* China seeking supply chain assets around the world

* Asciano offers port, rail assets in Australia

* CIC part of Qube-led $6.4 bln bid

* China made record infrastructure investments in 2015

By Swati Pandey and Brenda Goh

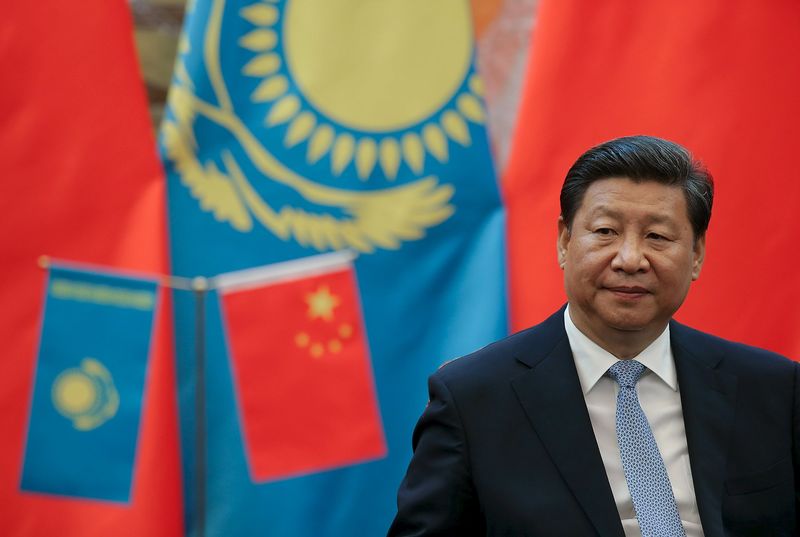

SYDNEY/SHANGHAI, March 1 (Reuters) - President Xi Jinping's

ambitious One Belt, One Road initiative is coming Down Under as

China's hunger to secure global supply chains leads its giant

sovereign wealth fund into the $6.4 billion battle for

Australia's Asciano Ltd AIO.AX .

Australia, already a major supplier of commodities to China,

is set to boost exports under a free trade deal signed last

year. Asciano, the country's largest ports and rail operator,

fits with Beijing's ambition to expand transportation linkages

across a region it sees key to its economic growth.

"This is part of a process where China does want to control

its logistics chains," said Harry Theochari, London-based global

head of transport at law firm Norton Rose Fulbright.

"If you are a big emerging nation that's very heavily

reliant on raw materials from other countries ... you'd want to

have as much control over the transporting of those fundamental

raw materials as you possibly can."

China Investment Corp (CIC) CIC.UL , the country's $747

billion sovereign wealth fund, is part of a consortium headed by

cargo handler Qube Holdings Ltd QUB.AX offering A$9 billion

($6.4 billion) for Asciano. Under the deal, which has been

recommended by Asciano's board, CIC would take a stake in both

Asciano's ports and rail operations.

A potential alternative proposal being discussed involving

Qube teaming up with rival Canadian bidder Brookfield Asset

Management Inc BAMa.TO would leave CIC owning the railways,

but not the ports, which Australia views as strategic assets

that should remain in local hands.

A spokeswoman said CIC was working on its bid with the Qube

consortium and declined to comment further.

CHINA DEALS

Beijing, through the country's firms, has been snapping up

assets as part of the One Belt One Road project launched in

2013, undertaking a record 19 global infrastructure deals worth

$6.8 billion in 2015, according to Thomson Reuters data.

The initiative envisions building a network of land, sea and

air routes that will open new trade links and markets for

Chinese firms as the domestic economy slows.

CIC, one of the sponsors of the $40 billion Silk Road Fund,

has been active, but other Chinese companies are also involved.

CIC holds a 10 percent stake in London's Heathrow Airport

and a 9 percent stake in the company behind the UK's largest

water and sewage company. In the United States, CIC's

investments include a 17 percent stake in power company AES.

China Merchants Holdings 0144.HK owns stakes in the ports

of Morocco, Djibouti and France while Cosco Pacific has

interests in terminals at the Suez Canal and Belgium's Antwerp.

"I think it is quite a smart move by them and it plays into

the One Belt, One Road project because it means they are not

just recreating the Silk Route but also owning the Silk Route,"

said a Sydney-based M&A lawyer who advises on investments by

Chinese companies into Australia.

POLITICAL SENSITIVITIES

The China Australia Free Trade Agreement is set to help

boost investment, with in-bound private Chinese proposals below

A$1.08 billion no longer requiring Foreign Investment Review

Board (FIRB) approval.

But political sensitivities remain around investments in

areas such as agriculture and ports.

The sale of Darwin Port, used by a deployment of U.S.

Marines as well as the terminus for a critical underwater data

cable, to China's Landbridge Group, sparked a rebuke from

Washington last year.

People familiar with the Asciano deal say the new proposal

is being designed to alleviate some of those regulatory concerns

as the critical port assets would remain with the Australian and

Canadian companies.

M&A lawyers and bankers said Chinese state-owned funds and

enterprises are also buying access to best practices via deals

like the Asciano bid.

They are keen on engineering and infrastructure deals to

replicate technology and know how back in China, ANZ Bank said

in a December report titled 'What else is China buying in

Australia?'

"I think we'll see them doing lots of investments into

freight infrastructure, into agriculture," said the Sydney-based

M&A lawyer, who declined to be identified because she was not

authorised to talk to the media. "Also, I wouldn't be surprised

if they start moving into healthcare, if they're not already and

then technology. All of that is going to be of assistance to

them in the building of their economy."

($1 = 1.3826 Australian dollars)

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

China's Silk Road http://reut.rs/1kuH3n4

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>