In this XDC Network (XDC) price prediction 2024, 2025-2030, we will analyze the price patterns of XDC by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

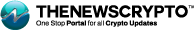

XDC Network Current Market Status

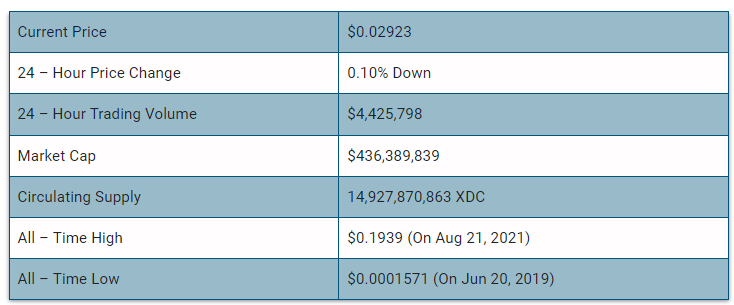

What is XDC Network (XDC)

XDC serves as the fuel token for the XinFin Network, an enterprise-ready blockchain featuring a hybrid (public/private) architecture. With EVM compatibility, the network caters to enterprises looking to build or scale their infrastructure within a blockchain ecosystem. From seamless interoperable smart contracts to frictionless payments, XDC Network provides all the necessary resources for various blockchain use cases.

Moreover, XinFin’s mainnet token, XDC, presents a real-world utility, exemplified by platforms like TradeFinex.org. This allows small and medium businesses or institutions to create their financial requirements digitally and distribute them to banks or non-bank lenders through a common distribution standard, streamlining the financial origination process.

Further, XDC Network is about to reach its next major milestone as XDC 2.0 prepares to launch its mainnet upgrade at block number 80,370,000. This upgrade will introduce the XDPOS Consensus 2.0, based on the Chained HotStuff Byzantine Fault Tolerance (BFT) algorithm, aimed at enhancing security, efficiency, and user experience across the network.

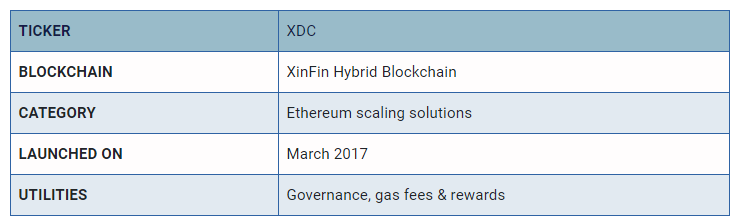

XDC Network (XDC) 24H Technicals

XDC Network (XDC) Price Prediction 2024

XDC Network (XDC) ranks 131th on CoinMarketCap in terms of its market capitalization. The overview of the XDC Network price prediction for 2024 is explained below with a daily time frame.

In the above chart, XDC Network (XDC) laid out a Symmetric Triangle pattern. Symmetrical triangles form during price consolidation, characterized by two converging trend lines of similar slopes. This pattern typically precedes a breakout or breakdown, where breaking the lower trend line initiates a bearish trend while breaking the upper trend line indicates a bullish trend’s start. The breakout or breakdown targets are determined by measuring the distance between the pattern’s initial high and low, applied to the breakout or breakdown point.

At the time of analysis, the price of XDC Network (XDC) was recorded at $0.02924. If the pattern trend continues, then the price of XDC might reach the resistance levels of $0.03014, $0.03395 and $0.04401. If the trend reverses, then the price of XDC may fall to the support of $0.02349.

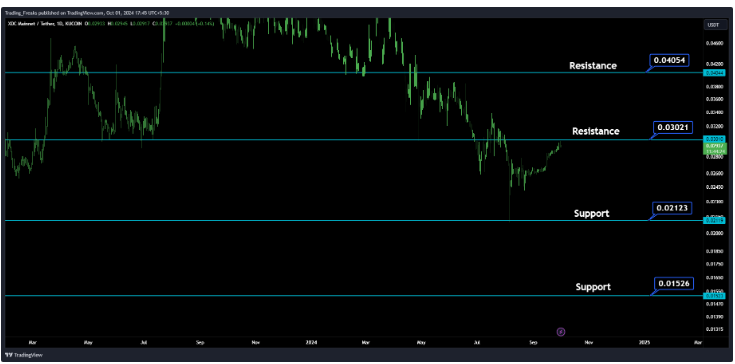

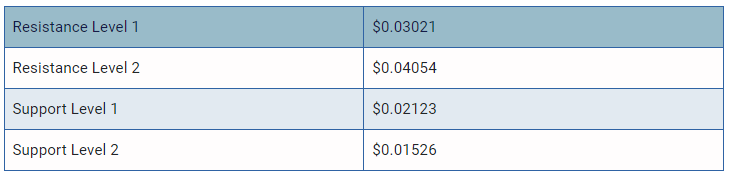

XDC Network (XDC) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of XDC Network (XDC) in 2024.

From the above chart, we can analyze and identify the following as resistance and support levels of XDC Network (XDC) for 2024.

