(Bloomberg) -- Singapore’s economic growth will probably be weaker than previously forecast as the U.S.-China trade war spreads to the technology sector, the central bank’s Managing Director Ravi Menon said.

The government and central bank are reviewing their growth projection range of 1.5% to 2.5% for this year, Menon said at the release of the Monetary Authority of Singapore’s annual report on Thursday.

“The outlook for the global economy has deteriorated in recent months,” particularly as “we are now indeed in a trade and technology war,” said Menon. However, “the global economy is not heading for a crash,” he said.

Inflation is likely to remain subdued and the monetary policy stance is still “appropriate,” Menon said.

As trade disagreements between the U.S. and China morphed over the past year into a full-blown trade war, “three engines have stalled” as MAS feared they would under this scenario, said Menon. Global manufacturing, trade volumes, and investments all have suffered amid weakening business confidence as a result of the tensions.

The central bank chief cited recent weakness in purchasing manager index and exports data, especially in Asia where some of the world’s most trade-reliant economies are. PMIs for Japan, Malaysia, Taiwan and South Korea all contracted last month alongside Singapore’s, and global manufacturing slumped to its worst performance since 2012.

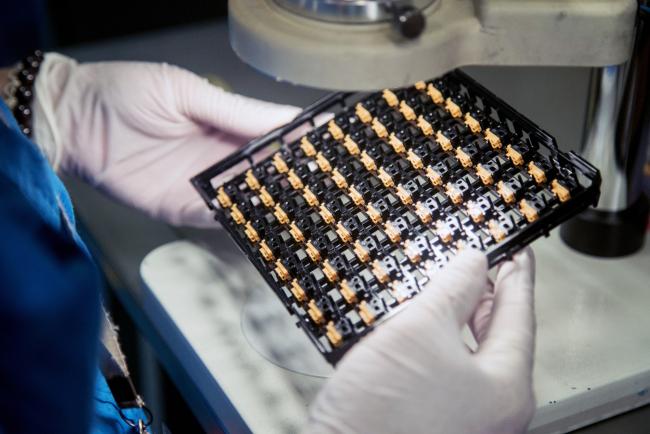

Singapore’s non-oil domestic exports plunged in May by the most since February 2013, driven by an ongoing slump in the electronics sector that’s now the worst in more than a decade, Enterprise Singapore figures showed last week.

“At this point it’s too early to say where we’re going to end up” in revising the 2019 growth forecast, Menon said. MAS Chief Economist Edward Robinson noted that the MAS and Ministry of Trade and Industry would have to gather second-quarter data before a fresh announcement.

Menon said the MAS is in “active” discussions with the U.S. Treasury after Singapore was included in a list of countries that the U.S. is monitoring for possible currency manipulation. The MAS’s currency policy is solely directed at securing price stability, Menon said. Singapore’s inclusion in the report has no direct consequence for the economy or monetary policy, he added.

The MAS chief also made the following comments to reporters:

- The global economy is not headed for a crash, and will find support from monetary policy easing and resilient private consumption

- Services growth in Singapore is still holding up, while the trade sector is decelerating

- Core CPI will be near the midpoint of the 1%-2% forecast range, while CPI is seen at 0.5%-1.5%

- The MAS made a net profit of S$19.2 billion ($14.2 billion) in 2018/19 fiscal year, all of which was transferred to the government. It also had investment returns of S$26.2 billion in 2018/19, which were relatively high and probably won’t be sustained

- The MAS sees no significant shift in businesses and funds from Hong Kong amid the political uncertainty there. “Prolonged uncertainty in Hong Kong is not good for Singapore,” Menon said

(Adds Menon comments from third paragraph.)