Precious metals like gold and silver have traditionally been associated with inflation hedges, due to their ability to maintain their relative value over long periods of time. Their performance over 2022 however was fairly dismal considering the high inflation environment, although a rally has been forming since late November. We take a closer look to see if this rally still has legs or has it mostly run its course?

Precious Metals as an inflation hedge

To begin, we need to first understand the historical relationship between precious metals and the rate of inflation, to see if their 'hedge’ status holds water.

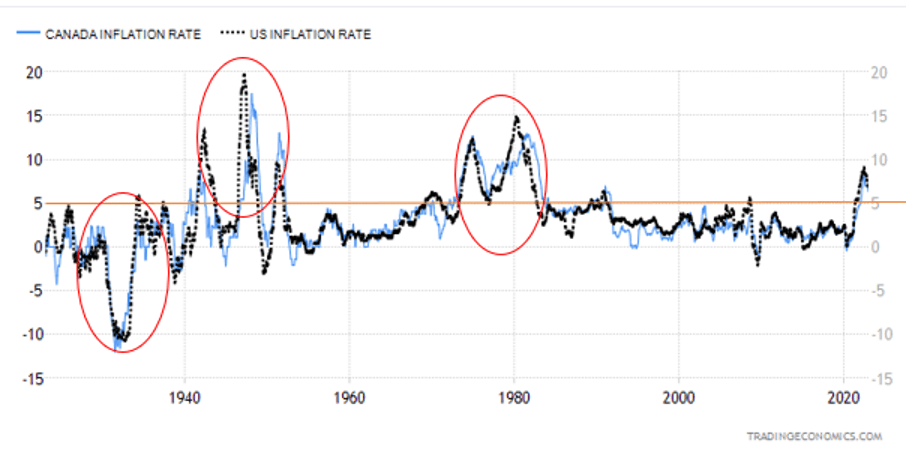

Gold's role as an inflation hedge has been relatively mixed during periods of high inflation, which can be defined as 5% and up - more than two times the inflation targets set by the FED and the Bank of Canada. Historically speaking there have only been a handful of occasions when inflation has gone beyond this 5% level as can be seen from the graph below:

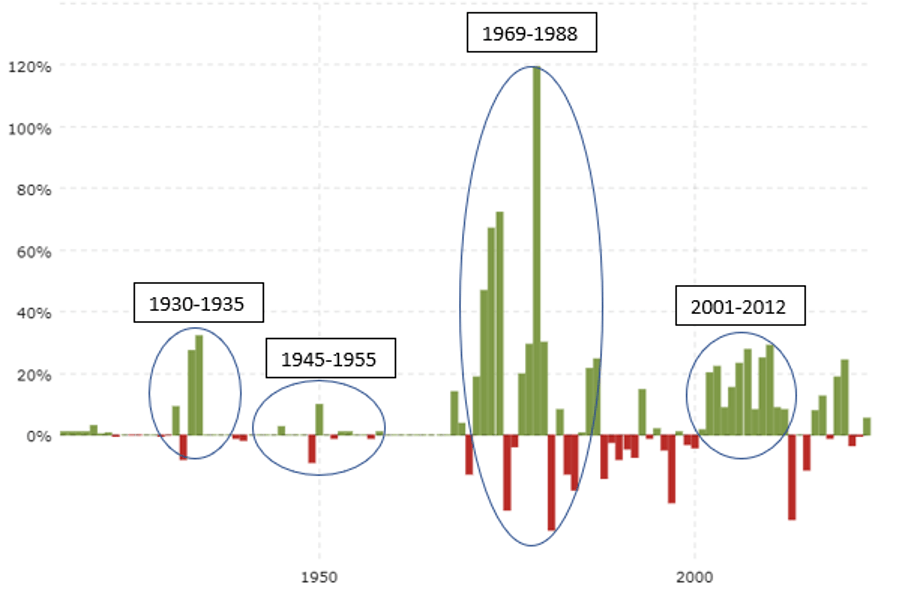

If we look at the prices of gold over the last 100 years, we notice a somewhat inconsistent pattern in gold's performance relative to the rates of inflation:

1930-1935: In the 1930s, which was characterized by deflation and the Great Depression, we saw increases in the price of gold of 25-35% for two years in a row.

1945-1955: During the inflationary burst of the 1940s and ‘50s gold mostly experienced weak performance.

1969-1988: Fast forward to the '70s and '80s - which is often remembered as one of the highest inflationary environments of modern history (despite the actual rate being lower than in the ‘40s) - and the price of gold had a stellar performance, helping to consolidate its status as an inflation hedge (a status which, based on additional years’ data, some may now question).

2001-2012: Looking at the gold price performance chart we see another period of sustained price gain, from 2001 to 2012. Curiously, however, inflation did not break above the 5% level and remained range bound from the 90s all the way to 2020.

Therefore, historically we can see the price of gold increasing in periods of relatively low inflation, or even deflation, and remaining somewhat muted during high inflationary environments, with the exception of the ‘70s and '80s.

Could there be another factor at play?

Given the seemingly weak correlation between high inflation rates and the price of gold, investors should ask themselves one very important question: are there other factors at play?

As is usually the case with financial markets, the answer is probably "yes". Using the mantra of "correlation does not equal causation”, I propose another factor that seems to have at least an equal effect on the price of gold, and one which Warren Buffett himself seems to be a proponent of. I'm talking about interest rates.

