Stagflation seems to be good for our portfolio, as we now have a dozen stocks and funds with double-digit-percentage returns. Almost every recommendation is profitable this year.

So far, we have avoided the tradition on Wall Street to “sell in May and go away.” Last year, President Joe Biden and the Democrats imposed a 1% tax on all stock repurchases. But stock buybacks are good for investors because they avoid double taxation of dividends and increase the value of a shrinking stock issue.

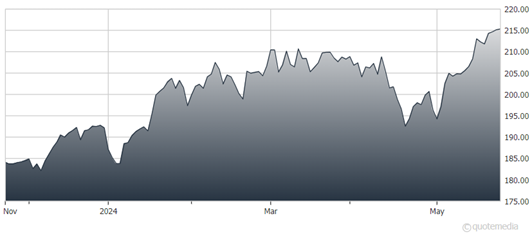

Technology Select Sector SPDR® (NYSE:XLK)

As a result, most companies are offering stock buybacks. Goldman Sachs (NYSE:GS) expects S&P companies to allocate $1.1 trillion in share repurchases in 2025. Recently, Apple Inc (NASDAQ:AAPL) unveiled a record stock buyback plan and increased its dividend to 25 cents per share. Apple stock has soared on the news.

We recommend Apple indirectly through XLK, which is now ahead by double digits in 2024. Over 22% of XLK is invested in Apple stock alone. All five of its top holdings rose steadily recently.

Even as Wall Street is hitting all-time highs, the big news is the new bull market in gold, silver, copper, uranium, and Bitcoin. Commodities have done great, with gold and copper hitting new highs. Bitcoin, silver, and uranium are also recovering and moving higher.

The recession and the bear market have been postponed, despite the Fed’s tight-money policy. Last month, Wall Street expected robust growth in the first-quarter gross domestic product (GDP) number. The Atlanta Fed forecast 2.9% growth. Even Kevin Hassett, former chairman of Trump’s economic team, told Larry Kudlow on Fox Business that he expected real growth of 3.5%.

The real number turned out to be an anemic 1.6%, with higher-than-expected price inflation. But my subscribers weren’t fooled. As I stated last month, and in my Wall Street Journal column, gross output (GO) — a measure of total spending at all stages of production — was slowing sharply, and business-to-business (B2B) spending was negative for the fourth quarter.

Recommended Action: Buy XLK.