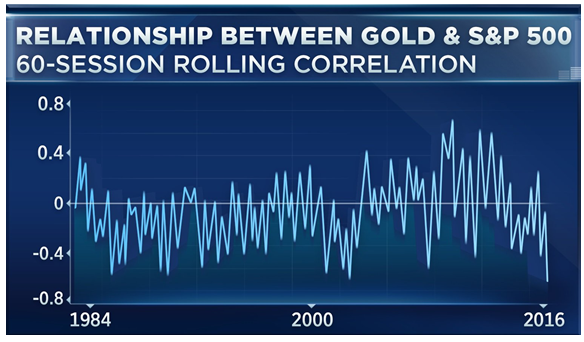

Perhaps most concerning for gold bulls, however, is the fact that the traditional safe-haven asset hasn't enjoyed strong inflows in the wake of the increased volatility and turbulence seen across U.S. and global stock markets in recent days, although its 'sister' safe haven asset, the yen, saw gains of 1.4% over the similar period. Not only has the price of gold failed to get a lift from the fickle market conditions, but the commodity—which traditionally moves higher as market risk increases—actually sank in unison with the stock market. What's driving this unusual turn?

The recent downward trend in gold can be attributed to a pair of key factors: rising bond yields and a resurgent dollar.

The benchmark U.S. 10-year bond yield rose as high as 2.902% on February 12, the loftiest levels since January 2014, reflecting rising expectations among investors of higher inflation and a stronger economy. But rising inflation would typically be a tailwind for gold, since it is often considered a hedge against rising prices. However, uncertainty about how quickly yields will rise and the degree to which inflation will resurface may be giving gold traders pause.

Indications of stronger inflation have led investors instead to fear that the Federal Reserve may raise rates faster and more often than previously expected. Indeed, the market is now adjusting to the possibility that the Fed could raise rates four times in 2018, compared to the three it currently forecasts, especially if Congress loosens the fiscal purse-strings. Meanwhile, the Dollar Index, which tracks the greenback's strength against a basket of six major rival currencies, firmed above the 90-level, after spending most of January at around the 88-handle.

Those factors will likely take the shine off gold even more as the year progresses as the Fed and the world's other leading central banks start moving away from their easy monetary policy for this first time since the 2008 financial crisis, toward normalization and higher interest rates.

Gold is highly sensitive to rising interest rates. As these increase, the opportunity cost of holding non-yielding bullion decreases, while boosting the dollar, in which it is priced. A stronger U.S. dollar usually weighs on gold, since it dampens the metal's appeal as an alternative asset and makes dollar-priced commodities more expensive for holders of other currencies.

The notion that the inverse relationship between stocks and gold is breaking down is certainly not a good signal for the precious metal over the longer term. Ordinarily, gold would draw bids from investors fretting about a volatile equity market.

Source: CNBC

From a technical perspective, gold looks set to test support near the $1,300-level, which if breached, would see prices fall towards $1,250. A break below that line would see the yellow metal head to the key $1,200-mark, where it has strong support.

The chart above depicts how gold prices have been trapped in a range between $1200 to the downside and $1375 to the upside since February 2017. Until one of these levels is ultimately breached, the precious metal will remain confined to this range.

Though some analysts continue to recommend gold as a key component of a diversified portfolio, taking all the above into consideration, it's easy to see why gold has lost its luster among many investors.