On Thursday, Western Digital Corp. (NASDAQ:WDC), currently trading at $66.47 with a market capitalization of $23 billion, received a continued vote of confidence from Evercore ISI, as the firm reiterated its Outperform rating and $85.00 price target on the company's stock.

This endorsement follows updates from Western Digital's CEO David Goeckeler and CFO Wissam Jabre, who spoke at a competitor conference earlier today, discussing intra-quarter trends and addressing concerns about flash pricing.InvestingPro analysis reveals that Western Digital is a prominent player in the Technology Hardware, Storage & Peripherals industry, with additional exclusive insights available through the platform's comprehensive Pro Research Report.

The company acknowledged that flash pricing faced greater challenges than anticipated as the quarter progressed. Despite these headwinds, Western Digital's performance, particularly in the NAND business, surpassed the low expectations of the buyside, especially concerning margins.

With revenue growth of 26.6% in the last twelve months and a healthy gross profit margin of 30.5%, the company has demonstrated resilience. The company reported that flash pricing in the September quarter was down modestly quarter over quarter but indicated that this was driven by product mix, while average selling prices on a comparable basis actually increased.

Management expressed optimism about a potential recovery in the markets for PCs and smartphones, which are significant consumers of flash storage, as the calendar year 2025 approaches. However, they noted that enterprise solid-state drives (SSDs) are currently a relative strength for the company. Western Digital is comfortable with its projection that enterprise SSDs will make up approximately 15-20% of overall flash bit shipments in fiscal year 2025, which is a significant increase from the initial expectation of around 10% at the start of the year.

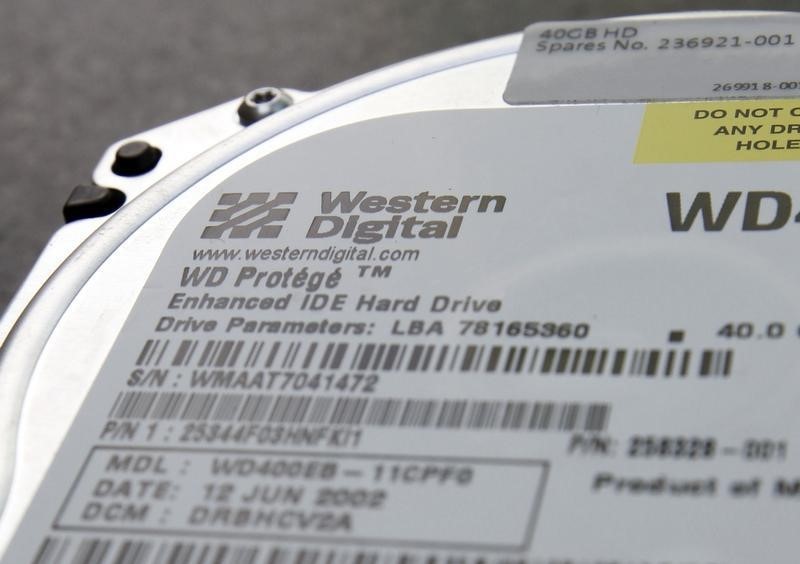

The demand for enterprise SSDs has been largely driven by the need for high-performance storage for large language model training. Nonetheless, Western Digital believes that hard disk drives (HDDs) will continue to dominate bulk data storage, particularly in hyperscale environments, due to the cost advantages over flash storage.

Regarding HDD technology, Western Digital is focusing on developing its UltraSMR technology to reach storage capacities in the high-30TB range and will consider heat-assisted magnetic recording (HAMR) technology for drives that exceed approximately 40TB. The company also commented on the current state of HDD margins, indicating satisfaction with the levels achieved but showing an ongoing commitment to improving margins through product innovation and supply chain management.

In summary, while concerns about flash pricing persist, Western Digital's management remains focused on the company's strengths and long-term market recovery. According to InvestingPro data, analysts maintain a positive consensus on the stock, with price targets ranging from $60 to $115, and the company is expected to remain profitable this year. The stock has shown strong momentum with a 40.9% return over the past year, though current valuations suggest it may be trading slightly above its Fair Value.

In other recent news, Western Digital has been facing pricing challenges in the technology sector. The company's management has forecasted these difficulties to persist into the next quarter, according to insights provided by Evercore ISI analyst Amit Daryanani. Meanwhile, Micron Technology (NASDAQ:MU) has been identified by Lynx Equity Strategies as a potential beneficiary of the recent martial law declaration in South Korea, which has led to an increase in Korean memory prices.

Citi maintained a bullish stance on Western Digital, adjusting the share price target to $85 from $87, despite a forecast update predicting a 2% year-over-year decline in the NAND Average Selling Price (ASP) growth for 2025. The firm's Earnings Per Share (EPS) estimates for Western Digital have been reduced by approximately 5-8% due to a softer demand in mobile and PC sectors anticipated in the first half of 2025.

TD (TSX:TD) Cowen reaffirmed a Buy rating on Western Digital shares, following the company's announcement of an upcoming spin-off of its Flash business. Western Digital recently reported significant growth in its fiscal first quarter of 2025, with revenue hitting $4.1 billion and earnings per share increasing to $1.78.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.