(Bloomberg) -- OPEC and its allies have almost achieved their goal of clearing an oil glut, but their efforts could be derailed by rising supplies from the U.S. and other rivals, the International Energy Agency said.

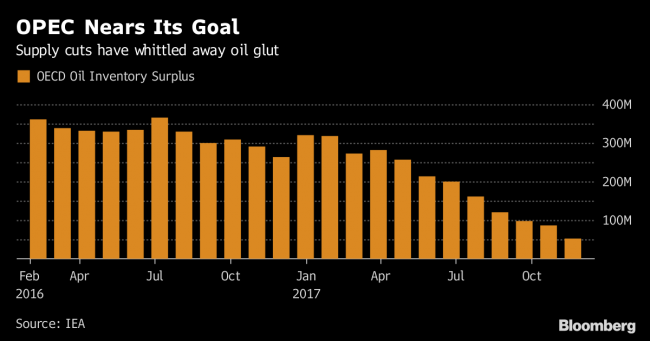

Oil stockpiles in developed nations fell the most in more than six years in December as supply cuts by the Organization of Petroleum Exporting Countries and Russia took effect. The surplus is also being cleared by higher consumption, with the agency boosting its forecast for global demand growth in 2018 by about 100,000 barrels a day to 1.4 million a day.

Yet OPEC’s strategy could be backfiring, as the increase in prices to a three-year high stimulates more supply from America. U.S. output will soon surpass that of the cartel’s biggest producer, Saudi Arabia, and may overtake Russia as global leader by the end of the year, according to the IEA.

“With the surplus having shrunk so dramatically, the success of the output agreement might be close to hand,” said the Paris-based agency, which advises most of the world’s major economies. Nevertheless, the “main message” remains that “fast-rising production in non-OPEC countries, led by the U.S., is likely to grow more than demand.”

OPEC and Russia, once fierce market rivals, forged an alliance in late 2016 to offset the oil glut unleashed by the advent of the U.S. shale industry.

After a year of output cuts, stockpiles in industrialized nations have shrunk to the lowest since November 2014. They were about 52 million barrels above the five-year average in December, a drop of 80 percent from a year earlier, the IEA said.

Last month, OPEC’s implementation of pledged cuts was its strongest since the deal came into force, with the group reducing output by 37 percent more than it promised, according to the IEA. Compliance was given a boost by Venezuela, whose oil industry has been crippled by years of under-investment and economic decline.

Shale Drilling

Global inventories may stop falling in the early part of this year with the onset of new supplies, the agency said. It raised estimates for growth in non-OPEC supply in 2018 by about 100,000 barrels a day to 1.8 million a day -- approximately equal to the amount of production OPEC and its partners promised to cut.

Having cut costs during a three-year market slump, U.S. shale companies are able to deliver even more oil as recovering prices fund new drilling, it said. The nation’s output could climb enough this year to satisfy the expected increase in global consumption, according to the IEA.

Oil futures traded near $59 a barrel in New York on Tuesday. Prices fell last week, continuing their retreat from the three-year high of $66.66 reached in late January.

(Updates with non-OPEC supply forecast in eighth paragraph.)