Investing.com - Here are the top five things you need to know in financial markets on Monday, April 9:

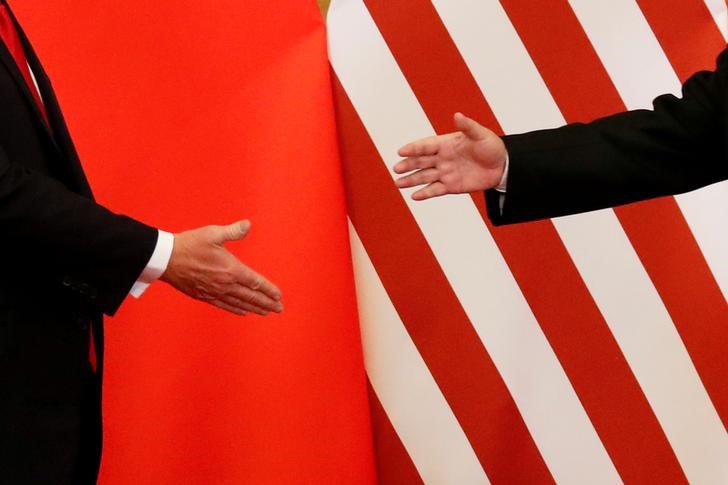

1. U.S.-China Trade Spat Eases… For Now

Investors awaited fresh developments on the simmering trade spat between the United States and China after escalating rhetoric last week fueled worries over an all-out trade war between the world’s two largest economies.

Over the weekend, U.S. President Donald Trump tweeted that he was hopeful an agreement could be reached between the two nations on trade.

As well, White House administration officials made the rounds of Sunday talk shows, playing down the possibility that the situation will escalate.

Treasury Secretary Steve Mnuchin told CBS’s “Face the Nation” that he doesn’t “expect there will be a trade war.”

Attention now turns to China’s Boao Forum - the so-called Asian Davos - where Chinese President Xi Jinping will make a much-anticipated speech on Tuesday, which traders are watching for any reference to the trade dispute with the U.S.

Markets have been on edge over how heightened trade tensions between the world's two largest economies could result in a potential trade war.

2. U.S. Stock Futures Rally Amid Trade Optimism

U.S. stock futures pointed to strong gains at the open, signaling a comeback on Wall Street after a sharp selloff on Friday, as traders again shook off concerns about a U.S.-China trade war.

The blue-chip Dow futures rallied 210 points, or around 0.9%, the S&P 500 futures rose 21 points, or about 0.8%, while the tech-heavy Nasdaq 100 futures jumped 66 points, or roughly 1%.

The coming week marks the start of the first-quarter earnings season on Wall Street, which analysts have been hoping would take market focus away from trade and put it on strong corporate profits.

Elsewhere, in Europe, the continent's major bourses advanced in mid-morning trade, with most sectors trading in positive territory. Financial stocks contributed the most to the rise with Deutsche Bank (DE:DBKGn) gaining more than 3% following news the German lender has replaced its chief executive, John Cryan, with the senior head of its retail bank, Christian Sewing.

Earlier, in Asia, most of the bourses in the region closed higher, as markets shrugged off declines seen on Wall Street late last week.

3. Dollar Steadies After Post-NFP Slip

The dollar was mostly steady against its major rivals, having retreated late last week following data that showed the U.S. economy created the fewest jobs in six months in March.

The dollar index against a basket of six major currencies was little changed at 89.84, following a drop of 0.4% on Friday. It had set a one-month high of 90.30 ahead of the U.S. nonfarm payrolls report data early Friday, but later lost some steam.

Despite the miss on the jobs number, the data pointed to a pickup in wage gains, which should allow the Federal Reserve to further raise interest rates this year.

In the bond market, the U.S. 10-year Treasury yield inched up to around 2.80%.

There is no first-tier economic data or Fed speakers expected Monday.

4. Oil Prices Firm On Reports Of Syria Airstrike

Oil prices pushed higher to start the week, as traders watched developments out of Syria, after reports an air base near Homs was struck by missiles.

Russia and Syria blamed Israeli warplanes for carrying out the missile strikes on the Syrian air base, hours after U.S. President Donald Trump warned via tweets of a "big price to pay" following reports of a chemical-weapons attack on civilians near Damascus that left 49 dead over the weekend.

The United States denied attacking the Syrian base, and France also said its forces had not carried it out.

New York-traded WTI crude futures rose 0.5% to $62.34 per barrel, while Brent futures tacked on 0.6% to $67.53 per barrel.

5. Zuckerberg To Meet With U.S. Lawmakers

Facebook (NASDAQ:FB) CEO Mark Zuckerberg is set to meet U.S. lawmakers today ahead of Tuesday and Wednesday's Congressional hearings on the Cambridge Analytica scandal.

The planned meetings at Capitol Hill are expected to continue through Monday afternoon and include some lawmakers from committees before whom Zuckerberg is due to testify.

Zuckerberg is scheduled to appear before a joint hearing of the U.S. Senate Judiciary and Commerce committees on Tuesday and the U.S. House Energy and Commerce Committee on Wednesday.

The social media firm has come under fire in recent weeks after it revealed that the personal information of up to 87 million users may have been improperly shared with political consultancy Cambridge Analytica.