By Naomi Rovnick and Xie Yu

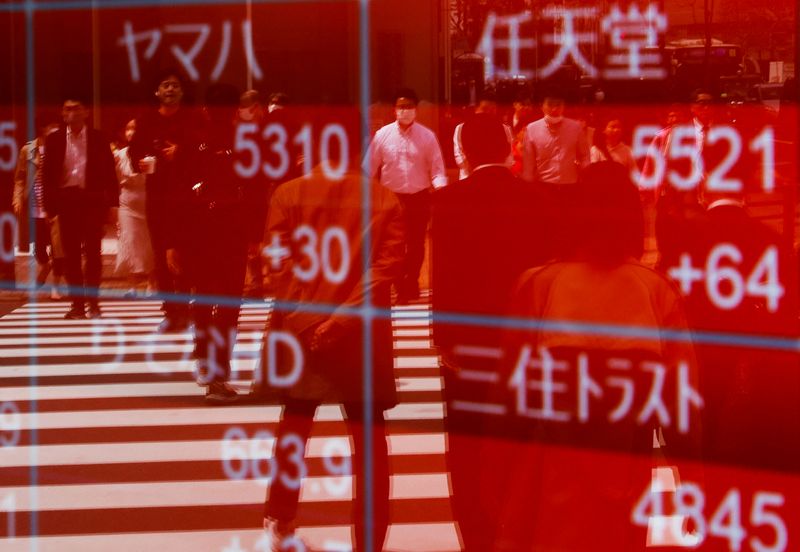

LONDON/HONG KONG (Reuters) - Global stocks held steady on Tuesday, as investors balanced the inflationary force of rising oil prices with hopes that central banks would not over-tighten monetary policy into a potential recession.

MSCI's broadest index of world stocks, which rose almost 6% last month as the U.S. Federal Reserve paused its cycle of aggressive rate hikes, was flat in light trading, with Wall Street closed for the July 4 holiday.

Europe's Stoxx 600 share index added 0.2%.

Earlier in the session, Australia's central bank held interest rates steady at 4.1%, saying it needed time to assess the economic impact of its rate hikes so far.

Complicating the outlook for inflation, oil prices rose on Tuesday as markets weighed supply cuts for August by top producers Saudi Arabia and Russia.

Brent crude futures climbed 1.5% to $75.74 a barrel, with West Texas Intermediate crude up by the same amount at $70.87.

Data on Monday from the Institute of Supply Management showed U.S. manufacturing activity slumped in June to levels last seen during the initial wave of the COVID-19 pandemic in May 2020. Purchasing managers surveys showed a similar factory downturn in the euro zone.

"At least the improved supply-demand imbalance seems to be having an effect on price pressures," Capital Economics global economist Ariane Curtis said.

Despite evidence that goods inflation was easing off, Curtis cautioned that central bankers might keep policy tight to battle service-sector inflation "which has proven stickier".

In the U.S., Barclays (LON:BARC) analysts said in a note to clients, "rising real incomes, thanks to a strong labor market, will continue to support consumption," despite the recessionary signals from the weak ISM data.

MIXED BAG OF DATA

Investors are watching out for a mixed bag of economic data ahead of second-quarter earnings while uncertainty remains over the outlook for Fed monetary policy, said Manishi Raychaudhuri, head of Asia Pacific equity research at BNP Paribas (EPA:BNPP).

The minutes from the central bank's last meeting are due later this week and could provide additional clues on policy direction, but also inject some volatility, he said.

"If the Fed over-tightens and decides to do more rate hikes than twice, as the market widely expected, then there's a concern that the recession may turn out to be deeper than what is being factored in," Raychaudhuri said.

Geopolitical tensions also persist, he noted, with China's export controls on minerals adding more uncertainty around global trade relations.

In the currency market, the dollar index, which tracks the greenback against six major peers, was flat. The euro dipped 0.1% lower against the dollar to $1.0898.

Euro zone government debt was steady, with Germany's two-year Schatz yield, which tracks interest rate expectations, drifting around the 3.32% level, around its highest since early March, just before a U.S. regional banking crisis drove a flight into safe havens. Bond yields rise as prices fall.

The Treasury market was shut on Tuesday for Independence Day. On Monday, a widely watched section of the U.S. Treasury yield curve hit its deepest inversion since the high inflation era of Fed Chairman Paul Volcker in the early 1980s, reflecting financial markets' concerns that an extended hiking cycle may tip the U.S. into recession.

Gold was slightly higher, with spot gold up 0.4% at $1928.28 per ounce.

(additional reporting by Ankur Banerjee in Singapore, Editing by Sam Holmes, Himani Sarkar, Alex Richardson and Christina Fincher)