- As Salesforce gears up to reveal its Q4 earnings, the San Francisco-based company's strategic focus on AI-driven solutions is under the limelight.

- Salesforce's financial outlook points to a potential turnaround, with expectations high for a profitable finish in 2023.

- ProTips analysis indicates Salesforce's noteworthy net profit growth and overall strong performance, signaling that the positive momentum could continue for the stock.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

While much attention has been given to Nvidia's (NASDAQ:NVDA) success in riding the AI wave, another stock poised to gain from this tailwind is Salesforce (NYSE:CRM).

The San Francisco, California-based company has been prioritizing digital transformation in cloud-based customer relationship management solutions, focusing on enhancing its AI-powered products and services.

As Salesforce prepares to unveil its Q4 earnings report tomorrow after the market closes, expectations are high for the cloud-based software company to finish 2023 with a profit, rebounding from the previous year's losses, driven by robust business growth.

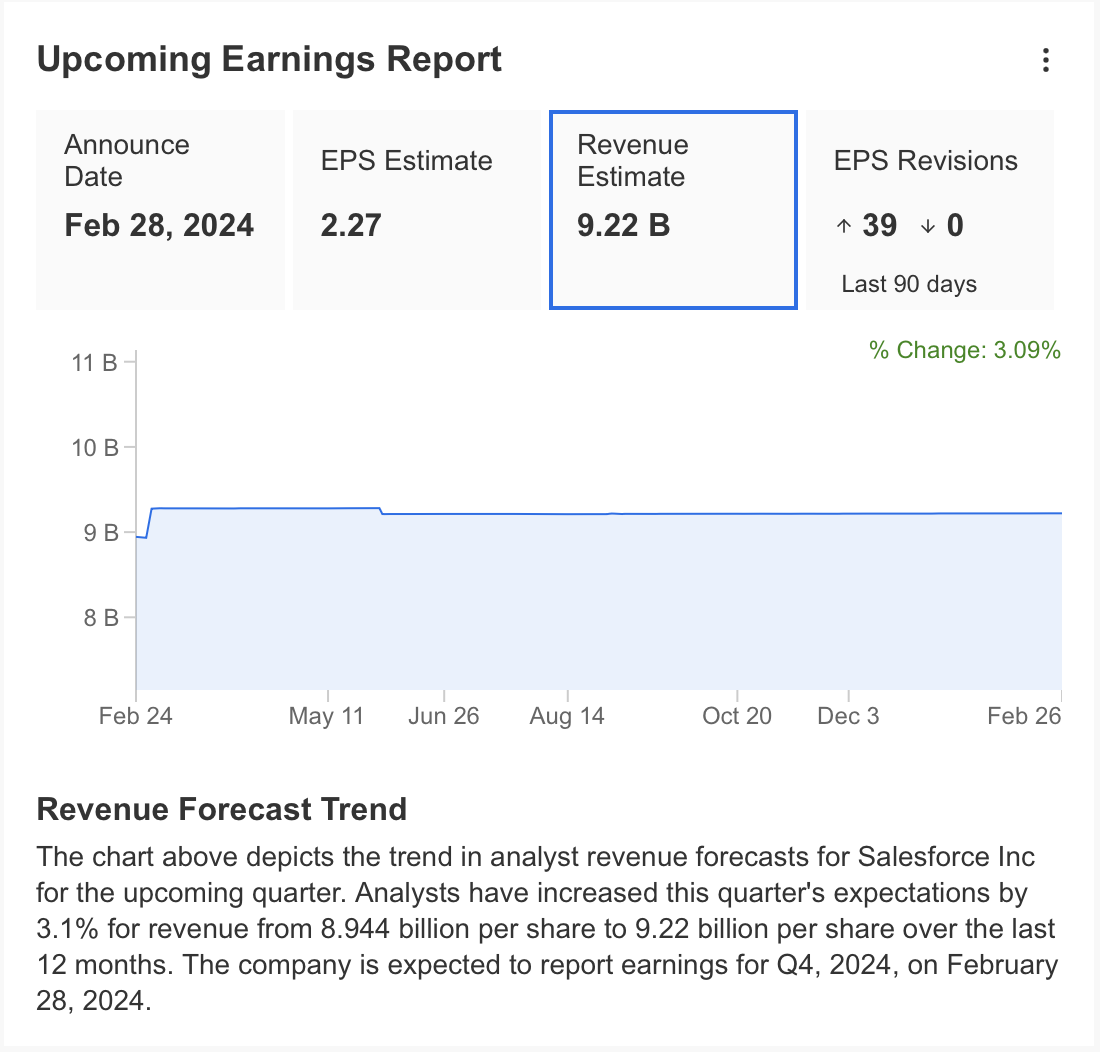

Source: InvestingPro

According to theInvestingPro forecast, Salesforce's last quarter revenue is expected to be $9.22 billion. Earnings per share (EPS) is estimated at $2.22. In the same period last year, the company announced a loss per share of $0.1.

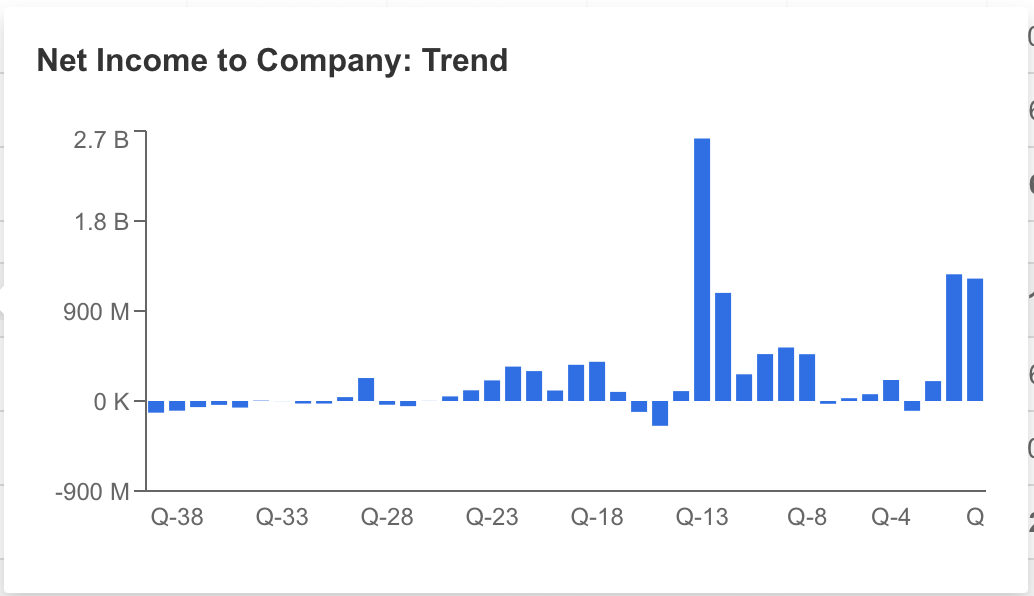

Source: InvestingPro

The company managed to increase its net income to $1.2 billion in the 2nd and 3rd quarters of 2023 and is expected to keep its net profit at $1.2 billion in the last quarter.

Salesforce posted a loss of $98 million in the same period last year and is expected to continue to increase its profit margin this year.

