By Barani Krishnan

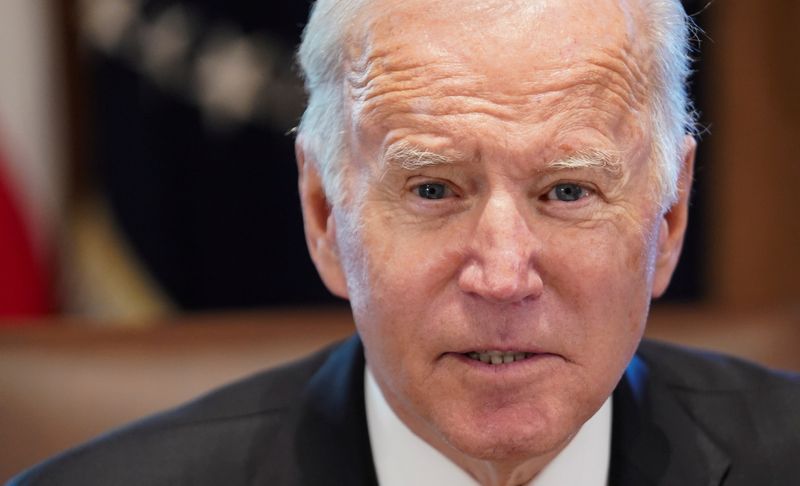

Investing.com -- The Biden administration has stopped drawing crude oil from the U.S. Strategic Petroleum Reserve, the Energy Information Administration said in its weekly inventory report Thursday, as the government attempts to rebuild a reserve it pulled more than 200 million barrels from to keep fuel prices low for Americans.

The EIA reported an SPR crude balance of 371.6M barrels at the end of the Jan. 13 week, unchanged from the previous week to Jan. 6. The zero SPR draw for last week closes the chapter on some 220M barrels taken from the emergency oil reserve since November 2021 by the Biden administration to provide more crude to the marketplace and bring pump prices of gasoline down.

Prior to those draws, SPR inventories stood at just under 600M barrels. At their present level of just above 370M, the reserve’s stockpiles are at their lowest since December 1983, the EIA said.

At one time, the administration drew as much as 8M barrels weekly from the reserve. The crude releases from the SPR, along with other global market developments, added significantly to international oil supplies over the past year. They helped slash crude prices from a high of more than $130 a barrel in early March, right after the outbreak of fighting in Ukraine and the subsequent sanctions on Russian crude, to below $90 a barrel by August.

The strategy worked for the administration: pump prices of gasoline fell to below $3 a gallon at some U.S. pumps by late last year from a mid-June record high of $5 as the SPR draws flooded the domestic marketplace for crude. Gasoline at U.S. pumps now average $3.38 a gallon, the American Automobile Association said on its website Thursday.

Last week’s zero SPR draw came after the administration announced late last year that it was winding down its dependence on the reserve and preparing to add to its inventory.

The administration is negotiating purchases with U.S. energy firms to refill the reserve, starting with a base offer of $70 per barrel. With U.S. crude trading at just above $81 a barrel on Thursday, sellers will likely be seeking more, resulting in a longer lag to replenish the reserve.