(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

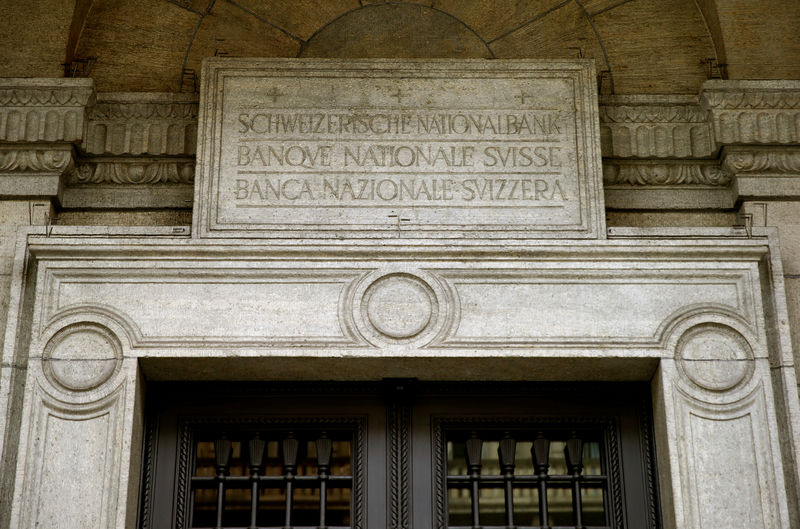

The Swiss National Bank stuck with ultra-low interest rates in response to lingering risks to the economy from the pandemic and keep its “highly valued” currency in check.

Officials led by President Thomas Jordan, back at work after sick leave, also reiterated their pledge to use foreign-exchange interventions as needed. They kept both the deposit rate and the policy rate at -0.75%, a decision widely expected among economists.

Switzerland finds itself in something of a sweet spot because the economy is recovering apace without the flare up in consumer prices seen in other countries. While inflation has risen from its 2020 low, it’s still forecast to remain below 1% through 2023 on average.

Other central banks are in a different position. Policy makers in Norway may raise interest rates later on Thursday, while Federal Reserve Chair Jerome Powell said Wednesday the U.S. central bank could begin scaling back asset purchases in November.

The SNB sees the economy growing about 3% this year, compared with roughly 3.5% expected in June.

Despite a buoyant recovery and low unemployment, the central bank is reluctant to raise what’s currently the world’s lowest benchmark interest rate because that could boost the haven franc and drive down inflation. Over the past decade, the SNB has spent hundreds of billions of francs on interventions.

A byproduct of that loose policy has been a worsening of property market imbalances. Lending got a boost when during the early days of the pandemic when Swiss officials deactivated a countercyclical capital buffer for banks’ mortgage assets to prevent a credit crunch.

The SNB said Thursday that the “vulnerability of the mortgage and real estate markets has increased further.” According to some measures, housing is overvalued by as much as 30%, and a UBS Group AG indicator says real estate is close to a bubble.

©2021 Bloomberg L.P.