- Stephen Mandel is an American billionaire and founder of the Lone Pine Capital fund established in 1997.

- The fund's current structure is based on a relatively balanced distribution of funds across 26 stocks.

- But the billionaire's big bet on Meta has paid off well so far - but will it continue?

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

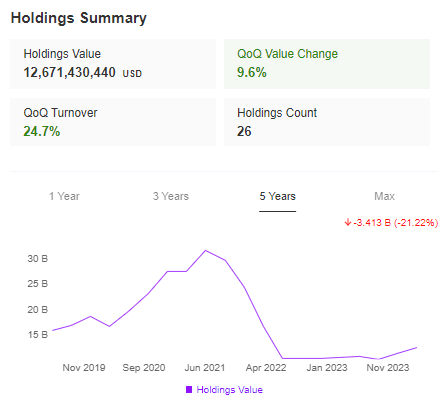

Stephen Mandel, the founder and managing director of Lone Pine Capital, is an investor with a net worth of $3.9 billion. His hedge fund, Lone Pine Capital, manages $12.6 billion in assets (down from $15.2 billion in 2023).

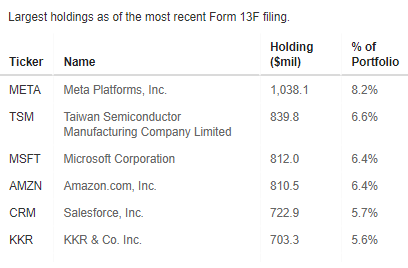

Unlike some other prominent investors who concentrate their holdings on a few key players, Mandel's portfolio is more diversified. However, one company stands out: Meta Platforms (NASDAQ:META).

Mandel's fund holds the largest position in Meta, with an 8.2% stake. This significant allocation indicates his strong belief in the future of the social media giant.

Let's delve deeper into the rest of Lone Pine Capital's portfolio to see where else Mandel is placing his bets.

Lone Pine Capital Diversifies Portfolio, Sees Gains in Recent Quarter

Lone Pine Capital's portfolio showcases a notably flat holding structure, with no single position exceeding 10% of the total holdings. The difference between the largest and smallest positions is just 6.9%, indicating a high level of diversification.

This structure ensures the fund's performance is not overly reliant on a few dominant companies.

Source: InvestingPro

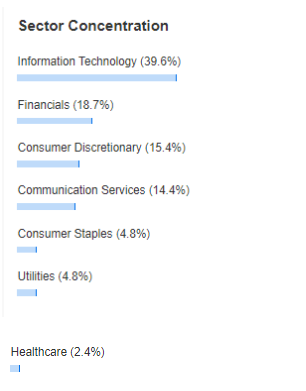

Despite the diversification, the information technology sector (NYSE:XLK) clearly dominates, comprising 39.6% of the portfolio. This sectoral advantage underscores Lone Pine Capital's strategic focus on tech investments.

Source: InvestingPro

After a challenging period in 2021-22, marked by significant declines due to a stock market correction, Lone Pine Capital rebounded strongly in the last quarter. The portfolio's value increased by over 16%, with a quarter-to-quarter growth of 9.6%.

Source: InvestingPro

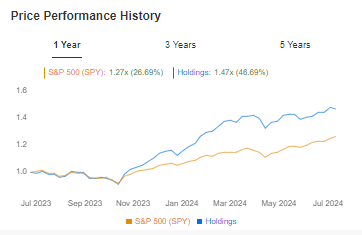

Using the InvestingPro tool, investors can compare their portfolio's performance against the S&P 500 benchmark over a period of up to five years. Over the past 12 months, the portfolio has outperformed the main index, indicating strong potential, especially if the bull market persists.

Source: InvestingPro

Meta's Dynamic Gains and Potential Correction

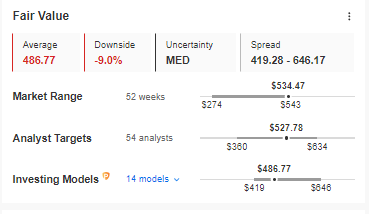

Meta Platforms stands out as the dominant company in the portfolio, based on the F13 report published on May 15. Meta's shares have been on a dynamic uptrend, reaching new historical highs above $540 per share this week. However, the fair value index suggests a potential correction, with prices possibly dropping below $490 per share.

Source: InvestingPro

Technically, the closest support area for Meta is around $520, which is further supported by an upward trend line. If this support area is breached, it could trigger a correction targeting the fair value range.

As we enter the earnings season, the release of Meta's second-quarter 2024 data and future forecasts will be crucial for its stock price movements. Meta is set to disclose its earnings on July 31, which will provide further insight into the company's financial health and future prospects.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.