CAMBRIDGE, MA - Moderna , Inc. (NASDAQ:MRNA), a pioneer in mRNA therapeutics and vaccines, announced today that Abbas Hussain, the former CEO of Vifor Pharma and Global President of GlaxoSmithKline (NYSE:GSK)'s Pharmaceuticals and Vaccines, has been appointed to its Board of Directors.

Hussain's extensive experience in healthcare, which spans over 35 years, is expected to bolster Moderna's global commercialization initiatives. His prior roles have endowed him with significant expertise in vaccine commercialization in diverse markets and a wealth of knowledge in corporate governance through various board directorships.

The addition of Hussain comes at a time when Moderna continues to expand its influence in public health on a global scale. Noubar Afeyan, Co-Founder and Chairman of Moderna, expressed confidence in Hussain's ability to contribute strategic insights and operational expertise to the company's growth and innovation efforts.

Stéphane Bancel, CEO of Moderna, echoed this sentiment, highlighting the value of Hussain's leadership in healthcare to the company's mission of delivering mRNA medicines for a wide range of diseases.

Hussain has held numerous leadership positions throughout his career, including his recent tenure as CEO of Vifor Pharma from 2021 to 2023. His earlier experience includes various global leadership roles at Eli Lilly and Company (NYSE:LLY). In addition to his new role at Moderna, Hussain maintains several non-executive director and advisory positions in the healthcare sector.

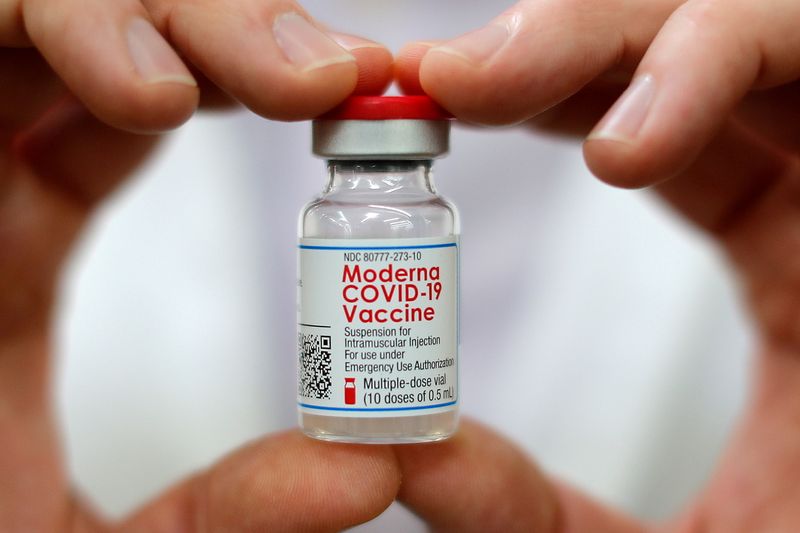

Moderna has been at the forefront of mRNA technology development, which has led to the rapid creation of medicines and vaccines, including one of the first COVID-19 vaccines. The company's platform continues to facilitate the development of treatments for infectious diseases, immuno-oncology, rare diseases, and autoimmune diseases.

This appointment is based on a press release statement and reflects Moderna's ongoing efforts to strengthen its leadership and governance as it advances its mission in mRNA medicine.

In other recent news, Moderna Inc. has embarked on a significant Phase 3 clinical trial for its investigational norovirus vaccine, mRNA-1403. This trial, known as the Nova 301 Trial, will enroll approximately 25,000 participants worldwide. Concurrently, Moderna's updated COVID-19 vaccine, SPIKEVAX®, has received approval from Health Canada, marking it as the first updated vaccine approved in Canada for the 2024-2025 season.

Several analyst firms have revised their outlooks on Moderna. Piper Sandler reduced its target for Moderna to $115 from $157, while maintaining an Overweight rating. Oppenheimer downgraded Moderna stocks to a neutral "Perform" status, and RBC (TSX:RY) Capital reduced its price target for Moderna from $90 to $75, both due to a shift in R&D strategy. Brookline Capital Markets reduced its price target to $238.00 from $310.00, but maintained a Buy rating, and TD (TSX:TD) Cowen revised its price target for Moderna, reducing it to $60 from $70, while retaining a Hold rating.

These are recent developments that investors should take into account. Moderna estimates product sales to be between $3 billion and $3.5 billion for the current year. However, the forecast for reaching cash flow breakeven has been deferred to 2028, with projected revenues of approximately $6.0 billion. These decisions and projections are part of Moderna's broader strategy to construct a more diversified suite of late-stage leads and streamline its R&D budget.

InvestingPro Insights

As Moderna welcomes Abbas Hussain to its Board of Directors, the company faces significant financial challenges that underscore the importance of strategic leadership. According to InvestingPro data, Moderna's revenue has declined by 52.6% over the last twelve months, with a concerning gross profit margin of -62.99%. This financial landscape highlights the critical need for experienced guidance in navigating the post-pandemic market for vaccine manufacturers.

InvestingPro Tips reveal that Moderna is "quickly burning through cash" and that "analysts anticipate sales decline in the current year." These insights align with the company's decision to bring on board a seasoned pharmaceutical executive like Hussain, whose expertise in global commercialization could be crucial in reversing these trends.

Despite these challenges, Moderna maintains a strong balance sheet, with InvestingPro noting that the company "holds more cash than debt" and "liquid assets exceed short term obligations." This financial stability provides a foundation for the company to pursue its ambitious goals in mRNA technology development across various therapeutic areas.

For investors seeking a more comprehensive analysis, InvestingPro offers 13 additional tips on Moderna, providing a deeper understanding of the company's financial health and market position.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.