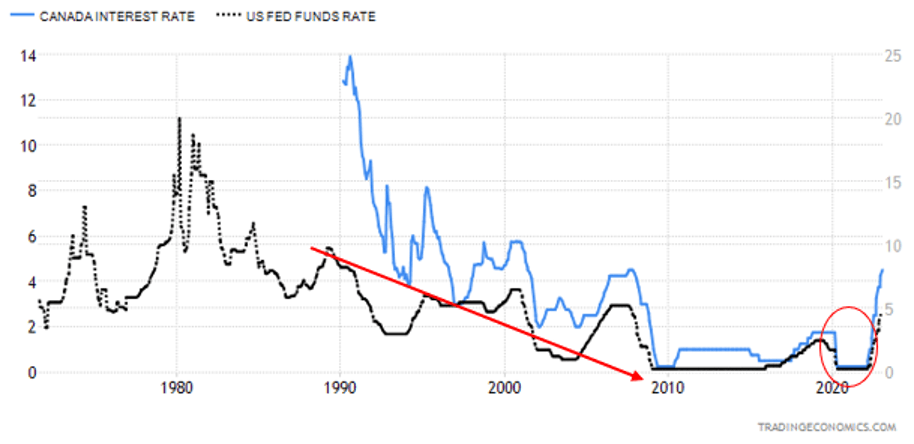

Although the data for historical interest rates in the United States and Canada is not nearly as complete as I would wish, we can use the last 30 years to examine the relationship between gold prices and interest rates.

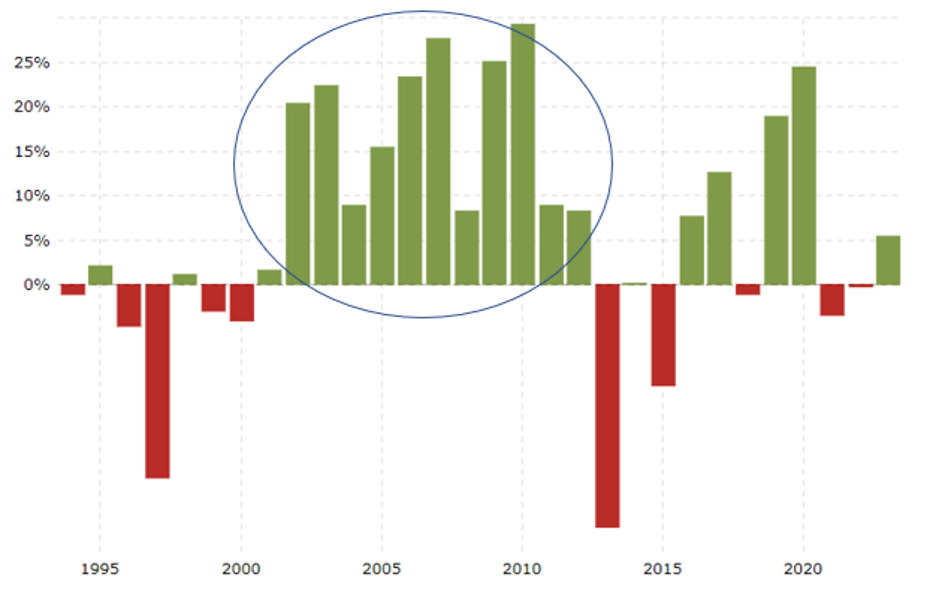

Using similar charts as in the previous analysis, we can zoom in on the ‘90s, 2000s, and 2020, which are periods of relatively normal or even slightly negative inflation and compare that to the path of interest rates in those same years.

What we quickly discover is that the ‘90s and 2000s are characterized by falling interest rates in both Canada and the United States, which seemed to coincide with a strong performance of gold prices for at least half of that period. Granted, the ‘90s saw a downtrend in interest rates and a downtrend in gold prices at the same time, but there is perhaps a third factor at play during this decade, such as the ability to earn higher returns elsewhere (perhaps the tech sector?).

Fast forward to the year 2020, which was also characterized by near-zero interest rates, and essentially no inflation, we can actually see the price of gold was up almost 25%.

Based on the historical data we can see a much stronger relationship between low interest rates and high gold prices, than between high inflation and high gold prices.

Where does this leave us for 2023 and beyond?

Given the factors considered above, it’s important to compare previous bullish gold environments with today's conditions and see how they match up.

From an inflationary perspective, although still high we are starting to see a clear downtrend that began in November. Coincidentally the current rally in gold prices also started in November, which once again seems to go against the inflation hedge theory. After all, if high inflation was the main driver behind the price of gold, we should have seen the rally start in February and peak in September or so.

On the other hand, a peak in inflation and the beginning of a downtrend could signal an eventual end to the interest rate cycle, and perhaps even rate cuts over the next 10 to 12 months. We are already starting to see a divergence in central bank policies, with the Fed insisting there is more work to be done, while the Bank of Canada has recently announced its pause, making it the first central bank to do so.

This seems to lend credibility to interest rates as being the primary factor behind the price of gold, which unfortunately would give it the status of a risk asset, similar to equities.

By most estimates, 2023 will continue to see a downtrend in inflation, as well as a peak in the interest rate cycle. Therefore, investors must choose which theory they subscribe to. If they believe inflation to be the main driver of gold prices, then the current rally is likely to be temporary with gold offering little growth potential.

If, on the other hand, they subscribe to the interest rate theory, then perhaps this is not a bad time to consider an allocation. We will likely not see any rate cuts in the first half of 2023, but the prospect of cuts in the future could be enough to fan the flames of the rally for longer.

For investors looking to get exposure to gold bullion prices, the CI Gold Bullion Fund and Purpose Gold Bullion Fund are two ETFs worth considering. They have low MERs of 0.16% and 0.25% respectively and fairly similar year-to-date returns. Alternatively, iShares Gold Bullion ETF is another option to consider – it currently offers the highest year-to-date performance of the three but with a higher MER of 0.55%.

This content was originally published by our partners at the Canadian ETF Marketplace.