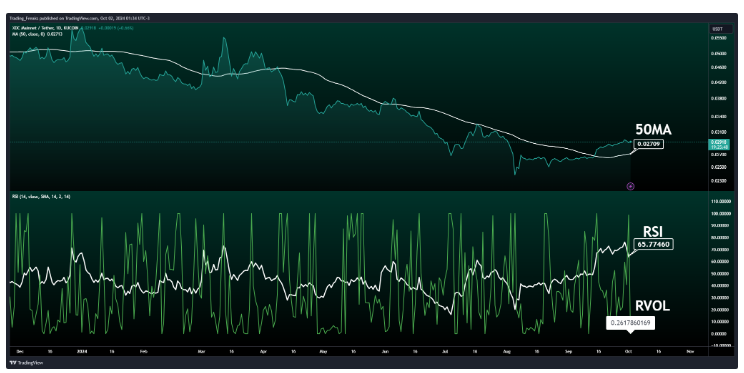

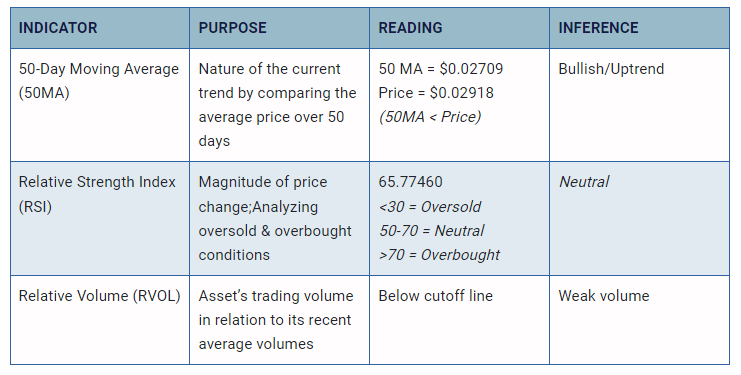

XDC Network (XDC) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of XDC Network (XDC) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current XDC Network (XDC) market in 2024.

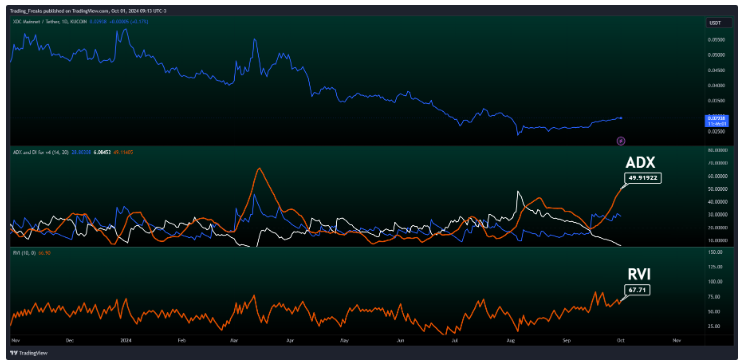

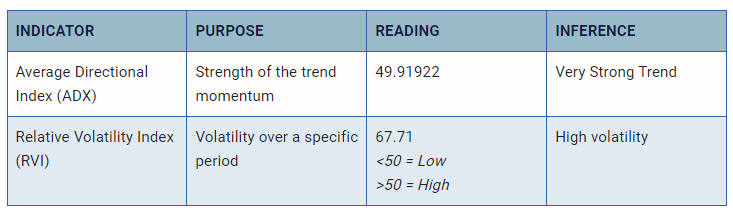

XDC Network (XDC) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of XDC Network (XDC) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of XDC Network (XDC).

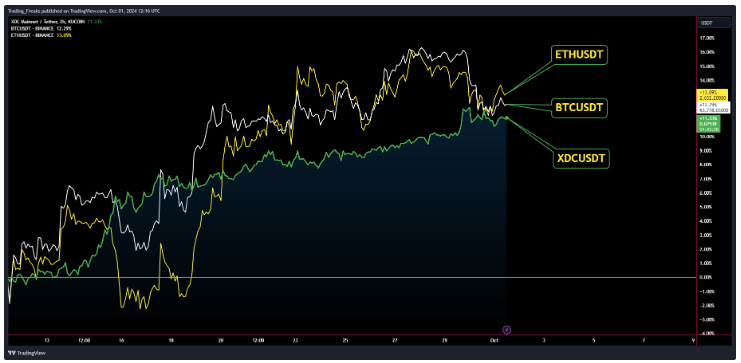

Comparison of XDC with BTC, ETH

Let us now compare the price movements of XDC Network (XDC with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of XDC is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of XDC also increases or decreases respectively.

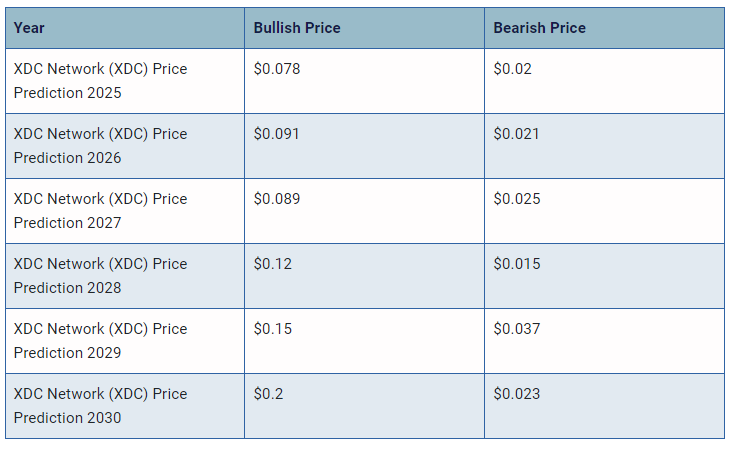

XDC Network (XDC) Price Prediction 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of XDC Network (XDC) between 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If XDC Network (XDC) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish XDC Network (XDC) price prediction for 2024 is $0.04054. Comparatively, if unfavorable sentiment is triggered, the bearish XDC Network (XDC) price prediction for 2024 is $0.01526.

If the market momentum and investors’ sentiment positively elevate, then XDC Network (XDC) might hit $0.1. Furthermore, with future upgrades and advancements in the XDC Network ecosystem, XDC might surpass its current all-time high (ATH) of $0.1939, and mark its new ATH.

This content was originally published by our partners at The News Crypto.