Goldman Sachs (NYSE:GS) recently published its 13th annual Global Insurance Survey, which provides valuable insight into the macroeconomic outlook of one of the largest institutional investor groups: insurance companies. A clear takeaway from this year’s report is the growing interest in private credit and its investment benefits. This paper will highlight the investment value proposition of private credit and a recently launched ETF solution that retail investors can use to gain in the asset class.

Growing demand for Private Credit

Among institutional investors, insurance companies are known to be savers with a formulaic business model: write policies, take in premiums, invest those premiums, and use the return on those investments to make claims payments. In the current market environment, there is growing concern about an economic slowdown potentially leading to a recession, ultimately weakening the credit quality of fixed-income instruments. There is also the prospect of declining interest rates, resulting in insurance companies receiving less income from their fixed-income investments to support their claims payments.

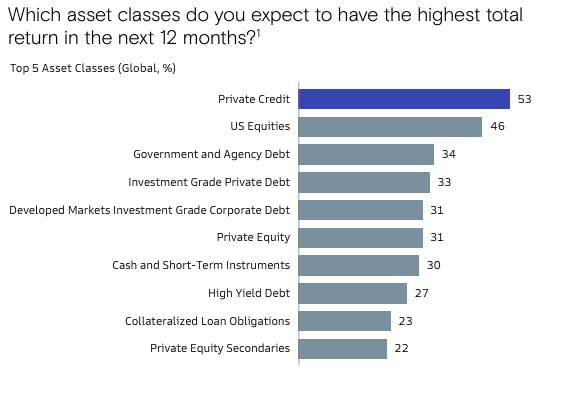

Against this backdrop, insurance companies are seeking asset classes that improve resiliency and provide additive yield, such as private credit.

What is private credit, and what are its advantages?

Private credit refers to non-bank lending, where investors provide loans or other forms of financing directly to companies without going through traditional financial institutions such as banks. This type of financing typically comes from private debt funds, institutional investors, or other non-bank entities.

Private credit is an excellent hedge against inflation and rising interest rates. It is effective because companies generally receive it on a floating interest rate basis. Investors are also attracted to private credit as a diversification strategy because it offers stable income and risk-adjusted returns. These investments, furthermore, have a thorough due diligence process. This process ensures high credit quality, stable cash flow companies, and lower loan defaults.

There are several advantages of Private Credit, but they can be summarized primarily as:

Attractive Returns:

Private credit can offer higher yields than public debt or traditional fixed-income investments. This is often due to the higher risk associated with lending to less established or more leveraged companies.

Diversification:

Including private credit in an investment portfolio can provide diversification benefits. It typically has low correlation with public equity and bond markets, potentially reducing overall portfolio volatility.

Income Generation:

Private credit investments often generate regular income through interest payments, which can be appealing for income-focused investors, such as pension funds and insurance companies.

Direct Lending Opportunities:

Investors can have more direct involvement and influence over the terms and management of their investments. This hands-on approach can provide opportunities to negotiate better terms and closely monitor the performance of the investment.

Protection in Downturns:

Private credit investments can offer downside protection through collateral and covenants that provide lenders with security interests in the borrower’s assets. This can help mitigate losses in the event of default.

How to gain access to Private Credit through an ETF

Recently, Accelerate Financial Technologies Inc. (”Accelerate”), a leader in alternative investment solutions, launched the Accelerate Diversified Credit Income Fund (Ticker: INCM), Canada’s first private credit ETF.

The Accelerate Diversified Credit Income Fund seeks to deliver exposure to alternative income sources compared to traditional fixed-income funds by focusing on the private credit and direct lending market. The Fund aims to generate a 10% yield, paid monthly, for investors from a diversified portfolio of hundreds of senior secured floating-rate loans to private middle market companies. INCM gains this exposure through allocations to top-tier U.S. private credit managers attained through the secondary market. Through the Accelerate Diversified Credit Income Fund, investors gain exposure to the attractive yields generated by direct loans while also having the convenience, transparency, and liquidity of an ETF.

In speaking about the fund’s value proposition, Julian Klymochko, CEO and Chief Investment Officer of Accelerate, stated, “In a high interest rate environment, private credit has compelling tailwinds. Moreover, we believe that interest rates will stay higher for longer, which supports the sustainability of the private credit thesis over the medium term. Currently, private credit is the highest-yielding asset class, and the case for investing in senior secured loans at a double-digit yield is logical. Furthermore, the floating rate nature of private credit helps diversify traditional fixed income portfolios, which have been decimated by rising interest rates.

In addition to providing exposure to the positive fundamental characteristics of private credit, including its high yield, we launched INCM to provide Canadian investors and allocators with benefits we viewed as lacking in the traditional private debt space: 1) Liquidity through an ETF structure with no gating risk and, 2) Credit diversification through exposure to more than 4,000 direct loans.

The Accelerate Diversified Credit Income Fund’s targeted 10% yield, supported by its exposure to a diversified portfolio of senior secured floating rate loans, may help investors achieve their monthly income goals.”

Should you invest in Private Credit?

As institutional investors, such as insurance companies, look to private credit as a preferred asset class during this economic period, its value proposition could also be appropriate for individual investors. Private credit represents a growing segment of the financial market, providing valuable financing options for businesses that might not have access to traditional bank loans while offering attractive returns and diversification benefits for investors. The flexibility, speed, and tailored solutions of private credit can be particularly advantageous for companies in need of capital, while investors benefit from higher yields and potential portfolio diversification.

This content was originally published by our partners at the Canadian ETF Marketplace.