On Tuesday, Citi maintained its Buy rating on Western Digital Corp. (NASDAQ:WDC) stock but adjusted the share price target to $85 from $87. Currently trading at $73.43, WDC has demonstrated strong momentum with a 51.75% return over the past year.

The revision follows a forecast update by Citi regarding the NAND Average Selling Price (ASP) growth for 2025, now expecting a 2% year-over-year decline, revised from a previously anticipated 5% increase. According to InvestingPro data, analyst consensus remains bullish with price targets ranging from $60 to $115.

This change is attributed to a softer demand in mobile and PC sectors in the first half of 2025, with a recovery projected to begin in the third quarter due to reduced production from suppliers and robust demand for enterprise Solid-State Drives (eSSD).

The analyst's commentary included a reduction in Western Digital's Flash ASP and margin expectations for the March, June, and September quarters, reflecting the anticipated softer pricing environment.

Consequently, the firm's Earnings Per Share (EPS) estimates have been reduced by approximately 5-8%. Despite these adjustments, the Buy rating is upheld, with the price target now set at $85, based on a 10-11x Price to Earnings (PE) ratio.

InvestingPro analysis reveals the company maintains a healthy gross profit margin of 30.45% and shows promising revenue growth of 26.61% in the last twelve months. Get access to 8 more exclusive InvestingPro Tips and comprehensive valuation metrics with an InvestingPro subscription.

Citi's stance remains positive regarding the potential value to be unlocked from the upcoming spin-off of Western Digital. A recent note highlighted incremental details about the spin-off process and confirmed that no additional debt would be raised in the course of the transaction.

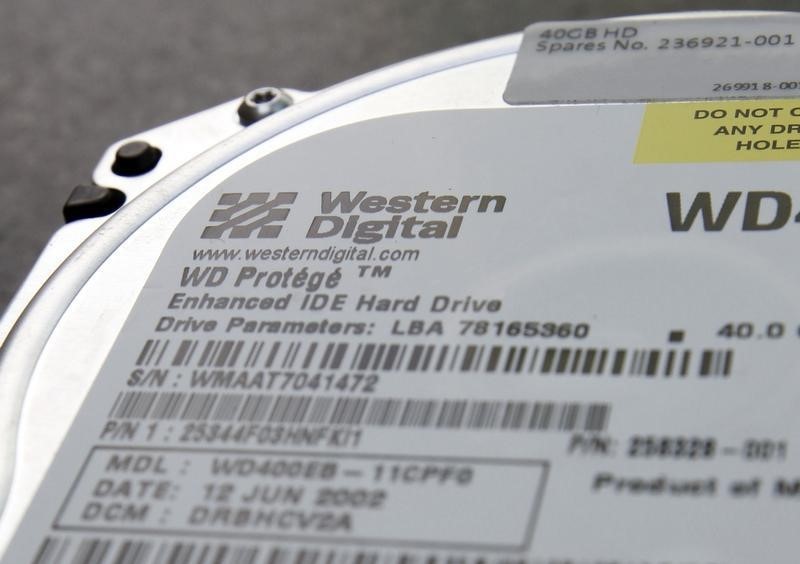

The current valuation of Western Digital, according to Citi's analysis, suggests that the Hard Disk Drive (HDD) business accounts for approximately 95% of the company's valuation, while the Flash segment represents about 5%.

Based on InvestingPro's Fair Value analysis, WDC appears to be trading near its fair value, with a solid financial health score of 2.33 out of 5, indicating FAIR overall condition.

In other recent news, Western Digital Corp has reported significant growth in its fiscal first quarter of 2025, with revenue hitting $4.1 billion and earnings per share increasing to $1.78. The company also announced an expansion of its 2021 Long-Term Incentive Plan by 6 million shares. Western Digital is progressing with the spin-off of its Flash business, which TD (TSX:TD) Cowen views as a positive strategic move, maintaining a Buy rating on the company's shares.

Citi has raised its outlook on SK Hynix shares, predicting an optimistic scenario for 4Q DRAM pricing. These are recent developments as Western Digital continues to separate its Flash and HDD businesses, anticipating completion by the end of the fiscal second quarter. For the next quarter, the company projects revenue between $4.2 billion and $4.4 billion, with earnings per share between $1.75 and $2.05.

However, Western Digital experienced operational dissynergies of approximately $30 million due to carrying dual cost structures. These facts highlight the company's focus on optimizing profitability and executing strategic initiatives amidst evolving industry dynamics.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.