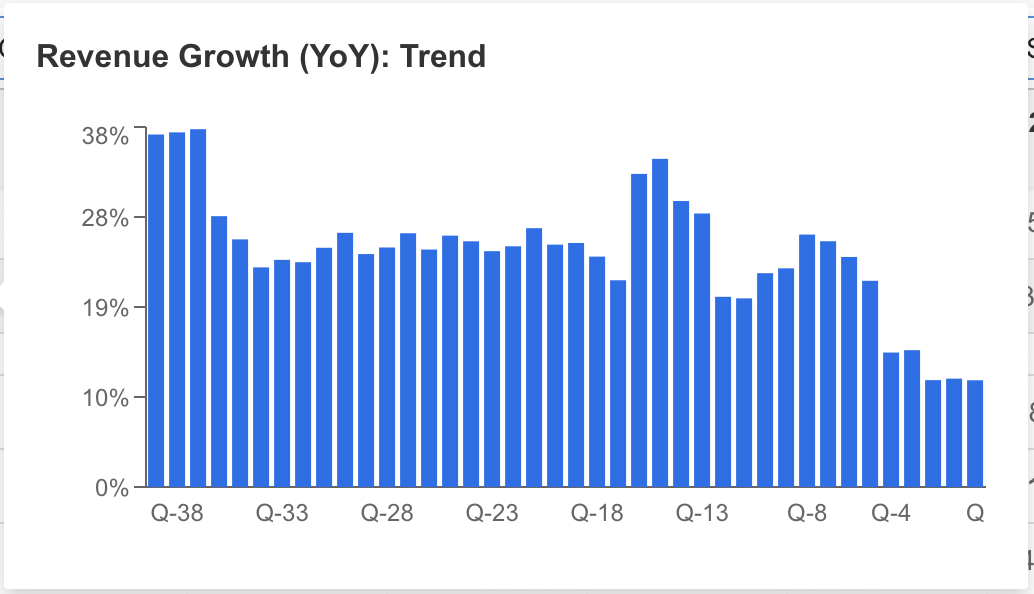

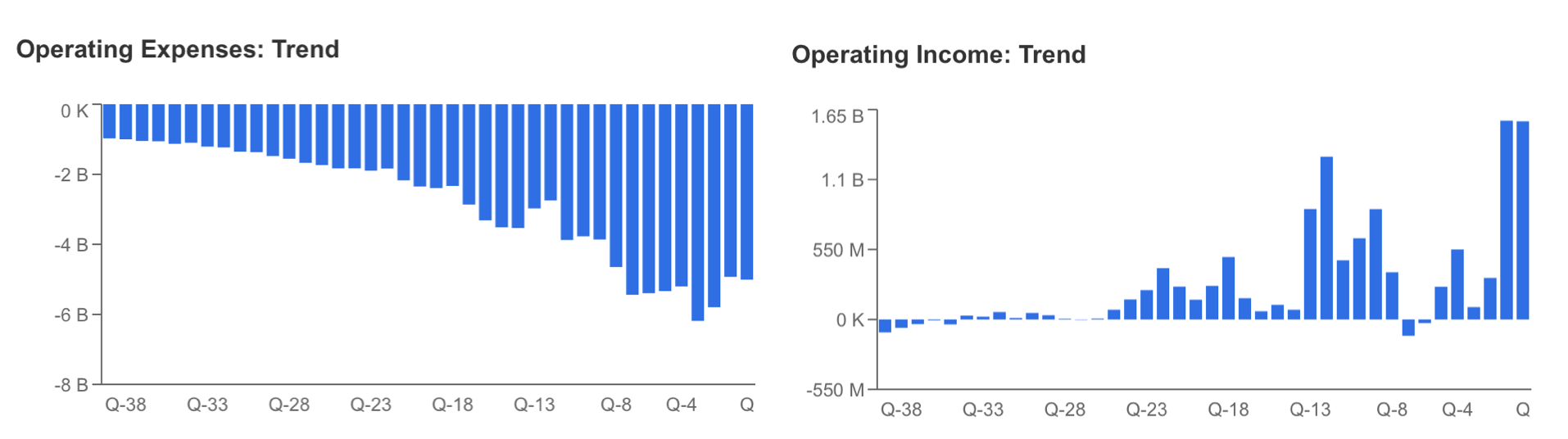

Source: InvestingPro

Margins Rise, But Revenue Growth Continues to Slow: Can AI Help Turn the Tide?

Although it is expected to announce the highest quarterly revenue of all time, the downward trend in revenue growth draws attention.

Salesforce managed to increase its net profit with a remarkable increase in operating income while successfully implementing its cost policy.

Source: InvestingPro

Last year, Salesforce launched Einstein GPT, its first artificial intelligence tool in customer relationship management, and focused on increasing its AI-powered services.

Thus, the company started to manage the demand for AI well and started to increase its operating revenues rapidly as the global demand for the sector continued.

As a result, Its data cloud services have become the fastest-growing segment with the support of artificial intelligence, and it is expected to generate the highest revenue in the last quarter.

Salesforce announced two significant acquisition plans and simultaneous layoffs as part of its cost-cutting policy in 2023.

