The central Bank of the United States, the Federal Reserve, also known simply as “The Fed” has raised its benchmark interest rates more rapidly than at any other period in history from March through September 2022.

The goal of this is demand destruction, with hopes that it will result in cooling down inflation, which has been running red hot for almost a year and a half.

This has wreaked havoc for assets known as “risk-on” such as stocks and Bitcoin, which have had negative years so far in 2022.

Will this continue?

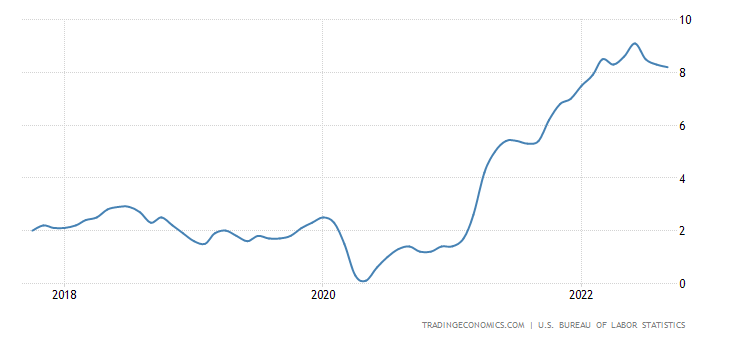

Inflation

The Fed is justified in its concern for inflation. Addressing it is their #1 goal according to Jerome Powell, the Fed Chairman.

You can see inflation began to skyrocket in the first half of 2021.

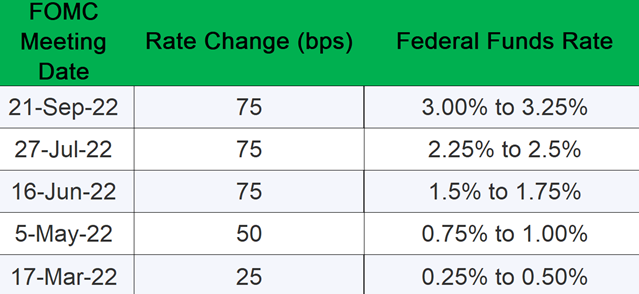

Rate Hikes

The Fed has attempted rate hikes to cool inflation down. So far this has only worked to a small degree, causing fears in some that they will not be able to achieve a so-called “soft landing”.

So far this year, they have increased rated 5 times, including 3 consecutive 75 basis point rate hikes.

There is one remaining Federal Open Market Committee, or FOMC meeting remaining this year. It is being held on November 1–2. This is where the Fed Chair announces rate hikes.

November FOMC Estimate

For the estimation on what happens at the FOMC meeting, I used the CME FedWatch Tool. This is in real time so it will shift, but as of this writing, it is sitting at a 98.7% chance of a 75 basis point hike, which would be an unprecedented 4th in a row.

There is a 1.3% chance of a 50 basis point hike.

What Does This Mean for My Portfolio?

Rate hikes make it harder to borrow money, and thus harder for businesses to take out loans to expand and innovate.

Thus, this has a bearish effect on stocks, and other assets currently considered risk-on such as Bitcoin. This generally makes the US dollar stronger, as seen in the DXY index. As most US companies make significant revenue overseas, this also can have a destructive effect on their revenue causing further downward pressure on their stock prices.

This bear market won’t last forever, but the odds of a rapid turnaround for the stock market, crypto or the economy are unlikely over the next few months. The next FOMC meeting is on January 31 & February 2, 2023.

Since the market has already priced in this rate hike, this may not further depress asset prices.

Short-term predictions are most likely to fail, but I suspect that November and December may actually see inflation increase due to the possibility of rising energy prices.

For those like myself who are long-term Bitcoin and stock market bulls, here are three strategies to consider:

Dollar Cost Averaging. Timing the bottom is almost impossible, so through DCA one can soften the blow if they are wrong. I personally consider this a great time to accumulate assets at a cheaper price. Whatever asset you choose, this decreases the penalty for being wrong.

Energy Commodities. An increase in energy inflation due to geopolitical factors over November and December could mean rising oil and gas prices. This would be bullish for oil and gas company stocks and commodities, specifically natural gas and crude oil. Following a short-term jump, I do not see this continuing long-term.

Dividend Stocks. A longer-term period of a recession or slowly growing US economy could change the stock market picture. A big change from the past 20 years, I see a strong possibility that dividend stocks and those considered “consumer staples” outperform growth stocks over a period of months and possibly even a few years. In other words, McDonald’s and Home Depot (NYSE:HD) would outperform Zoom and Roku.

Bitcoin and Ethereum. I expect Bitcoin and Ethereum to see strong growth over the next decade, and their prices are historically low compared to the last bull run. Other than a possible shock in November/December due to energy inflation, I see the upside very high.

Outside of those, cryptocurrency overall is a crapshoot. There are others that will be successful, but the odds of finding the projects that succeed are low enough that I won’t mention any other projects at this time.

This article originally appeared on www.thelatestblock.com