In recent months, Salesforce has unveiled plans to acquire Airkit.ai and Spiff, two companies specializing in artificial intelligence.

These announcements underscore the company's commitment to expanding its presence in the growing AI sector.

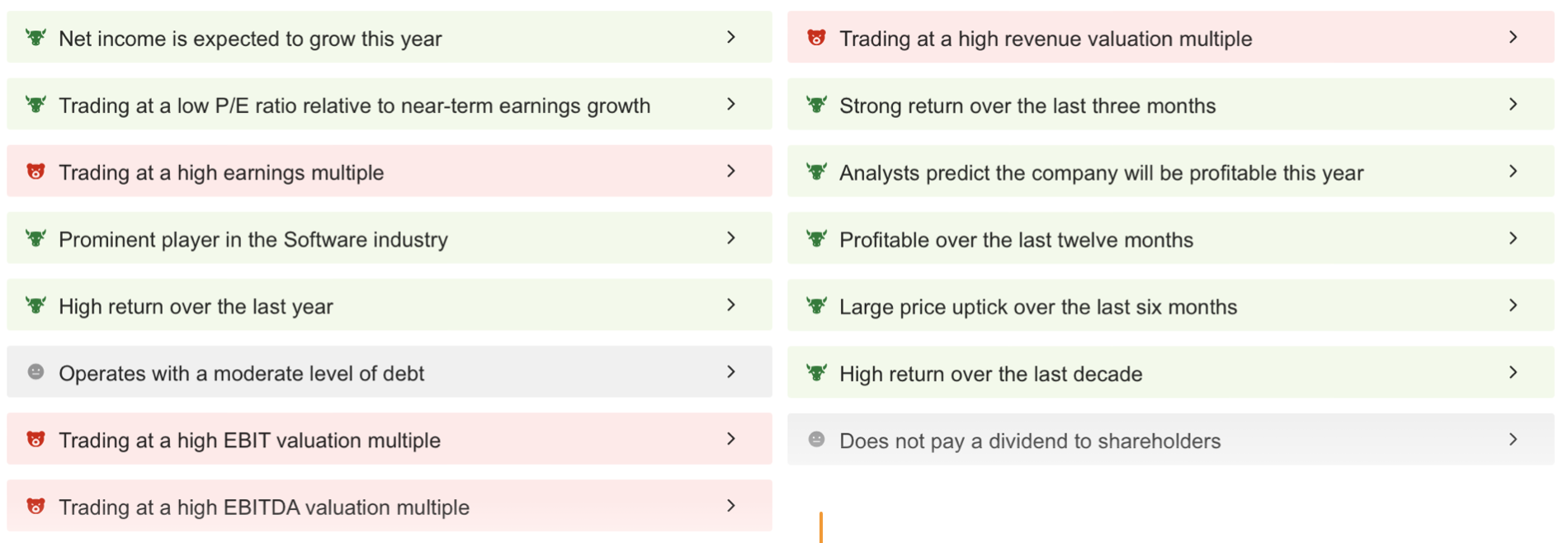

Salesforce: What Does ProTips Indicate?

Continuing to assess the company based on its financial data before the earnings report, we can gain clear insights into Salesforce using ProTips.

Source: InvestingPro

Salesforce's net profit growth this year stands out, while the company's strong performance in the short and long term paints a reassuring picture for its investors.

Additionally, watch out for high P/E and EBITDA valuation ratios—they might signal a potential issue.

However, if the company can sustain its revenue growth and effectively handle its growth strategy, this might not harm the stock price.

The absence of dividend payments from Salesforce could be viewed as a drawback for long-term investors.

Source: InvestingPro

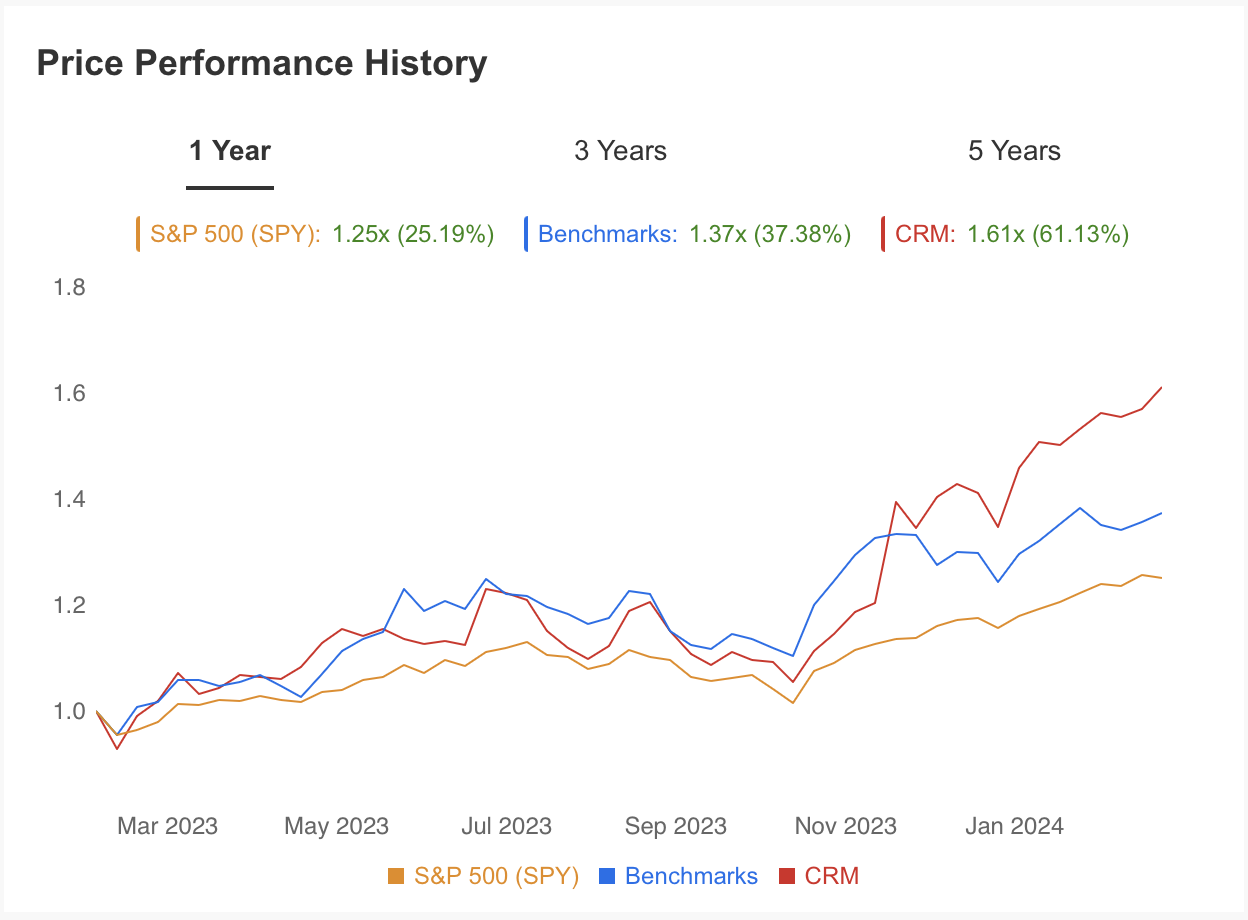

The last one-year performance of CRM stock also supports its financials. Salesforce stock has risen 61% in the last year, compared to the average return of 25% for the S&P 500 and 37% for its peers.

Source: InvestingPro

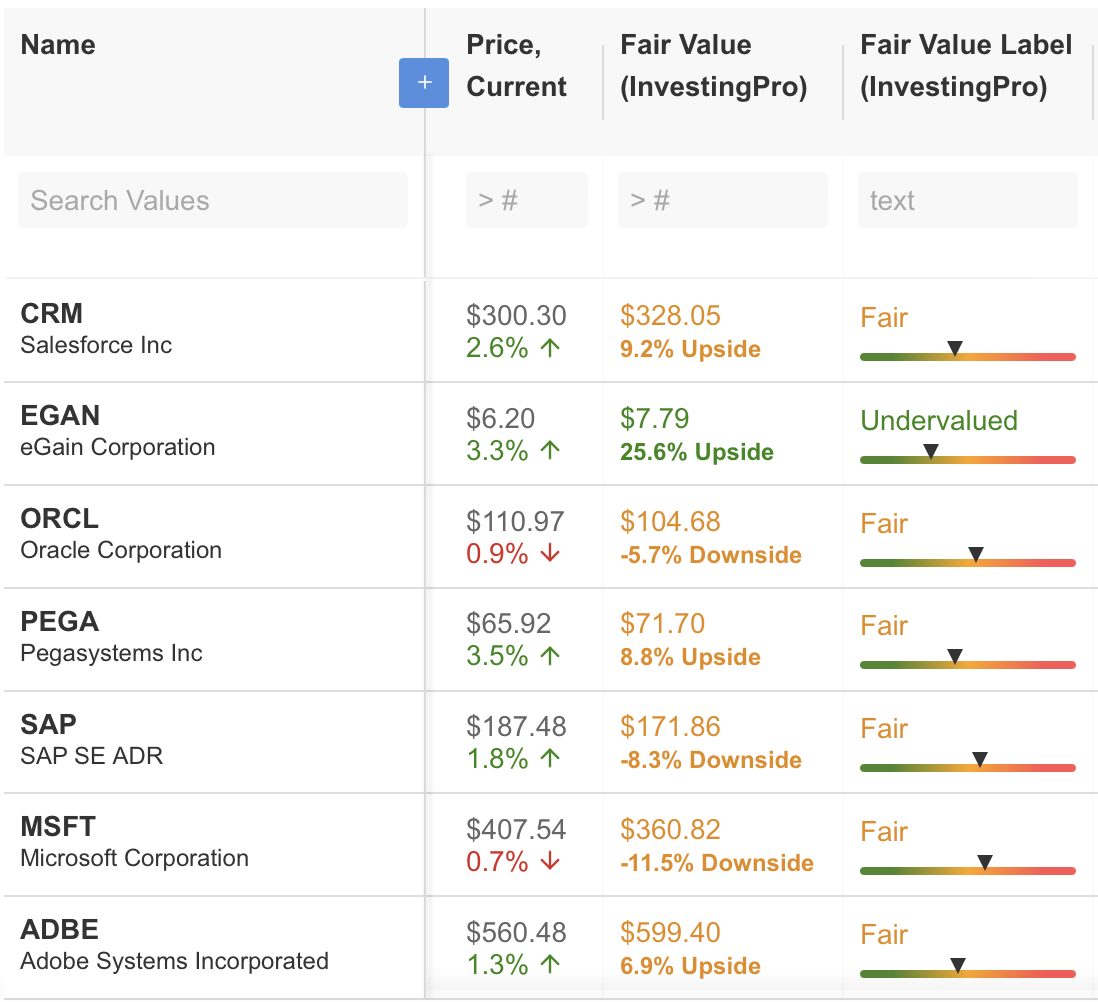

Comparing CRM's price with the shares of peer companies with the help of InvestingPro, the stock has a 10% upside expectation according to the fair value analysis.

CRM, which moved at $300 before the earnings report, has the potential to rise to $328 in the coming periods according to InvestingPro's fair value analysis.

The company's financial health is solid, with excellent growth and price momentum performance. Cash flow and profitability are also positive.

Overall, the company's financial health is sound, and it's worth keeping a close eye on the ongoing improvements in profitability.

Salesforce: Technical Levels to Watch

CRM has reached its November 2021 peak this week thanks to the uptrend that has been going on for more than a year. This shows that the $ 300 - 310 range is a critical resistance area.

If the earnings report comes in above expectations, if the increase in demand for the stock continues, the trend can continue up to $ 355, which is the next target price according to Fibonacci levels.

If CRM encounters resistance in the peak zone and the selling pressure accelerates at this point, a possible retracement up to an average of $ 270 may be considered reasonable.

Below this value, the correction movement may be triggered and the share price may sag to the range of $220 - 240.

However, the overall outlook shows that the stock is more likely to continue its uptrend in 2024, even if it sees limited corrections.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,427.8% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code INVPROGA24 at checkout for a 10% discount on all InvestingPro plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.